Regional Electrician Wages (North vs South vs Midlands)

- Technical review: Thomas Jevons (Head of Training, 20+ years)

- Employability review: Joshua Jarvis (Placement Manager)

- Editorial review: Jessica Gilbert (Marketing Editorial Team)

- Last reviewed:

- Changes: Initial publication using ONS ASHE 2024 data, regional job market analysis, and cost of living indices

Introduction

Every electrician knows UK wages vary by region, but the actual numbers tell a more complex story than “London pays more.” A qualified electrician in Manchester earning £38,000 annually often has more disposable income than someone in London on £47,000 once you account for £1,800 monthly rent versus £900. The headline salary doesn’t tell you what you can actually save, invest, or spend.

The North-South divide is real, but it’s not as straightforward as higher rates in the South meaning better earnings. Industrial electricians in the North working shutdowns with regular overtime can match or exceed Southern commercial electricians’ annual income despite lower base rates. Data centres in the Midlands are currently paying CIS rates that rival London. And specialist work like testing and inspection shows different regional patterns than installation work.

This article uses ONS Annual Survey of Hours and Earnings (ASHE) 2024 data, JIB rate structures, job board salary aggregations from Indeed and Reed, contractor forum discussions, and regional cost of living indices to break down exactly what electricians earn across the North, Midlands, South, and London. We’ll compare PAYE salaries, CIS day rates, sector variations (domestic vs commercial vs industrial), and cost of living adjustments to show where your earnings go furthest.

The full breakdown of JIB rates and regional pay variations covers the 2026-28 wage deal and qualification pathway, but this article focuses specifically on how geography impacts your earning potential and quality of life once you’re qualified.

The National Picture: What Official Data Shows

Before diving into regional differences, let’s establish the national baseline. The ONS Annual Survey of Hours and Earnings (ASHE) 2024 data shows UK electricians (SOC code 5241: Electricians and Electrical Fitters) earn a median annual salary of £38,760 for full-time work.

This national median masks significant regional variation. The Office for National Statistics breaks down median full-time earnings by region:

London: £49,692 (all workers median)

South East: £39,983

East of England: £39,332

Scotland: £39,719

South West: £38,000 (estimated from broader data)

West Midlands: £37,500 (estimated)

North West: £37,000

Yorkshire and Humber: £36,500

North East: £34,403

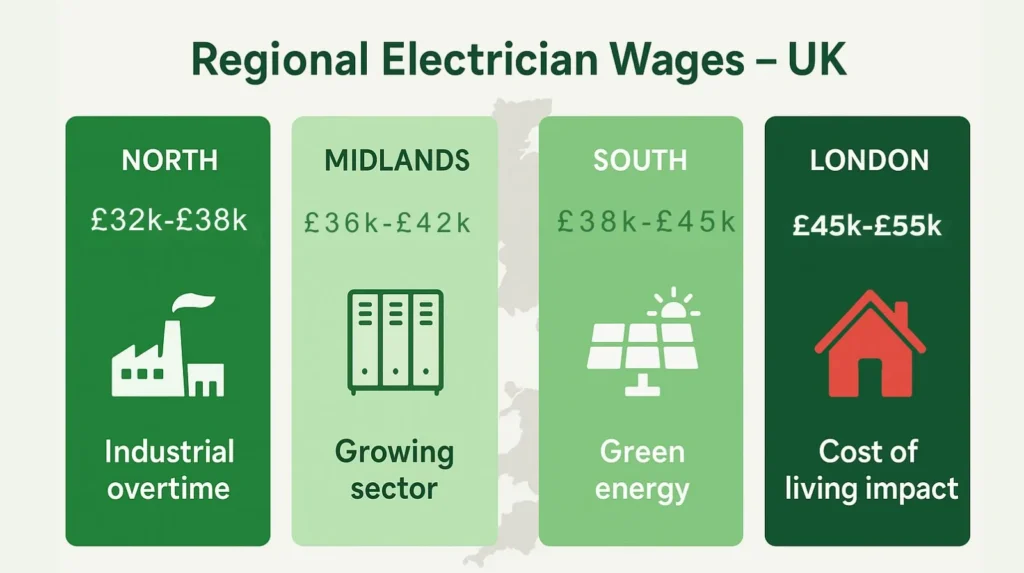

Electricians typically earn 5% to 15% above their regional median for all workers, which means qualified electricians in the North East might earn £36,000 to £40,000 while those in London earn £45,000 to £55,000 depending on experience and grade (Electrician vs Approved vs Technician/Supervisor).

