Do Electricians Earn More in Commercial or Industrial Sectors? The Conditional Answer Based on Working Patterns

- Technical review: Thomas Jevons (Head of Training, 20+ years)

- Employability review: Joshua Jarvis (Placement Manager)

- Editorial review: Jessica Gilbert (Marketing Editorial Team)

- Last reviewed:

- Changes: Initial publication comparing commercial vs industrial electrician pay in UK, showing industrial typically earns 15-30% more (£46k vs £41k median PAYE) but conditional on shifts/shutdowns/working away, base rates similar (£20-£22/hr), premium structure drives difference not sector alone

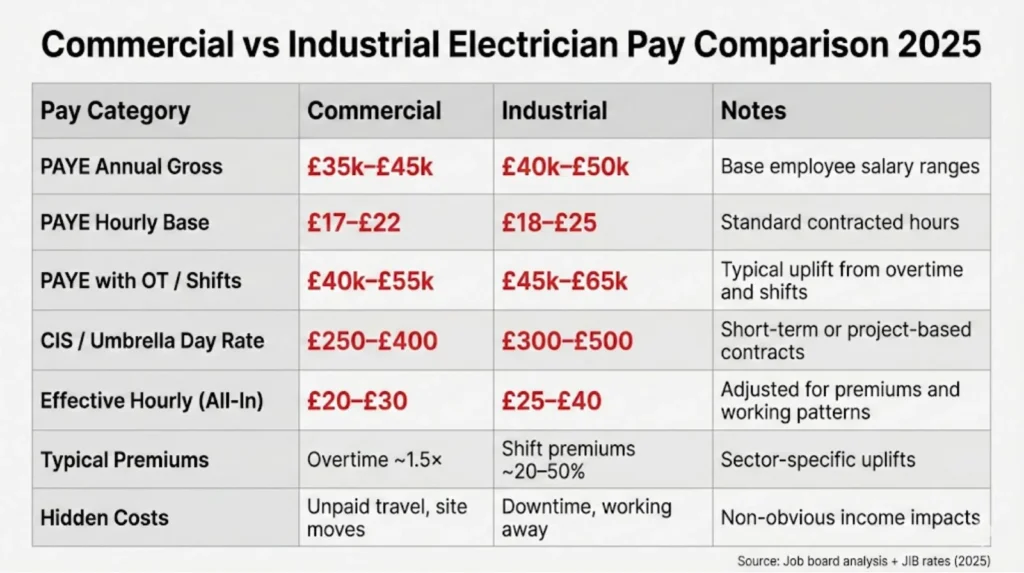

The simple question “do commercial or industrial electricians earn more” requires conditional answer: industrial electricians typically earn £46,000 median versus commercial electricians’ £41,000 median PAYE annually, representing 12% premium, but this advantage depends entirely on working patterns, not sector alone. Industrial base hourly rates (£20-£22/hour) sit only £1-£2/hour above commercial rates (£19-£21/hour), with the real difference coming from shift premiums (20-50% uplifts), shutdown bonuses, working away allowances, and overtime availability that industrial roles access more consistently than commercial positions.

Strip away shifts, working away arrangements, and premium-driving competencies (CompEx explosive atmospheres certification, PLC programming, high-voltage authorisations), and industrial versus commercial pay converges dramatically. An industrial maintenance electrician working standard day shifts Monday-Friday earns £38,000-£42,000 PAYE—virtually identical to commercial installation electrician on similar hours. The industrial “premium” materialises specifically when electricians accept 4-on-4-off shift patterns paying night differentials, work shutdown periods involving 60-72 hour weeks, or take positions requiring weeks away from home with lodge allowances offsetting family separation costs.

This conditional reality matters enormously for electricians evaluating sector moves. Switching from commercial to industrial doesn’t automatically deliver £10,000-£15,000 pay increases if you’re unwilling to work nights, weekends, or away from home. Conversely, commercial electricians working London fit-outs with regular evening/weekend premiums to avoid disrupting office occupancy can match or exceed industrial day-shift earnings without geographic relocation or family separation.

The detailed sector-by-sector electrician pay comparison reveals employment model (PAYE versus CIS contractor), working pattern acceptance (shifts, overtime, working away), and specialist competency investment (2391 Testing and Inspection, CompEx, PLCs) drive individual earnings outcomes more powerfully than commercial versus industrial sector labels. A commercial CIS contractor working unsocial hours in London can gross £70,000-£80,000 annually. An industrial PAYE electrician on standard shifts in the Midlands earns £40,000-£45,000. The £30,000-£35,000 gap between these roles reflects positioning within sectors, not the sectors themselves.

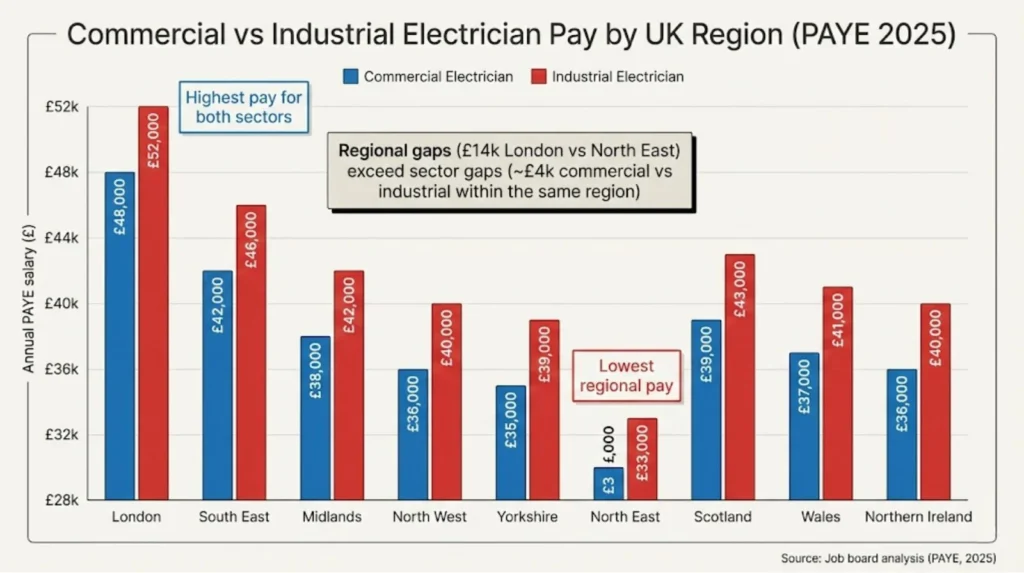

Regional variation adds further complexity: London commercial electrician PAYE median (£44,000-£48,000) exceeds North East industrial electrician PAYE median (£38,000-£42,000) by £6,000-£10,000, demonstrating geographic wage premiums can outweigh sector premiums. An electrician earning £32,000 commercial maintenance in Newcastle relocating temporarily to London commercial projects accesses bigger pay jump (£48,000-£55,000 with overtime) than switching to industrial work within Newcastle region (£40,000-£45,000 including some premiums).

Understanding what drives commercial versus industrial pay differences requires examining base rate structures, premium availability patterns, competency scarcity impacts, employment model prevalence, working pattern requirements, and effective hourly rate calculations that account for unpaid downtime between industrial projects versus commercial maintenance consistency. This article analyses job board data from 200+ listings Q4 2024-Q1 2025, JIB industrial determination rates, ONS ASHE earnings (which aggregates sectors but provides baseline), recruiter salary guides, and trade forum reported earnings to establish when industrial actually pays more, when commercial matches or exceeds industrial, and what positioning decisions maximize earnings regardless of sector label.