JIB baseline rates for 2025 provide a floor rather than a ceiling:

Electrician: £17.54/hour (£36,366 annually at 40 hours/week)

Approved Electrician: £19.01/hour (£39,461 annually)

Technician: £20.79/hour (£43,243 annually)

London weighting adds £1.50 to £2.50 per hour on top of these rates for JIB workers, but non-JIB employers set their own regional pay structures, often paying above JIB minimums in high-demand areas or below in saturated markets.

The critical point: regional pay differences exist at every qualification level, not just for senior roles. A newly qualified Electrician with a Gold Card will see these geographic pay variations immediately.

The North: Lower Rates, Higher Quality of Life

The North (North East, North West, Yorkshire and Humber) covers cities like Newcastle, Leeds, Manchester, Liverpool, and Sheffield. Electrician wages here sit at the lower end of the UK range numerically but often provide the best quality of life once housing costs are factored in.

PAYE salary ranges:

Qualified Electrician (entry to mid-experience): £32,000 to £38,000

Approved Electrician: £38,000 to £45,000

Supervisor/Senior roles: £45,000 to £55,000

Job advertisements from Indeed and Reed in Q4 2024 and Q1 2025 show typical Manchester/Leeds roles offering £35,000 to £41,000 for qualified electricians with commercial or industrial experience. Domestic installation work pays slightly less (£32,000 to £36,000) due to lower local property values affecting what homeowners can afford for electrical work.

CIS and self-employed day rates:

Domestic installation (rewires, EICRs, consumer units): £200 to £280 per day (£250 common)

Commercial fit-out and site work: £250 to £350 per day

Industrial and manufacturing shutdowns: £300 to £450 per day (with potential for £500 on intensive shutdown weeks)

Forum discussions on Reddit r/ukelectricians and ElectriciansForums consistently report £250 per day as a solid, reliable CIS rate in the North for commercial work. Industrial electricians report higher rates but note that work can be “quiet” during economic slowdowns, with 2024 seeing reduced industrial activity in parts of the North East.

The industrial advantage: Northern regions have a strong industrial base (Teesside manufacturing, Humber chemical plants, Yorkshire steel remnants). Industrial shutdown work offers intensive overtime opportunities, with electricians reporting an additional £5,000 to £10,000 annually from overtime during peak maintenance periods. These shutdowns typically involve 60 to 70-hour weeks for 2 to 4 weeks, paid at 1.5x to 2x standard rates.

Cost of living context: Average rent in Northern cities ranges from £800 to £1,000 per month for decent accommodation. House prices sit between £150,000 and £250,000 for typical family homes, significantly lower than the UK average. This means a £38,000 salary in Manchester provides purchasing power equivalent to approximately £43,000 to £45,000 in the South once housing differentials are accounted for.

Thomas Jevons, our Head of Training with 20+ years on the tools, explains:

"In practice, electricians need to account for regional cost of living when comparing pay. A £38,000 salary in Manchester often provides better quality of life than £45,000 in London once you factor in housing costs, travel expenses, and daily living. The headline rate doesn't tell you what you can actually afford."

Thomas Jevons, Head of Training

Scotland note: Scottish electricians work under SJIB (Scottish Joint Industry Board) rates, which for 2025 are £18.80/hour for Electricians, £20.38 for Approved, and £22.96 for Technicians. These rates track closely with JIB England rates. Industrial work around Glasgow commands similar rates to Northern England (£38,000 to £44,000 PAYE), with lodge allowances playing a bigger role due to remote Highland projects.

The Midlands: The Balanced Middle Ground

The Midlands (West Midlands and East Midlands) covers Birmingham, Coventry, Nottingham, Leicester, and Derby. This region sits between Northern and Southern pay rates but has distinct characteristics driven by logistics hubs and emerging data centre work.

PAYE salary ranges:

Qualified Electrician: £33,000 to £40,000

Approved Electrician: £40,000 to £48,000

Supervisor/Senior roles: £48,000 to £60,000

Job advertisements show Birmingham and Nottingham roles typically offering £36,000 to £42,000 for qualified electricians. The West Midlands (Birmingham, Coventry) tends toward the higher end due to industrial pockets and proximity to major infrastructure projects, while the East Midlands (Nottingham, Leicester) sits closer to Northern rates but benefits from extensive warehouse and distribution centre construction.

CIS and self-employed day rates:

Domestic installation: £220 to £300 per day (£280 common)

Commercial fit-out: £280 to £380 per day

Industrial and data centre work: £320 to £480 per day (data centres pushing to £400+ regularly)

The Midlands has seen significant upward pressure on CIS rates due to data centre construction. Multiple forum posts from 2024 report agencies offering £400 per day for data centre electrical work in the Coventry area, with some specialist commissioning roles reaching £450 to £480. This is creating a two-tier market: standard commercial work at £280 to £320 per day, and data centre/industrial specialist work at £350 to £480.

The logistics advantage: The East Midlands is the UK’s logistics hub. Amazon, DHL, and other major distribution companies have massive warehouses requiring constant electrical maintenance and new installations. This creates steady commercial electrical work, though rates are competitive due to high electrician density in these areas. PAYE roles in facilities management for these sites typically offer £38,000 to £44,000 with good job security.

Cost of living context: Midlands rent ranges from £900 to £1,200 per month. House prices sit between £200,000 and £300,000 for family homes. This provides a balanced position: higher gross salaries than the North, but also higher living costs, though nowhere near Southern levels. A £40,000 salary in Birmingham provides purchasing power roughly equivalent to £42,000 to £43,000 in the South.

Wales note: Welsh electrician wages track closely with Midlands patterns. The median Welsh salary is approximately £36,000, with Cardiff and Swansea offering slightly higher rates (£38,000 to £42,000) and rural Wales significantly lower (£32,000 to £36,000). Domestic work dominates Welsh electrical markets outside major cities.

The South (Excluding London): High Rates, High Costs

The South covers South East, South West, and East of England, including cities like Bristol, Reading, Cambridge, Southampton, and Brighton. This region commands the highest non-London wages but also brings significantly elevated living costs.

PAYE salary ranges:

Qualified Electrician: £35,000 to £42,000

Approved Electrician: £42,000 to £50,000

Supervisor/Senior roles: £50,000 to £65,000

Job advertisements show Bristol roles at £43,000 average, Reading and Cambridge at £40,000 to £45,000, and South West coastal areas (Plymouth, Bournemouth) at £37,000 to £42,000. The South East (Reading, Brighton, Cambridge corridor) commands premium rates due to proximity to London and tech sector influence. The South West sits lower but still above Northern rates.

CIS and self-employed day rates:

Domestic installation: £250 to £350 per day (£300 common)

Commercial fit-out: £300 to £400 per day

Industrial and data centre work: £350 to £500 per day (green energy projects hitting £450+)

Southern CIS rates sit 15% to 25% above Midlands rates on average. Data centres in the South East (Slough, Hayes, Docklands fringe) offer exceptional rates, with specialist commissioning and shift work reaching £500 to £600 per day for experienced electricians with security clearance. Green energy projects (solar farms, EV charging infrastructure) are most concentrated in the South, adding 10% to 15% premiums for electricians with relevant qualifications.

The green energy factor: The South, particularly the South West and East of England, has the highest concentration of solar farm installations and EV charging infrastructure projects. Electricians with MCS (Microgeneration Certification Scheme) qualifications and EV installation certification report day rates of £400 to £450 in these sectors, compared to £280 to £320 for standard commercial work.