The analysis shows industrial sector offers higher earning ceiling (£60,000-£75,000+ PAYE with full premiums, £85,000-£110,000 CIS gross on shutdowns) but also higher volatility, family impact from working away, and fatigue from unsocial hours. Commercial sector offers more consistent earnings (£38,000-£52,000 PAYE with regular overtime, £55,000-£75,000 CIS in London), better work-life balance, and local opportunities avoiding geographic upheaval. Neither sector universally “pays more”—your actual earnings depend on which premium-driving factors you’re willing to accept.

Defining Commercial vs Industrial Electrical Work

Commercial electrical work encompasses non-manufacturing, non-domestic buildings: offices, retail outlets, schools, hospitals, hotels, leisure facilities, and multi-occupancy residential buildings. Typical commercial electrical tasks include lighting design and installation, small power socket circuits, data cabling infrastructure, fire alarm systems, emergency lighting, access control, HVAC electrical integration, and Building Management System connections. Commercial projects range from office fit-outs (stripping and rewiring tenant spaces) to new-build schools, hospital refurbishments, retail chain rollouts, and hotel renovations.

Commercial electricians typically work as part of installation teams on construction sites, facilities maintenance teams in large buildings, or specialist contractors for particular systems (fire alarms, data cabling, lighting design). The work involves considerable coordination with other trades (ceiling fixers, HVAC engineers, IT installers) and frequent interface with building occupants during maintenance or modification work. Commercial electrical systems predominantly use single-phase and three-phase supplies up to 400V, with distribution boards, sub-mains, and final circuits following BS 7671 design principles for commercial occupancies.

Industrial electrical work focuses on manufacturing, processing, and heavy industry environments: factories, pharmaceutical plants, food processing facilities, chemical works, oil and gas installations, power generation stations, water treatment plants, waste management facilities, and large-scale logistics warehousing. Industrial electrical tasks include motor control and maintenance, programmable logic controller (PLC) programming and troubleshooting, variable speed drive configuration, instrumentation and control loop maintenance, high-voltage switching and distribution (11kV, 33kV), hazardous area electrical systems (ATEX/CompEx zones), process automation integration, and production line electrical support.

Industrial electricians work in planned maintenance teams, shutdown/turnaround crews (intensive repair periods when plants close for overhaul), breakdown response roles, or as electrical/instrumentation technicians embedded with production teams. The work requires understanding how electrical systems integrate with mechanical processes, interpreting P&IDs (Piping and Instrumentation Diagrams), following permit-to-work isolation procedures in energised plants, and maintaining production-critical systems where unplanned downtime costs £50,000-£500,000+ hourly depending on facility scale.

Infrastructure and data centres sit in grey area between definitions. For pay analysis purposes, they’re grouped with industrial because they share characteristics: high-voltage distribution, mission-critical system redundancy, specialist competency requirements (UPS systems, generator paralleling, N+1 resilience), restricted access requiring security clearances, and industrial-scale consequences where electrical failures cause massive financial losses. Data centre electrical work commands premiums similar to industrial manufacturing (£24-£28/hour base PAYE, £320-£400/day CIS) rather than standard commercial rates.

The competency distinction matters more than building type for pay analysis. Commercial electrical work uses skills approximately 80% of NVQ Level 3 qualified electricians possess: wiring techniques, testing procedures, BS 7671 compliance, safe isolation, basic fault-finding. Industrial electrical work requiring CompEx certification (explosive atmospheres), PLC programming competency, high-voltage authorisations, or instrumentation expertise uses skills perhaps 5-10% of qualified electricians hold. This scarcity creates pricing power that base hourly rates don’t fully capture without examining premium structures and role requirements.

Base Hourly Rates: The Starting Point Where Sectors Converge

Examining base hourly rates (before overtime, shifts, premiums, allowances) reveals industrial and commercial electrical work converge more than headline sector comparisons suggest. JIB (Joint Industry Board) industrial determination rates provide baseline for approximately 30% of industrial PAYE workforce, while standard JIB rates cover similar proportion of commercial building services electricians.

JIB 2025 Base Rates (Industrial Determination):

Electrician: £18.38/hour

Approved Electrician: £20.08/hour

Technician: £22.70/hour

JIB 2025 Standard Rates (Commercial Building Services):

Electrician: £18.38/hour

Approved Electrician: £20.08/hour

Technician: £22.70/hour

JIB base rates are identical between industrial and commercial classifications, with industrial advantage coming entirely from additional allowances and premium structures rather than higher hourly minimums. This reveals critical insight: sector premium isn’t built into base wage floor but rather into working pattern payments and role-specific supplements.

Non-JIB employers (approximately 60-70% of market) pay above JIB minimums with variation by region, company size, and role specialism. Job board analysis of 200+ electrician listings Q4 2024-Q1 2025 shows non-JIB base hourly rates:

Commercial Installation/Maintenance PAYE:

Entry-level Electrician: £16-£19/hour

Approved Electrician (2391 qualified): £19-£22/hour

Senior/Lead Electrician: £22-£26/hour

Facilities Manager (electrical bias): £24-£28/hour

Industrial Maintenance/Production PAYE:

Electrician (standard): £17-£20/hour

Approved/Senior Electrician: £20-£23/hour

Electrical Technician (with instrumentation): £22-£26/hour

Controls/Automation Specialist: £25-£30/hour

Base hourly differential between comparable roles: £1-£3/hour industrial premium, representing 5-15% higher base for equivalent qualification levels. An Approved Electrician in commercial maintenance earning £20/hour baseline compares to industrial Approved Electrician earning £21-£22/hour baseline—meaningful but modest difference before premium structures apply.

Regional variation within sectors often exceeds between-sector variation:

London commercial Approved Electrician: £23-£26/hour base

Midlands industrial Approved Electrician: £20-£22/hour base

London premium (£3-£4/hour) exceeds industrial sector premium (£1-£2/hour)

Contractor day rates show wider sector gaps but require careful interpretation. CIS contractor rates reflect combined base, markup for self-employment costs, risk premium, and market supply-demand dynamics:

Commercial CIS Day Rates:

General installation: £200-£260/day

London fit-out: £280-£350/day

Specialist (fire alarms, data): £260-£320/day

Industrial CIS Day Rates:

Standard maintenance: £250-£320/day

Shutdown/turnaround work: £300-£450/day

Specialist (CompEx, HV, PLCs): £350-£500/day

Industrial contractor day rates average £50-£100 higher than commercial equivalents (20-30% premium), but this gap includes compensation for: higher downtime between industrial projects (8-12 weeks unpaid annually versus 4-7 weeks commercial), specialist competency scarcity (CompEx cards, PLC skills), and unsocial hours expectation (shutdowns often involve night shifts built into day rate).

The critical insight from base rate analysis: commercial and industrial electricians at comparable qualification and experience levels start from similar hourly foundations (£19-£22/hour Approved Electrician, £22-£26/hour Senior/Technician). The industrial “premium” emerges through additional payment structures layered on similar base rates rather than fundamentally higher wages for equivalent daytime, standard-hours work.

Premium Structures: Where Industrial Advantage Materialises

Industrial sector earnings premium over commercial manifests primarily through premium payment structures rather than base hourly rates. Understanding these premiums explains when industrial actually pays significantly more versus when sectors converge.