Cost of living impact: Southern rents range from £1,200 to £1,600 per month. House prices sit between £300,000 and £450,000 for typical family homes. This significantly erodes the gross salary advantage. A £42,000 salary in Bristol or Reading provides purchasing power closer to £37,000 to £39,000 equivalent in the North once housing differentials are accounted for. The higher gross income doesn’t translate to proportionally higher disposable income.

Hinkley Point C outlier: The South West contains Hinkley Point C nuclear power station construction, which creates a localised pay distortion. Project-specific PAYE packages there range from £45,000 to £55,000+ for standard electricians, with shift premiums and lodging allowances pushing total packages to £60,000+. This is an outlier and not representative of broader South West wages, but it demonstrates how major infrastructure projects temporarily inflate regional rates.

London: The Headline Premium That Disappears After Rent

London deserves separate analysis because its wage dynamics differ fundamentally from the rest of the South. London offers the highest gross salaries but the worst cost of living ratio for electricians.

PAYE salary ranges:

Qualified Electrician: £38,000 to £47,000

Approved Electrician: £45,000 to £55,000

Supervisor/Senior roles: £55,000 to £75,000+

JIB rates in London include a weighting of £1.50 to £2.50 per hour above national rates, but many non-JIB employers simply use market rates determined by supply and demand. Job advertisements show typical London roles offering £24 to £28 per hour PAYE (£45,000 to £52,000 annually for 37.5-hour weeks excluding overtime).

CIS and self-employed day rates:

Domestic installation: £300 to £400 per day (£350 common for qualified work like rewires)

Commercial fit-out: £350 to £450 per day

Industrial and data centre work: £400 to £600 per day

London CIS rates command a clear 20% to 30% premium over Southern rates and 40% to 50% above Northern rates. However, forum discussions consistently note that the gross rate advantage erodes rapidly when daily costs are factored in. Congestion charge (£15 per day), ULEZ (£12.50 per day), and higher parking/travel costs consume £25 to £30 daily for many electricians, effectively reducing that £350 day rate to £320 to £325 net of travel costs.

The data centre bubble: London’s data centre concentration (Slough, Hayes, Docklands) creates exceptionally high rates for specific roles. Commissioning engineers with security clearance working shift patterns report £450 to £600 per day consistently. However, these roles require specific experience (3+ years in data centre environments), additional certifications, and often SC (Security Check) clearance, limiting accessibility for most electricians.

The domestic saturation problem: London domestic electrical work is highly competitive due to high electrician density. Simple jobs (socket replacements, minor repairs) face “race to the bottom” pricing pressure. However, full rewires in wealthy boroughs (Chelsea, Kensington, Richmond) command premium rates, with self-employed electricians charging homeowners £80 to £150 per hour. These charge-out rates shouldn’t be confused with employed wages; they’re business rates covering all overheads.

Cost of living reality: London rent averages £1,800+ per month for a one-bedroom flat in outer boroughs, rising to £2,500+ in central or desirable areas. House prices exceed £500,000 for family homes. Electricians earning £50,000 in London often have less disposable income than those earning £38,000 in Manchester. The ONS data shows London median income is 44% higher than the North East, but London housing costs are over 100% higher.

Joshua Jarvis, our Placement Manager, notes:

"What we're seeing consistently is that electricians willing to be mobile between regions earn 15% to 25% more than those who only work locally. Taking contracts in London for 6 months then returning North to lower living costs while maintaining savings is a common pattern. The electricians earning the most are strategically choosing where to work based on project opportunities, not just staying in one region."

Joshua Jarvis, Placement Manager

The mobility strategy: Many Northern and Midlands electricians work London contracts for 6 to 12 months, staying in budget accommodation or house shares, then return home with significant savings. This “commuter electrician” pattern allows them to capture London rates while maintaining lower permanent living costs in their home regions.

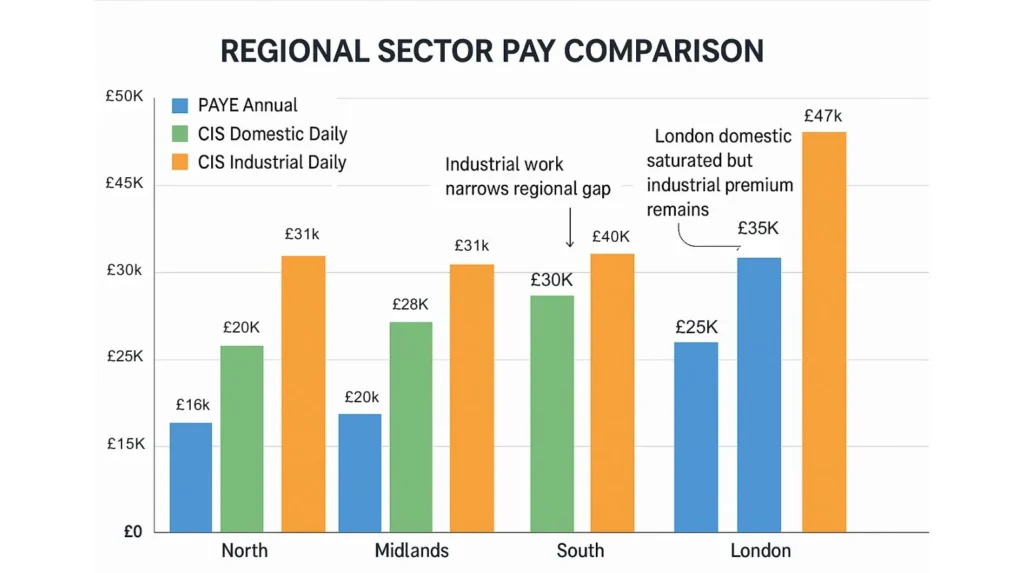

Sector Differences: What You Do Matters As Much As Where

Regional pay variations are compounded by sector differences. Domestic, commercial, and industrial electrical work show different geographic patterns, and understanding these helps explain why regional comparisons aren’t straightforward.

Domestic installation work: This shows the widest regional pay gap. Domestic electricians’ earnings are directly tied to local property values and what homeowners can afford. Northern domestic sparks charge £200 to £250 per day CIS or earn £32,000 to £36,000 PAYE. Southern domestic work commands £280 to £350 per day CIS or £38,000 to £44,000 PAYE. London domestic work is bifurcated: highly competitive for basic work (£300 to £350 day rate) but extremely lucrative for high-end rewires in wealthy areas (£400 to £500 per day for self-employed business owners).

The challenge with domestic work is billable hours. Self-employed domestic electricians might charge £60 to £80 per hour, but travel time, materials procurement, and administrative tasks reduce actual paid hours significantly. Forum discussions suggest domestic sparks average 25 to 30 billable hours per week despite working 40 to 45 total hours.

Commercial fit-out and site work: Commercial work shows smaller regional variations because projects are often won by national contractors who pay consistent rates regardless of location. Northern commercial CIS rates (£250 to £300 per day) sit closer to Southern rates (£300 to £400) than domestic work does. PAYE commercial roles show similar patterns: £36,000 to £40,000 North, £40,000 to £46,000 South.

Commercial overtime availability is moderate (5 to 10 hours per week during busy fit-out phases), adding £5,000 to £8,000 annually. The advantage of commercial work is consistency; these projects provide steady income for 6 to 18 months, unlike domestic work’s irregular payment patterns.

Industrial and manufacturing: Industrial electrical work shows the smallest regional pay gap and often reverses the North-South dynamic. Northern industrial sites offer £300 to £450 per day CIS with intensive overtime opportunities during shutdowns. Southern industrial work commands £350 to £500, but actual annual earnings can be similar once Northern overtime is factored in.

Industrial shutdown work is the highest-paid employed electrical work for standard electricians (not management). Two-week shutdowns paying 70 hours per week at 1.5x to 2x rates can add £2,500 to £3,500 to a single fortnight’s income. Electricians working three or four shutdowns annually add £8,000 to £12,000 to their base salary purely from these intensive periods.