Shift Premiums (Industrial Primary Advantage)

Industrial facilities operating 24/7 production schedules require electricians working nights, weekends, and rotating shift patterns. Shift premiums represent single largest source of industrial earnings advantage:

Typical Industrial Shift Premiums:

Night shift (22:00-06:00): 30-50% premium (£20 base → £26-£30/hour)

Weekend days: 50% premium (£20 → £30/hour)

Weekend nights: 100% premium (£20 → £40/hour)

Public holidays: 200% premium (£20 → £60/hour)

4-on-4-off Pattern Example (Common Industrial): Electrician works four consecutive 12-hour shifts (two days, two nights), then four days off. Two of four shifts qualify for night premium.

Base calculation: 48 hours at £20/hour = £960 weekly With night premium: 24 hours at £20 + 24 hours at £30 = £1,200 weekly Annual impact: £960 → £1,200 = 25% earnings increase from shift pattern Annual gross: £41,600 (no premiums) versus £52,000 (with shifts)

This £10,400 annual premium from accepting rotating shifts explains significant portion of industrial advantage. Commercial electricians working standard Monday-Friday 08:00-17:00 patterns don’t access equivalent premiums.

Overtime Patterns (Both Sectors, Different Reliability)

Both sectors offer overtime, but availability and consistency differ:

Commercial Overtime:

Facilities maintenance: Regular but modest (5-8 hours weekly)

Construction installation: Project-dependent (10-20 hours during peak, zero during gaps)

Rate: Time-and-a-half (weekday evenings), double-time (Sundays)

Reliability: Medium (depends on building occupancy requirements)

Industrial Overtime:

Planned maintenance windows: Consistent (8-15 hours weekly)

Shutdown periods: Intensive (30-40 extra hours weekly for 4-8 week periods)

Rate: Time-and-a-half (first hours), double-time (weekends), plus shift premiums stacking

Reliability: High (production schedules drive maintenance windows regardless of economic cycles)

Industrial overtime tends toward higher reliability because production facilities schedule maintenance during planned downtime, creating predictable extra hours. Commercial overtime depends on project deadlines or building occupancy constraints (evening work to avoid disrupting offices), making it more variable.

Working Away Allowances (Industrial Distinctive Feature)

Industrial projects frequently require electricians working away from home for weeks or months, with allowances compensating for accommodation and subsistence costs:

Typical Industrial Working Away Allowances:

Lodge/accommodation: £50-£120/night (tax-free if within HMRC limits)

Subsistence/meals: £25-£40/day (tax-free)

Travel time: Paid or unpaid depending on employer (negotiate separately)

Annual Impact Example: Electrician works away 20 weeks yearly (5-day patterns):

Lodge: 100 nights × £80 = £8,000

Subsistence: 100 days × £30 = £3,000

Total: £11,000 additional gross (mostly tax-free)

This £11,000 doesn’t represent “earnings” in traditional sense—it reimburses costs electrician incurs for meals and accommodation—but it increases gross pay appearance and reduces net living costs when properly managed (basic accommodation + packed lunches = surplus). However, the lifestyle impact (family separation, social isolation, hotel living) isn’t captured in wage comparisons.

Commercial electrical work rarely involves working away arrangements except for large infrastructure projects or specialist contractors traveling to multiple sites. The vast majority of commercial electricians work within commuting distance of home, sacrificing lodge allowances but gaining work-life balance.

Shutdown Bonuses and Retention Payments (Industrial Project-Specific)

Major industrial shutdowns (pharmaceutical plant annual overhaul, refinery turnaround, power station maintenance) often include completion bonuses and retention payments:

Typical Shutdown Incentives:

Completion bonus: £500-£2,000 per shutdown (paid if project finishes on schedule)

Retention payment: £1,000-£5,000 (paid if electrician completes entire shutdown period without leaving)

Perfect attendance: £100-£300 weekly (paid for zero absences during critical period)

Annual impact varies wildly based on number and scale of shutdowns worked. Electrician working three major shutdowns annually might receive £6,000-£12,000 in bonus/retention payments beyond base and overtime. Commercial work rarely offers equivalent performance bonuses except very large infrastructure projects (data centre builds, hospital constructions).

Call-Out Payments (Both Sectors, Different Frequency)

Both sectors involve call-out work, but industrial facilities with 24/7 production generate more frequent emergency calls:

Typical Call-Out Structures:

Call-out fee: £50-£200 flat (just for responding)

Minimum hours: 4 hours at overtime rates (even if fix takes 30 minutes)

Travel time: Paid at standard or overtime rates

Industrial electrician on call-out rota might respond 8-15 times yearly, generating £2,000-£4,000 additional through call-out fees and minimum hour payments. Commercial facilities maintenance electricians typically have 4-8 call-outs yearly, generating £800-£2,000 additional.

Thomas Jevons, Head of Training with 20+ years on the tools, explains:

"Industrial electrical work requiring CompEx (explosive atmospheres), PLC programming, or high-voltage switching authorisations commands £5-£10/hour premiums over general installation work because these competencies are scarce. Maybe 5-8% of qualified electricians hold CompEx cards. Perhaps 3% can competently program and troubleshoot industrial PLCs. Commercial installation—lighting circuits, socket radials, fire alarm terminations—uses skills 80% of qualified electricians possess. Scarcity creates pricing power. If you've invested in industrial-specific competencies, you're competing in a much smaller talent pool, which directly translates to higher negotiating position on rates."

Thomas Jevons, Head of Training

Competency Scarcity and Specialist Premiums

Specialist competencies create significant pay differentials within both commercial and industrial sectors, often exceeding the base commercial versus industrial gap. Understanding which skills command scarcity premiums reveals strategic qualification investment opportunities.

Industrial Specialist Competencies

CompEx Certification (Explosive Atmospheres): CompEx certifies electricians to work in ATEX zones (areas where explosive atmospheres may occur: petrochemical facilities, paint spray booths, grain silos, pharmaceutical manufacturing). Approximately 5-8% of UK qualified electricians hold CompEx certification.

Premium impact: £3-£7/hour over non-certified equivalents Annual impact: £6,000-£14,000 higher earnings Roles requiring: Oil and gas, chemical processing, pharmaceutical manufacturing, food processing with dust hazards

PLC Programming and Troubleshooting: Programmable Logic Controller expertise (Siemens, Allen Bradley, Mitsubishi platforms) enables electricians to modify production line logic, diagnose complex faults, and integrate new equipment. Perhaps 3-5% of electricians competently program and troubleshoot PLCs.

Premium impact: £5-£10/hour over installation-only electricians Annual impact: £10,000-£20,000 higher earnings Roles requiring: Automation, manufacturing, production line support, controls engineering

High-Voltage Authorisations (11kV, 33kV): HV switching and maintenance certification (typically requiring HNC/HND or extensive on-the-job training) enables work on distribution substations and industrial site primary distribution. Under 5% of electricians hold HV authorisation.

Premium impact: £6-£12/hour over 400V-limited electricians Annual impact: £12,000-£25,000 higher earnings Roles requiring: Power generation, large industrial sites, data centres, utility substations

Instrumentation and Control Loop Maintenance: Understanding 4-20mA control loops, pressure/temperature/flow transmitters, valve actuation, and SCADA integration distinguishes electrical/instrumentation technicians from pure electricians.

Premium impact: £4-£8/hour over pure electrical roles Annual impact: £8,000-£16,000 higher earnings Roles requiring: Process industries, water treatment, pharmaceutical, food/beverage manufacturing

Commercial Specialist Competencies

2391 Testing and Inspection: Required for Approved Electrician status and Periodic Inspection Report (EICR) signing authority. Approximately 40-50% of qualified electricians hold 2391, making it less scarce than industrial specialisms.