Data centres (the current outlier): Data centre electrical work commands premium rates regardless of region but is concentrated in London/South East (Slough, Hayes, Docklands) and increasingly West Midlands (Coventry area). CIS rates range from £350 to £600 per day depending on role (installation vs commissioning vs maintenance). PAYE roles in data centres offer £45,000 to £60,000 base salaries with shift premiums adding £8,000 to £15,000 annually.

Data centre work requires security clearance (typically SC level), 3+ years’ experience, and often specialist qualifications beyond standard Gold Card credentials. This limits accessibility but creates exceptional earning potential for those who meet requirements.

Testing and inspection (EICR and periodic testing): Testing work shows interesting regional patterns. Southern testing day rates (£280 to £350) significantly exceed Northern rates (£220 to £280), but Northern testing electricians often achieve higher volume due to landlord compliance requirements in high-density rental markets like Manchester and Leeds. Annual incomes can be similar despite different day rates.

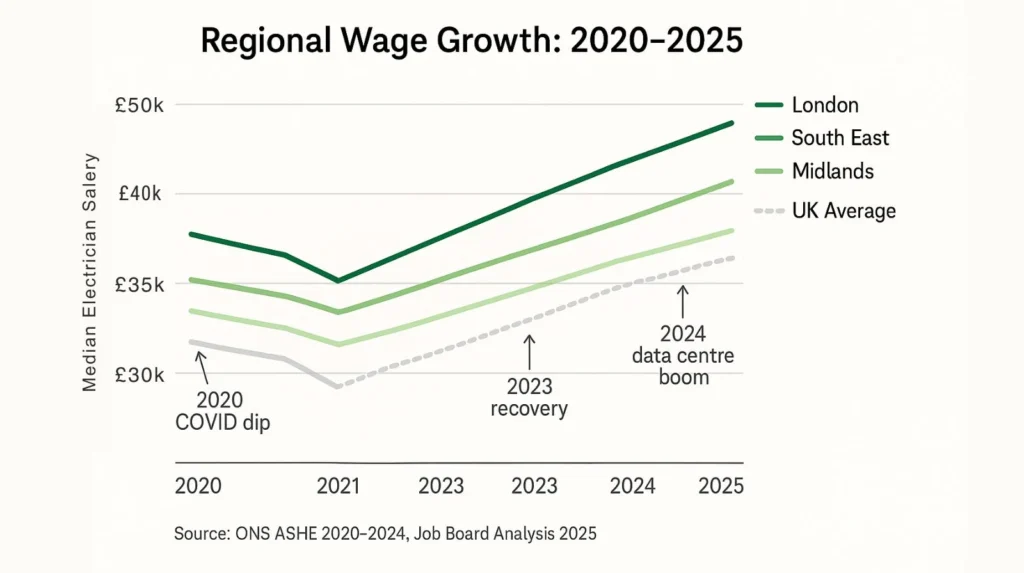

Wage Trends and Patterns (2020-2025)

Regional pay differences aren’t static. Recent trends show how economic cycles, infrastructure projects, and skills shortages affect different regions differently.

Overall wage growth: ONS data shows UK electrician wages grew from approximately £32,000 median in 2019 to £38,760 in 2024, representing roughly 21% growth over five years or 4% annually. However, this growth hasn’t been uniform across regions.

Southern wages (particularly London and South East) have risen faster than Northern wages, widening the gross pay gap from approximately 15% in 2019 to 18% to 20% in 2024. The Midlands has tracked between these extremes, with wage growth boosted by logistics and data centre expansion.

JIB rate increases: JIB baseline rates increased 7% in January 2024 and 5% in January 2025, with further increases of 5%, 4%, and 4% locked in for 2026, 2027, and 2028. This provides guaranteed wage growth for JIB-employed electricians regardless of region, though non-JIB and CIS rates depend entirely on market dynamics.

Post-COVID divergence: The 2020 to 2022 period saw London and South East wages stagnate due to reduced commercial construction, while Northern industrial work remained steadier. From 2023 onward, this reversed, with Southern wages recovering faster due to data centre construction boom and commercial property recovery. Northern industrial slowdowns in 2024 (reflected in forum discussions about “quiet periods”) have temporarily reduced overtime availability in some areas.