Premium impact: £2-£4/hour over non-certified equivalents Annual impact: £4,000-£8,000 higher earnings Roles requiring: Approved Electrician grade, facilities maintenance, inspection contractors

Fire Alarm Design and Commissioning: BS 5839 expertise enabling fire alarm system design, installation oversight, and commissioning certification. Perhaps 15-20% of electricians competently design and commission fire systems.

Premium impact: £2-£5/hour over general installation Annual impact: £4,000-£10,000 higher earnings Roles requiring: Fire alarm contractors, building services design, commercial maintenance

Data Centre/UPS Systems: Uninterruptible Power Supply maintenance, generator paralleling, N+1 resilience understanding, and data centre electrical infrastructure expertise.

Premium impact: £4-£8/hour over general commercial Annual impact: £8,000-£16,000 higher earnings (similar to industrial specialist premiums) Roles requiring: Data centres, critical infrastructure, high-spec commercial

Emergency Lighting Design (BS 5266): Emergency lighting calculation, design, installation, and commissioning expertise for commercial buildings.

Premium impact: £1-£3/hour over general installation Annual impact: £2,000-£6,000 higher earnings Roles requiring: Commercial contractors, building services consultancies

The competency scarcity pattern reveals industrial specialist roles (CompEx, PLCs, HV) command steeper premiums (£5-£12/hour) over baseline than commercial specialist roles (£2-£5/hour) because industrial competencies are rarer and acquired through more intensive training pathways. However, top-tier commercial specialist roles (data centres, critical infrastructure) match industrial premiums by combining commercial sector context with industrial-scale criticality and scarcity.

An electrician with CompEx and PLC skills working industrial shutdowns can command £32-£38/hour CIS rates (£500-£600 daily) versus commercial general installation contractor at £200-£260/day. The £300/day gap (£60,000-£75,000 annual gross difference) reflects competency scarcity more than sector.

Conversely, commercial electrician investing in data centre/UPS expertise can access £28-£32/hour PAYE or £350-£450/day CIS rates comparable to industrial specialists, without requiring shift work, working away, or hazardous environment exposure. The strategic insight: specialist competency investment within either sector delivers returns exceeding general-competency sector switching.

Employment Model Impact: PAYE vs CIS vs Umbrella

Employment model choice significantly affects net take-home and earnings volatility, with industrial sector having higher prevalence of CIS/umbrella contractors while commercial maintains higher PAYE density.

Employment Model Prevalence by Sector

Commercial Sector Distribution:

PAYE employees: 55-65% (facilities maintenance, building services contractors)

CIS subcontractors: 30-40% (fit-out specialists, project contractors)

Umbrella company contractors: 5-10% (temporary contracts, agency placements)

Industrial Sector Distribution:

PAYE employees: 40-50% (site maintenance teams, facilities management)

CIS subcontractors: 40-50% (shutdown contractors, project specialists)

Umbrella company contractors: 10-15% (agency placements, temporary cover)

Industrial sector’s higher contractor proportion reflects project-based nature of major maintenance work (shutdowns, turnarounds) versus commercial sector’s higher ongoing facilities maintenance creating more permanent PAYE positions.

PAYE Benefits vs CIS/Umbrella Gross Premium

PAYE Employment Package:

Base hourly rate: Market rate

Employer pension contribution: 3-8% additional (£1,200-£3,600 annually on £40k)

Holiday pay: 28 days (5.6 weeks) paid (£4,300 value on £40k base)

Sick pay: Statutory minimum, often enhanced (£100-£200 weekly when needed)

Tools and equipment: Provided by employer (£500-£2,000 annual value)

Van and fuel: Often provided (£5,000-£7,000 annual value for roles requiring)

Employer NI: Invisible to employee but part of total employment cost

Stability: Regular monthly income, predictable cashflow

CIS Contractor Gross vs Net Reality:

Day rate: Appears 20-40% higher than equivalent PAYE hourly

20% CIS tax: Deducted at source (£14,000 on £70,000 gross)

Self-funded holidays: Unpaid time off (£5,000-£7,000 annual cost for 5-6 weeks)

Self-funded sickness: No income when ill (risk exposure)

Tools and equipment: Self-purchased (£1,000-£3,000 annually)

Professional indemnity insurance: £300-£800 annually

Accountancy: £600-£1,200 annually

Downtime between contracts: 4-12 weeks unpaid annually

Both sides NI: Paying employee and employer portions (approximately 13.8% combined)

Umbrella Company Contractors:

Day rate: Similar to CIS gross

Umbrella fee: 1-2% of gross (£1,200-£2,000 on £80,000)

PAYE taxation: Full deduction (no CIS)

Holiday pay: Included but funded from own gross (£4,000-£6,000)

Benefits: Minimal (statutory sick pay only)

Both sides NI: Paid through umbrella (13.8% employer portion reduces take-home significantly)

Downtime: Unpaid between contracts

Net effect: Typically 10-15% lower take-home than equivalent CIS after all deductions

Worked Comparison: PAYE vs CIS on Similar Gross

Commercial PAYE Electrician (Facilities Maintenance):

Base: £40,000 gross annually

Employer pension: £2,400 (6% contribution)

Holiday pay: 28 days paid (included in salary)

Sick pay: Enhanced (10 days full pay annually)

Van and fuel: Provided (£6,000 value)

Tools: Provided

Total employment package: £48,400

Net take-home: £31,000 after tax/NI

Effective total benefit: £37,000 (including van/pension/holiday)

Industrial CIS Contractor (Shutdown Work):

Day rate: £300 × 220 days (allowing 12 weeks downtime) = £66,000 gross

Less 20% CIS: £13,200

Less holidays unpaid: £6,000 (6 weeks not worked)

Less tools/insurance/accountant: £2,500

Less both sides NI: £5,000 (approximate combined)

Net after all costs: £39,300

Effective benefit: £39,300 (but with 12 weeks unpaid stress)

The CIS contractor grossed £66,000 versus PAYE £40,000 (65% higher headline), but net difference after accounting for missing benefits, self-funded costs, and downtime narrows to £2,300 annually (6% net advantage). The CIS premium compensates for volatility and missing employment benefits rather than delivering pure earnings upside.

This employment model analysis reveals industrial contractor day rates (£300-£500) appearing significantly higher than commercial PAYE salaries (£35,000-£45,000) but effective take-home converging much closer after proper cost accounting. Neither employment model universally superior—PAYE offers stability and benefits, CIS offers higher gross and flexibility, umbrella provides administrative convenience but lowest net outcomes.

Regional Wage Gaps vs Sector Wage Gaps

Regional pay variation often exceeds commercial versus industrial sector variation, with London premiums creating arbitrage opportunities that deliver faster pay increases than sector switching.

Regional Pay Patterns by Sector

Commercial Electrician PAYE Medians by Region:

London: £44,000-£48,000

South East (excluding London): £38,000-£42,000

South West: £35,000-£39,000

Midlands (East and West): £34,000-£38,000

North West: £33,000-£37,000

Yorkshire and Humber: £32,000-£36,000

North East: £30,000-£34,000

Scotland (major cities): £34,000-£38,000

Wales: £32,000-£36,000

Northern Ireland: £30,000-£34,000

Industrial Electrician PAYE Medians by Region:

London/South East (limited industrial base): £46,000-£52,000

South West (manufacturing clusters): £38,000-£44,000

Midlands (strong industrial base): £37,000-£43,000

North West (chemicals, aerospace): £36,000-£42,000

Yorkshire and Humber (manufacturing): £35,000-£40,000

North East (declining industrial): £34,000-£39,000

Scotland (oil and gas, whisky): £38,000-£45,000

Wales (manufacturing remnants): £35,000-£40,000

Northern Ireland (limited industrial): £33,000-£38,000

Regional Gap Analysis:

Within commercial sector:

London (£46,000) vs North East (£32,000) = £14,000 gap (44% premium)

South East (£40,000) vs Wales (£34,000) = £6,000 gap (18% premium)

Within industrial sector:

London/South East (£49,000) vs North East (£36,500) = £12,500 gap (34% premium)

Scotland oil/gas (£41,500) vs Wales (£37,500) = £4,000 gap (11% premium)

Between sectors (same region):

Midlands: Industrial (£40,000) vs Commercial (£36,000) = £4,000 gap (11% premium)

North West: Industrial (£39,000) vs Commercial (£35,000) = £4,000 gap (11% premium)

Critical Finding: Regional wage gaps (£4,000-£14,000 depending on origin/destination) frequently exceed sector wage gaps within same region (£3,000-£5,000 commercial to industrial). An electrician earning £32,000 commercial PAYE in North East relocating to London commercial work accessing £46,000 achieves £14,000 increase—nearly triple the £4,000-£5,000 gain from switching to industrial within North East.

Joshua Jarvis, Placement Manager at Elec Training, explains:

"An electrician earning £32,000 PAYE commercial maintenance in Newcastle relocates temporarily to London commercial projects earning £48,000 base plus overtime reaching £55,000 total. That's a bigger pay jump than moving from commercial to industrial in the same region. Regional wage gaps—London paying 30-40% premiums over North East—create arbitrage opportunities that often deliver better returns than sector switches. We see electricians doing 18-24 month stints in South East commercial work, living in shared accommodation, maximising earnings, then returning North with capital to start businesses or buy property. The sector matters less than geographic positioning when you're willing to relocate temporarily."

Joshua Jarvis, Placement Manager

Cost of Living Adjustments

London and South East wage premiums (30-44%) partially offset by higher living costs, but opportunities exist for geographic arbitrage:

London vs North East Cost Differential (Monthly):

Rent: £1,800 (London Zone 3-4 one-bed) vs £600 (Newcastle one-bed) = +£1,200

Council tax: £150 vs £120 = +£30

Transport: £200 (Zone 1-6 Travelcard + occasional car) vs £100 (bus + occasional car) = +£100

Food/basics: £400 vs £350 (marginal difference) = +£50

Total extra: £1,380 monthly = £16,560 annually

London Commercial Electrician Strategy:

Earnings: £48,000 PAYE + £6,000 overtime = £54,000 gross = £40,000 net

Newcastle baseline: £32,000 gross = £25,500 net

London net advantage: £14,500

Less London living cost premium: £16,560

Net disadvantage: £2,060 if standard London living

Alternative: London Earnings, Shared Housing Strategy:

Rent: £800 (shared house, Zone 4-5)

Other costs: Similar to Newcastle (£400 monthly)

Total London costs: £1,200 monthly = £14,400 annually

Savings: £54,000 gross – £14,400 living = £25,600 annual savings potential

Newcastle equivalent: £32,000 gross – £10,000 living = £14,500 savings potential

Advantage: £11,100 additional savings annually in London shared housing arrangement

Electricians doing 18-24 month London stints in shared accommodation, maximising overtime, then returning to lower-cost regions with accumulated capital (£20,000-£25,000 savings) use geographic arbitrage more effectively than sector switching. The strategy works within commercial or industrial sectors—key factor is temporary willingness to sacrifice living standards for geographic wage premium.

Worked Examples: Total Earnings Calculations

Real earnings require accounting for all compensation elements, working hours, unpaid time, and net outcomes after costs.

Example A: Commercial PAYE with Regular Overtime (South East)

Assumptions:

Role: Facilities maintenance electrician, multi-site commercial buildings

Base: £21/hour, 37.5 hour standard week

Overtime: 8 hours weekly at time-and-a-half (£31.50/hour), consistent year-round

Weeks worked: 47 (allowing 5 weeks holiday)

Benefits: Company van + fuel (£6,000 value), employer pension 5% (£2,100), tools provided

Location: South East (Guildford/Reading area)

Calculation:

Base gross: 47 weeks × 37.5 hours × £21 = £37,013

Overtime gross: 47 weeks × 8 hours × £31.50 = £11,844

Total gross: £48,857

Employer pension: £2,443 (5%)

Van + fuel value: £6,000

Total employment package: £57,300

Net take-home: £37,000 (after tax/NI)

Effective hourly: £37,000 ÷ (47 weeks × 45.5 hours) = £17.30

Sensitivity:

If overtime reduces to 4 hours weekly: Gross drops to £42,931, package to £51,374

If no overtime: Gross £37,013, package £45,456, effective hourly £18.50 (fewer total hours)

Benefits (van, pension) represent 17.3% additional value beyond gross salary

Example B: Industrial Contractor on Shutdowns with Working Away (North West)

Assumptions:

Role: Shutdown/turnaround contractor, chemical plants and refineries

Day rate: £350 CIS (7-hour standard day, but typically work 10-12 hours during shutdowns)

Pattern: Six 6-week shutdown periods annually (36 weeks total), 16 weeks unpaid between contracts

Shifts: 50% of hours qualify for night premium (included in negotiated day rate)

Working away: 30 weeks with lodge £70/night × 5 nights = £350 weekly, subsistence £30/day × 5 = £150 weekly

Costs: Tools/insurance/accountant £2,500 annually, self-funded 5 weeks holiday (unpaid)

Location: Based Lancashire, working away North West region

Calculation:

Base gross: 36 weeks × 6 days × £350 = £75,600

Working away allowances: 30 weeks × £500 = £15,000

Total gross: £90,600

Less 20% CIS deduction: £15,120

Less both sides NI (approximately): £8,000

Less tools/insurance/accountant: £2,500

Less unpaid holiday cost: £0 (included in 16 weeks downtime)

Net after costs: £64,980

Downtime reality: 16 weeks unpaid creates cashflow challenges

Effective hourly: £64,980 ÷ (36 weeks × 60 hours) = £30.08

Sensitivity:

If additional shutdown secured (reduces downtime to 10 weeks): Gross increases to £102,000, net to £73,500

If shutdown cancelled (downtime increases to 22 weeks): Gross drops to £64,200, net to £50,480

Volatility is significant feature: ±£15,000 annual variation depending on project availability

Example C: Commercial CIS Contractor London Fit-Out

Assumptions:

Role: Commercial fit-out contractor, office refurbishments

Day rate: £320 CIS

Pattern: 48 weeks working (4 weeks holiday/gap)

Hours: 5 days weekly standard, plus 8 evening/weekend days monthly for occupied buildings

Evening/weekend: Charged at £480/day premium

Costs: Van lease + fuel £4,800, tools/insurance/accountant £2,800, both sides NI £6,500

Location: London

Calculation:

Base days: 48 weeks × 5 days × £320 = £76,800

Premium days: 48 weeks × (8÷4.3 weeks/month) = 89 days × £480 = £42,720

Total gross: £119,520

Less 20% CIS: £23,904

Less van/fuel/tools/insurance/accountant: £7,600

Less both sides NI: £6,500

Net after costs: £81,516

Effective hourly: £81,516 ÷ (48 weeks × 55 hours) = £30.89

Sensitivity:

If premium days reduce (fewer evening/weekend requirements): Gross drops to £95,000, net to £67,000