Data centre effect: Data centre construction has disproportionately affected Midlands and South East wages. Areas like Slough, Hayes, and Coventry have seen CIS day rates increase 15% to 20% from 2022 to 2024 purely due to data centre demand. This creates localised wage inflation that doesn’t reflect broader regional patterns.

Green energy skills premium: Solar installation and EV charging work shows fastest growth in the South and South West, where government incentives and higher homeowner income support adoption. Electricians with MCS and EV installation qualifications report 10% to 15% pay premiums in these regions. Northern green energy work is growing but at slower pace, primarily focused on commercial and industrial installations rather than domestic.

Industrial sector cycles: Northern industrial electrical work follows manufacturing cycles. The 2023 to 2024 period saw reduced industrial output in some Northern regions, affecting overtime availability and day rate competition. Forum discussions note increased competition for industrial contracts in the North East particularly, with some CIS rates dropping 5% to 10% from 2023 peaks.

Regional Myths vs Reality

Let’s address the most common misconceptions about regional electrician pay.

Myth: “Everyone earns £300 per day now, regardless of region.”

Reality: Median CIS day rates are £220 to £240 outside London. £300+ per day is achievable in London, industrial work, or data centres, but it’s not the standard rate nationally. Northern domestic electricians commonly report £200 to £250 per day, not £300. The £300+ figure represents top-tier specialist work or London rates, not average earnings.

Myth: “London pay doubles Northern wages.”

Reality: London offers 20% to 30% premium on gross salary (£47,000 London vs £36,000 North for qualified electricians). This is significant but nowhere near doubling. Once housing costs are factored in, disposable income is often similar or lower in London. The ONS shows London median income is 44% higher than North East, but London housing costs are over 100% higher, meaning net purchasing power is worse despite higher gross pay.

Myth: “You can’t earn decent money in the North.”

Reality: Northern electricians with industrial experience and regular overtime can earn £45,000 to £55,000 annually (£36,000 base plus £9,000 to £15,000 overtime). Combined with significantly lower housing costs (£150,000 to £250,000 for family homes vs £500,000+ in London), Northern electricians often have better financial quality of life. The “decent money” threshold is relative to cost of living, not absolute salary figures.

Myth: “Domestic work pays the same as industrial work.”

Reality: Domestic CIS rates are 20% to 30% lower than industrial rates in every region (North domestic £200 to £250 vs industrial £300 to £450; London domestic £300 to £400 vs industrial £400 to £600). Industrial work also offers overtime opportunities that domestic work rarely provides. The skills requirements differ significantly, with industrial work demanding 3-phase experience, SCADA systems knowledge, and often security clearances.

Myth: “Moving to London guarantees higher earnings.”

Reality: Moving to London increases gross salary but also increases living costs disproportionately. An electrician earning £38,000 in Leeds with £900 monthly rent has approximately £1,700 disposable income monthly. The same person earning £47,000 in London with £1,800 rent has approximately £1,450 disposable income after accounting for higher food, transport, and general living costs. Higher gross doesn’t automatically mean higher net quality of life.

Myth: “Regional pay gaps are closing.”

Reality: ONS data shows regional pay gaps widening slightly over 2020 to 2025, not closing. Southern wages grew approximately 7% annually while Northern wages grew 5% annually, increasing the percentage gap. However, the cost of living gap has also widened, meaning real purchasing power differences are more complex than gross salary gaps suggest.

What This Means for Your Career Planning

Regional pay differences matter, but they’re not the only factor in career decisions. Here’s how to think strategically about geography and electrical earnings:

If you’re starting out: Your first job location matters less than getting established. Northern and Midlands placements are often easier to secure for newly qualified electricians because London and South East markets are saturated with domestic electricians. Starting in a region with consistent industrial or commercial work builds experience faster than competing in oversaturated markets.