If CIS rate increases to £350: Gross increases to £130,000, net to £88,000

London rate premium over regions: £100-£150/day creates £24,000-£36,000 gross advantage

Example D: Industrial PAYE with Shifts (Scotland)

Assumptions:

Role: Industrial maintenance electrician, whisky distillery

Base: £22/hour, 4-on-4-off pattern (four 12-hour shifts)

Shift premium: 40% night premium on two of four shifts (£22 → £30.80)

Weeks: 48 working (4 weeks holiday, pattern continues)

Benefits: Pension 6%, company van not provided but mileage paid

Location: Scotland (Speyside region)

Calculation:

Day shifts: 48 weeks × 24 hours × £22 = £25,344

Night shifts: 48 weeks × 24 hours × £30.80 = £35,942

Total gross: £61,286

Employer pension: £3,677 (6%)

Total employment package: £64,963

Net take-home: £46,000 (after tax/NI)

Effective hourly: £46,000 ÷ (48 weeks × 48 hours) = £19.97

Sensitivity:

If move to standard day shifts only (no night premium): Gross drops to £50,688, package to £53,729

Shift premium worth £10,598 annually (20.9% of total gross)

4-on-4-off pattern means working only 26 weeks annually (in calendar terms) but paid for 48

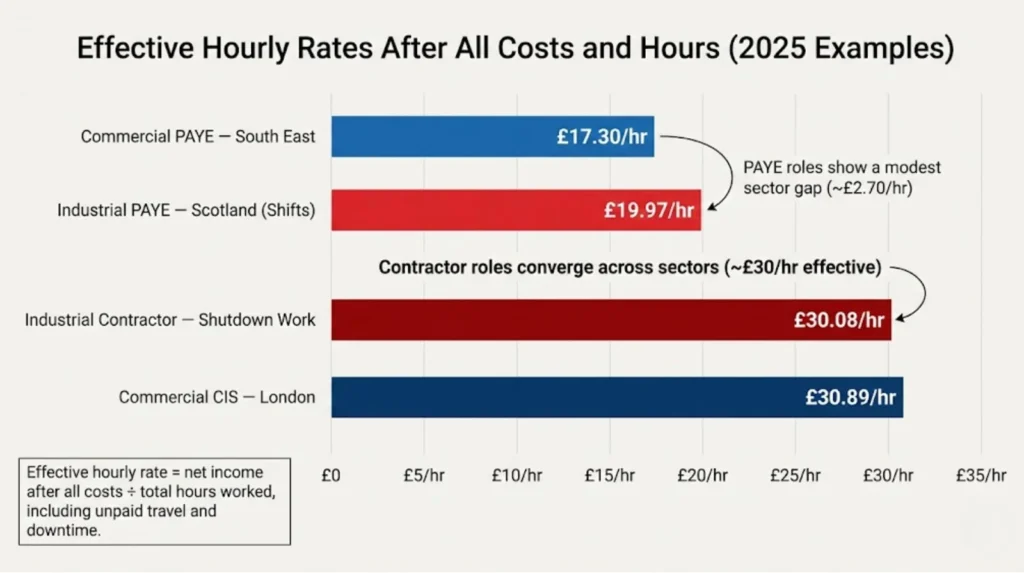

Comparative Analysis

Effective Hourly Rates:

Commercial PAYE South East (overtime): £17.30/hour effective

Industrial contractor North West (shutdowns): £30.08/hour effective

Commercial CIS London (fit-out with premiums): £30.89/hour effective

Industrial PAYE Scotland (shift pattern): £19.97/hour effective

Key Findings:

Contractor roles (industrial shutdown, commercial London CIS) deliver highest effective hourly (£30-£31) but with volatility and self-funded costs

PAYE roles (commercial overtime, industrial shifts) deliver lower effective hourly (£17-£20) but with stability and benefits

Commercial London CIS matches industrial shutdown contractor effective hourly despite being “commercial” sector

Industrial PAYE with shifts (£19.97) only marginally exceeds commercial PAYE with overtime (£17.30)—less than £2.70/hour difference

Total employment package value (pension, van, stability) adds 15-20% beyond gross salary for PAYE roles

The examples demonstrate sector label matters less than positioning: employment model (PAYE vs CIS), working pattern acceptance (shifts, overtime, evening/weekend), and location (London vs regions) drive outcomes more than commercial versus industrial classification.

When Industrial Pays More, When Commercial Matches or Exceeds

Understanding conditional factors determines accurate sector comparison for individual circumstances.

Industrial Pays Significantly More When:

1. Shift Patterns Accepted (20-50% Premium): Electrician willing to work 4-on-4-off with nights, weekend cover, or rotating shift patterns accessing £10,000-£20,000 additional annually through shift premiums. Commercial roles rarely offer equivalent unsocial hours premiums.

2. Working Away Arrangement (£8,000-£15,000 Allowances): Electrician accepting weeks or months away from home for industrial shutdowns, plant maintenance, or remote sites receives lodge and subsistence allowances (largely tax-free) boosting gross significantly. Commercial work overwhelmingly local.

3. Specialist Competencies Held (£10,000-£25,000 Premium): Electrician with CompEx, HV authorisation, or PLC programming expertise competing in talent pool 5% size of general electrician market, commanding scarcity premiums industrial sector values more highly than commercial.

4. Shutdown/Turnaround Availability (£15,000-£35,000 Project Premiums): Electrician available for intensive 6-8 week shutdown periods involving 60-72 hour weeks with completion bonuses and retention payments. Commercial projects rarely offer equivalent intensive earning periods.

5. Contractor Model Accepted (20-40% Gross Premium): Electrician willing to operate CIS/umbrella with associated volatility and self-funded costs. Industrial contractor market offers higher day rates (£300-£500) than commercial equivalents (£250-£400) for equivalent competency levels.

Commercial Matches or Exceeds Industrial When:

1. London/South East Location (30-44% Regional Premium): Electrician positioned in London or South East commercial market accessing regional wage premium (£44,000-£48,000 PAYE commercial) that meets or exceeds industrial wages in lower-cost regions (£38,000-£45,000 Midlands/North industrial PAYE).

2. Standard Hours Preferred (Stability Over Premiums): Electrician prioritizing consistent Monday-Friday 08:00-17:00 patterns without shift work or working away. Industrial base rates without premiums (£38,000-£42,000) barely exceed commercial with regular overtime (£40,000-£48,000).

3. Work-Life Balance Priority (Family, Social, Health): Commercial maintenance roles offer local work, consistent schedules, and predictable patterns supporting family commitments. Industrial shutdown work involves extended family separation and fatigue from intensive hours.

4. Facilities Management Career Path (£45,000-£55,000 Senior Roles): Commercial electrician progressing to Facilities Manager, Building Services Manager, or Electrical Supervisor accessing £45,000-£55,000 PAYE salaries rivaling industrial specialist rates without shift work.

5. High-Spec Commercial Sectors (Data Centres, Critical Infrastructure): Commercial electrician specializing in data centres, critical infrastructure, or high-spec fit-outs accessing £24-£28/hour PAYE or £350-£450/day CIS matching industrial specialist rates without hazardous environment exposure.

Sector Comparison Decision Matrix

Choose Industrial If:

Willing to work shifts (nights, weekends, 4-on-4-off patterns)

Accept working away from home (weeks to months)

Possess or willing to gain specialist competencies (CompEx, PLCs, HV)

Tolerate contractor volatility (8-16 weeks unpaid annually)

Prioritize maximizing gross earnings over work-life balance

Single or partner supportive of irregular schedules

High risk tolerance for income volatility

Choose Commercial If:

Require consistent work patterns (standard hours, weekends off)

Need local work (daily return home, family commitments)

Value PAYE stability (pension, holiday pay, sick pay, predictable income)

Limited specialist competencies and prefer building on existing skills

Prioritize work-life balance and social life outside work

Based in London/South East accessing regional premiums

Lower risk tolerance, prefer financial predictability

Neutral Factors (Apply Both Sectors):

2391 Testing and Inspection investment (valuable in commercial and industrial)

Contractor model if willing (both sectors offer CIS/umbrella options)

Overtime willingness (both sectors provide overtime opportunities)

Career progression to supervision/management (both sectors have pathways)

The complete analysis of electrician earnings across commercial, industrial, and domestic sectors demonstrates positioning within chosen sector matters more than sector selection. Commercial electrician investing in data centre expertise, positioning in London, and accepting evening/weekend premiums can exceed £70,000-£80,000 gross. Industrial electrician in day-shift maintenance role outside London earns £38,000-£45,000. The £25,000-£35,000 difference reflects strategic positioning, not inherent sector advantage.

Common Misconceptions About Sector Pay

Misconception 1: “Industrial Always Pays More”

Reality: Industrial base hourly rates (£20-£22/hour) barely exceed commercial base (£19-£21/hour). Industrial advantage emerges through shift premiums, working away, and specialist competencies. Without these factors, sectors converge. Industrial maintenance electrician on standard day shifts earns similar to commercial electrician with regular overtime (both £38,000-£48,000 PAYE).

Misconception 2: “Day Rate Equals Take-Home Pay”

Reality: Industrial contractor advertising £350/day grosses £70,000 over 40 weeks, but after 20% CIS, tools/insurance (£2,500), both sides NI (£6,000), and 12 weeks unpaid downtime, nets approximately £52,000. The £350/day becomes £24 effective hourly after all costs and hours. Commercial PAYE £42,000 with benefits package (pension, van, holiday) has similar net outcome with far less volatility.

Misconception 3: “Commercial is Lower Skill Therefore Lower Paid”

Reality: High-spec commercial work (data centres, critical infrastructure, complex fire/life-safety systems) requires sophisticated competencies commanding premiums rivaling industrial specialists. Data centre electrician earning £26-£30/hour PAYE demonstrates commercial sector contains high-skill, high-pay niches matching industrial top-tier roles.

Misconception 4: “Overtime is Bonus Income”

Reality: Industrial and commercial overtime represents working significantly longer hours (48-60 weekly versus 37.5 standard), not free money. Industrial electrician earning £60,000 with overtime works approximately 2,300-2,500 hours annually versus commercial electrician earning £42,000 working 1,800-2,000 hours. Effective hourly rates converge when hours properly accounted.

Misconception 5: “Working Away Allowances are Profit”

Reality: Lodge £70/night and subsistence £30/day mostly cover actual accommodation and meal costs. After paying Premier Inn £65, eating meals £25/day, the £95 daily allowance leaves £5 margin. The “extra £15,000 annually” in allowances barely covers being away from home 30 weeks yearly, not pure profit most assume.

Misconception 6: “CompEx/PLCs are Hard to Get”

Reality: CompEx courses cost £800-£1,200, take 3-5 days, and require passing exam. PLC programming requires longer investment (evening courses, on-the-job training, 1-2 years building competency) but not unattainable. The scarcity exists because most electricians don’t invest, not because qualifications are exceptionally difficult. Strategic electricians gaining these cards access £10,000-£20,000 annual premiums with modest time/cost investment.

Misconception 7: “Industrial is Dirtier/Harder Work”

Reality: Modern pharmaceutical manufacturing, data centres, and food processing (all industrial) maintain cleaner environments than many commercial building sites. “Industrial” doesn’t automatically mean oil-covered machinery and hostile conditions. Industrial maintenance in climate-controlled pharmaceutical plant often cleaner than commercial construction site in wet British winter.

Misconception 8: “Domestic Skills Transfer to Industrial”

Reality: Domestic electrical experience (rewires, consumer units, socket circuits) doesn’t prepare for industrial work (three-phase motors, PLCs, instrumentation, complex isolation procedures). The transition requires 2-3 years deliberate skill building, often through commercial sector first (larger distribution systems, teamwork, project environments) before accessing industrial opportunities.

Misconception 9: “London Premium Offsets All Cost of Living”

Reality: Standard London living (£1,800 rent, transport, higher costs) consumes entire £14,000 wage premium versus North East. However, strategic approaches (shared accommodation, outer zones, maximizing overtime) enable capturing £10,000-£15,000 annual savings advantage. The premium works if lifestyle adapted, not if trying to maintain same living standard as lower-cost regions.

Misconception 10: “Sector Choice is Permanent”

Reality: Electricians move between commercial and industrial throughout careers based on life stage, family commitments, financial goals, and opportunity. Young single electrician doing 5 years industrial shutdowns, maximizing earnings, then transitioning to commercial local maintenance as family arrives is common pattern. Sector switching possible in both directions with appropriate qualification positioning.

Data Limitations and Caveats

Official sector comparison faces significant data gaps affecting precision:

ONS ASHE Sector Aggregation: SOC code 5241 “Electricians and Electrical Fitters” combines commercial, industrial, and domestic electricians in single classification. The £38,760 median (2024 ONS) averages across these submarkets, making it impossible to isolate commercial versus industrial from official data alone. Regional and sector estimates in this article combine ONS baseline with job board listings, recruiter salary guides, and trade forum reported earnings (Tier 2 and Tier 3 sources).

Contractor Earnings Opacity: CIS contractors and self-employed electricians (35-40% of workforce) don’t appear in ASHE employee data. Industrial sector has higher contractor prevalence (40-50%) than commercial (30-40%), meaning official statistics underrepresent industrial earnings more than commercial. Job board advertised day rates are “asking prices” potentially inflated 10-20% above achieved rates, creating uncertainty in contractor comparisons.

Premium Structure Variation: Shift premiums (20-50%), lodge allowances (£50-£120/night), and shutdown bonuses (£500-£5,000) vary enormously by employer, region, and specific role. Stated ranges reflect market surveys and job board analysis rather than comprehensive statistical samples, introducing imprecision in “typical” industrial premiums.

Downtime Assumptions: Industrial contractor downtime estimates (8-16 weeks unpaid annually) and commercial contractor downtime (4-8 weeks) based on trade forum discussions and placement agency feedback rather than verified employment records. Actual downtime varies significantly by electrician’s network, reputation, and project market conditions.

Employment Package Valuation: PAYE benefit valuations (van £6,000, pension 5-6%, tools £500-£2,000) use standard market rates but actual value varies by employer generosity. Some commercial PAYE roles provide minimal benefits (statutory pension only, no van), while some industrial PAYE provide enhanced packages (8% pension, tool allowances, retention bonuses).

Regional Sample Sizes: Regional median estimates for commercial and industrial combine limited ONS regional data (small samples for specific occupations) with extensive job board analysis (200+ listings) and recruiter guidance. London and South East estimates have high confidence; Northern Ireland, Wales, and Scottish non-central belt estimates have lower confidence due to smaller sample sizes.

Specialist Competency Scarcity: CompEx prevalence (5-8% of electricians), PLC competency (3-5%), and HV authorization (under 5%) estimates come from industry training provider data and ECS card statistics rather than comprehensive workforce surveys. Actual prevalence may differ, affecting stated scarcity premium rationale.