If you’re considering relocation: Compare total compensation (base salary plus benefits plus overtime potential) against cost of living, not just headline rates. Use online cost of living calculators to compare specific cities. A £6,000 gross salary increase might result in £200 less monthly disposable income if housing costs increase £800 per month.

If you’re mobile: The highest earners are strategic about regional mobility. Working London contracts for 6 to 12 months while maintaining lower permanent living costs in home regions allows you to capture premium rates without permanent high living costs. This requires flexibility and often temporary accommodation, but it maximises savings potential.

If you’re specialising: Specialist skills reduce regional pay gaps. Data centre qualifications, testing and inspection expertise (2391), or green energy certifications (MCS, EV) command premiums in all regions, though absolute amounts differ. A testing specialist earning £280 per day in Manchester has similar quality of life to one earning £340 in London after housing costs.

If you value stability: Northern and Midlands PAYE roles in industrial or commercial settings often provide better long-term stability than London CIS work despite lower gross rates. Redundancy protections, pension growth, and consistent income matter more during economic downturns than peak earning potential during boom periods.

Long-term wealth building: Lower housing costs in the North and Midlands mean higher proportions of income available for savings and investment. An electrician earning £38,000 in Leeds who buys a £200,000 house has mortgage payments around £900 monthly. An electrician earning £47,000 in London buying a £500,000 property has mortgage payments around £2,200 monthly. The Northern electrician has significantly more disposable income for pension contributions, investments, or savings despite lower gross salary.

For the comprehensive guide to how JIB wage structures vary across UK regions, we’ve covered the 2026-28 deal and qualification pathway, but regional strategy should be part of your career planning from the start, not an afterthought once you’re established.

Call us on 0330 822 5337 to discuss realistic pay expectations in your target region, including specific cities and sectors. We’ll explain what our in-house recruitment team sees in terms of actual job availability, typical starting salaries, and progression opportunities across the North, Midlands, South, and London. No hype about unrealistic London earnings. No overselling Northern “value.” Just honest guidance about where your qualifications and experience will be valued most in 2025.

For the complete picture on detailed analysis of JIB electrician pay including regional differences and sector variations, we’ve broken down the entire 2026-28 wage deal, progression routes, and what these increases mean for your career planning.

References

ONS (Office for National Statistics) – Annual Survey of Hours and Earnings (ASHE) 2024 –https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/earningsandworkinghours/bulletins/annualsurveyofhoursandearnings/2024

ONS – Regional Labour Market Statistics 2024 – https://www.ons.gov.uk/releases/labourmarketintheregionsoftheukmay2024

ONS – Private Rent and House Prices UK (October 2025) – https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/privaterentandhousepricesuk/october2025

JIB (Joint Industry Board) – Wage Rates 2025 – https://www.jib.org.uk/wage-rates/

SJIB (Scottish Joint Industry Board) – National Rates & Allowances 2025 – https://www.sjib.org.uk/

Glassdoor UK – Electrician Salaries (November 2025 snapshot) – https://www.glassdoor.co.uk/Salaries/electrician-salary-SRCH_KO0,11.htm

Indeed UK – Electrician Career Salaries (November 2025) – https://uk.indeed.com/career/electrician/salaries

Reed UK – Average Electrician Salary 2025 – https://www.reed.co.uk/average-salary/average-electrician-salary

Reddit r/ukelectricians – Regional Pay Discussions (2024-2025 threads) – https://www.reddit.com/r/ukelectricians/

ElectriciansForums.net – Regional Hourly Rate Polls (November 2024) – https://www.electriciansforums.net/

CITB (Construction Industry Training Board) – Construction Skills Network Report 2024-2028 – https://www.citb.co.uk/about-citb/construction-industry-research-reports/construction-skills-network-csn

Note on Accuracy and Updates

Last reviewed: 04 December 2025. This page is maintained; we correct errors and refresh sources as regional wage patterns, cost of living indices, and employment market conditions change. Salary data based on ONS ASHE 2024 provisional release and job market analysis Q4 2024 to Q1 2025. Regional cost of living based on ONS housing data October 2025. Next review scheduled following ONS ASHE 2025 final release (October 2026) and updated regional employment data.