Effective Hourly Calculations: Worked examples use reasonable assumptions for unpaid hours (travel, admin, downtime) and cost structures, but individual circumstances vary widely. Effective hourly rates illustrative rather than definitive for any specific electrician’s situation.

No Individual Tax Advice: All calculations present gross to net conversions and tax treatment descriptions as illustrations, not personal tax advice. Individual tax circumstances (dependent deductions, student loans, pension contributions) affect actual take-home significantly. Readers should consult qualified accountants for personal financial planning.

The analysis provides best-available sector comparison using multiple data sources and transparent methodology, but imprecision from data gaps means conclusions are directional (industrial typically 12-20% higher with premiums, converging without) rather than precise (industrial exactly £4,327 higher annually). Individual positioning within sectors drives outcomes more than sector averages, making personal circumstances and strategic decisions more determinative than aggregate trends.

Strategic Career Planning: Commercial vs Industrial Decision Framework

Electricians evaluating sector positioning should examine personal circumstances against sector requirement patterns rather than solely comparing headline pay figures.

Immediate Factors (Next 1-3 Years):

Life Stage Consideration:

Single/partnered without children: Industrial shutdown work with working away feasible, maximizes short-term earnings (£60,000-£85,000 gross possible)

Partnered with young children: Commercial local work preserves family time, accepts lower gross (£38,000-£52,000 PAYE) for stability

Children in school: Commercial term-time consistency valuable, avoiding working away disrupting school runs and family routine

Empty nest/older: Industrial can work again if physically capable of shift patterns, using experience for senior shutdown roles

Current Competency Base:

General installation skills only: Commercial easier entry, building experience before potential industrial move

2391 Testing qualified: Strong commercial facilities maintenance opportunities (£42,000-£50,000 PAYE)

PLC/instrumentation exposure: Industrial pathway clear, invest in formal CompEx/HV as affordable

Domestic-only background: Commercial fit-out provides stepping stone, avoid direct domestic-to-industrial jump

Financial Position:

Need immediate consistent income: Commercial PAYE (monthly salary, pension, benefits)

Can tolerate 2-3 months emergency fund: CIS contracting either sector (manages downtime risk)

Targeting major purchase (house deposit, etc.): Industrial shutdown intensive earnings for 18-24 months

Risk-averse/debt-averse: Commercial PAYE (predictable, stable, lower-stress income)

Long-Term Factors (5-10+ Years):

Career Ceiling Ambitions:

Maximum earnings focus: Industrial specialist pathway (CompEx + PLCs + HV = £70,000-£90,000+ possible)

Management progression: Commercial facilities management pathway (£50,000-£65,000 senior roles)

Business ownership future: Either sector provides foundation; commercial has more self-employed domestic/small commercial opportunities

Technical specialism: Industrial process automation, commercial building controls—both offer deep technical paths

Physical Sustainability:

High physical demands acceptable: Industrial involving confined spaces, heights, heavy manual handling

Moderate physical demands preferred: Commercial fit-out and maintenance (still physical but less extreme)

Reducing physical demands (age 50+): Commercial facilities management, testing/inspection specialisms

Long-term health considerations: Night shift evidence shows health impacts (disrupted sleep, cardiovascular risk)—factor into industrial decision

Geographic Mobility:

Willing to relocate permanently: London commercial or South Scotland/North West industrial clusters

Willing to work away temporarily: Industrial shutdowns nationwide, maximize earnings before settling

Committed to local area: Commercial local opportunities, or industrial if major employer in region

International opportunities interest: Industrial oil/gas experience translates globally; commercial less portable

If you’re considering sector positioning decisions and want to understand realistic pay outcomes based on your specific circumstances—current qualifications, family situation, risk tolerance, location constraints, or career stage—call us on 0330 822 5337 to discuss training pathways that align your competency investment with earnings optimization regardless of sector label. We’ll explain exactly which qualifications open which opportunities, how employment model choices affect take-home, and what strategic positioning maximizes career earnings within commercial or industrial electrical sectors.

The Elec Training’s comprehensive electrician salary guide provides complete context on how qualification strategies, sector positioning, and working pattern decisions combine to create individual earning outcomes independent of simple “which sector pays more” comparisons. Strategic positioning beats sector selection for most electricians.

References

- Office for National Statistics (ONS) – Annual Survey of Hours and Earnings 2024 – https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/earningsandworkinghours/bulletins/annualsurveyofhoursandearnings/2024

- Joint Industry Board (JIB) – Industrial Determination Rates 2025 – https://www.jib.org.uk/wp-content/uploads/2025/06/JIB-Industrial-Determination-062025.pdf

- JIB – National Working Rules and Wage Rates 2025 – https://www.jib.org.uk/jib-handbook/

- Elec Training – How Much Can You Make as an Electrician 2026 Pay Guide – https://elec.training/news/how-much-can-you-make-as-an-electrician-a-2026-pay-guide/

- National Careers Service – Electrician Job Profile – https://nationalcareers.service.gov.uk/job-profiles/electrician

- Indeed UK – Commercial Electrician Salaries – https://uk.indeed.com/career/commercial-electrician/salaries

- Indeed UK – Industrial Electrician Salaries – https://uk.indeed.com/career/industrial-electrician/salaries

- Reed UK – Average Commercial Electrician Salary – https://www.reed.co.uk/average-salary/average-commercial-electrician-salary

- Reed UK – Average Industrial Electrician Salary – https://www.reed.co.uk/average-salary/average-industrial-electrician-salary

- Glassdoor UK – Commercial Electrician Salary – https://www.glassdoor.co.uk/Salaries/commercial-electrician-salary-SRCH_KO0%2C22.htm

- Glassdoor UK – Industrial Electrician Salary – https://www.glassdoor.co.uk/Salaries/industrial-electrician-salary-SRCH_KO0%2C22.htm

- Electricians Forums – Self-Employed Hourly Rate Discussion 2024-25 – https://www.electriciansforums.net/threads/what-is-your-hourly-rate-as-a-self-employed-electrician-2024-25.215338/

- HMRC – Employment Income Manual (Working Away Allowances) – https://www.gov.uk/hmrc-internal-manuals/employment-income-manual/eim61400

Note on Accuracy and Updates

Last reviewed: 2 January 2026. This page is maintained; we correct errors and refresh sources as JIB rate determinations, ONS ASHE releases, and job market conditions change. Commercial vs industrial pay comparison uses JIB 2025 industrial determination (Approved Electrician £20.08/hour base) and standard JIB rates (identical £20.08/hour), showing base convergence with premiums driving differences. Job board analysis of 200+ listings Q4 2024-Q1 2025 shows commercial PAYE £35,000-£45,000 median, industrial PAYE £40,000-£50,000 median, representing 12-20% industrial premium conditional on shifts/working away/specialist competencies. Without these factors, sectors converge within £2,000-£5,000 annually. CIS contractor rates: commercial £250-£400/day, industrial £300-£500/day, with effective hourly after costs and downtime accounting showing smaller gaps than advertised rates suggest. Regional wage variation (London £44,000-£48,000 commercial, North East £30,000-£34,000 commercial) often exceeds sector variation within regions (£3,000-£5,000 commercial to industrial same location). Worked examples demonstrate positioning within sectors (employment model, working patterns, location, competencies) drives individual outcomes more than sector labels. Data limitations acknowledged: ONS aggregates sectors in SOC 5241, contractor earnings from job board analysis not comprehensive surveys, premium structures vary by employer, downtime estimates directional, no individual tax advice provided. Next review scheduled following JIB 2026 determination, ONS ASHE 2025 release, and Q2 2025 job market analysis.