The Impact of Self-Employment on Electrician Income: Gross Earnings vs Net Reality

- Technical review: Thomas Jevons (Head of Training, 20+ years)

- Employability review: Joshua Jarvis (Placement Manager)

- Editorial review: Jessica Gilbert (Marketing Editorial Team)

- Last reviewed:

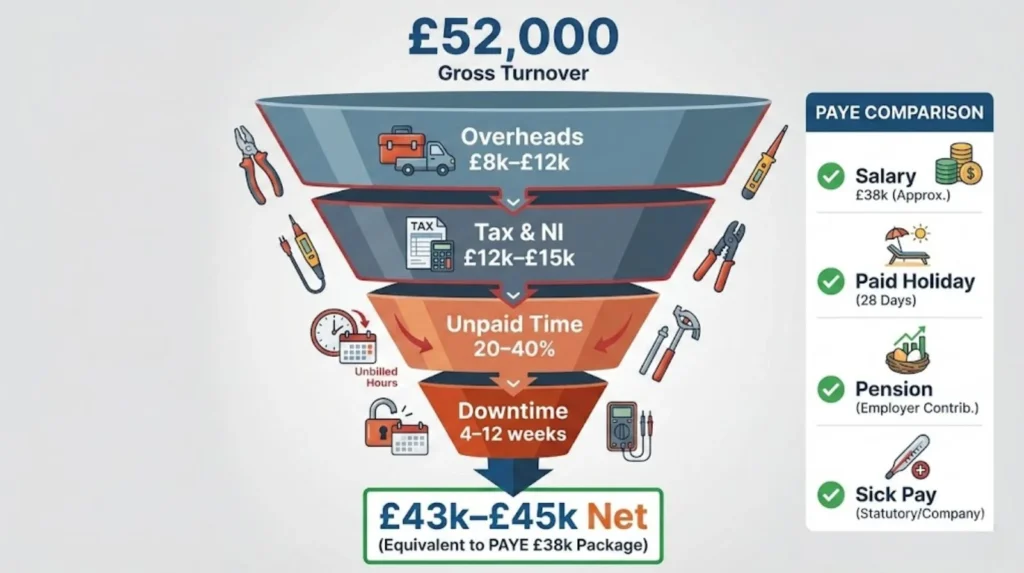

- Changes: Initial publication examining self-employment impact on electrician income, showing gross earnings typically 20-50% higher than PAYE but net take-home often similar (0-25% increase) after £7,000-£12,000 annual overheads, 20-30% CIS/umbrella deductions, 4-12 weeks downtime, 5-15 hours weekly unpaid admin, income quality analysis showing PAYE £38,000 package value £44,000-£46,000 vs self-employed £52,000 gross netting £43,000-£45,000 equivalent

Self-employment’s impact on electrician income requires examining the comprehensive analysis of electrician earnings across employment models distinguishing between gross turnover (total invoiced), business profit (after overheads), and net take-home pay (after tax/NI), because the common perception that “self-employed electricians earn significantly more” conflates gross day rates or hourly charges with actual disposable income. A PAYE electrician earning £38,000 annual salary takes home approximately £29,500 after tax and National Insurance with zero overhead costs, 28 days paid holiday (£4,200 value), 3-5% employer pension contribution (£1,140-£1,900 value), sick pay protection, and employer-funded training. A self-employed electrician charging £300/day achieving £60,000 gross turnover appears vastly superior until accounting for £7,000-£12,000 annual overheads (van, insurance, tools, compliance), £12,000-£15,000 tax/NI, self-funded holidays and training, resulting in £33,000-£41,000 net take-home—only 12-39% higher than PAYE despite 58% higher gross.

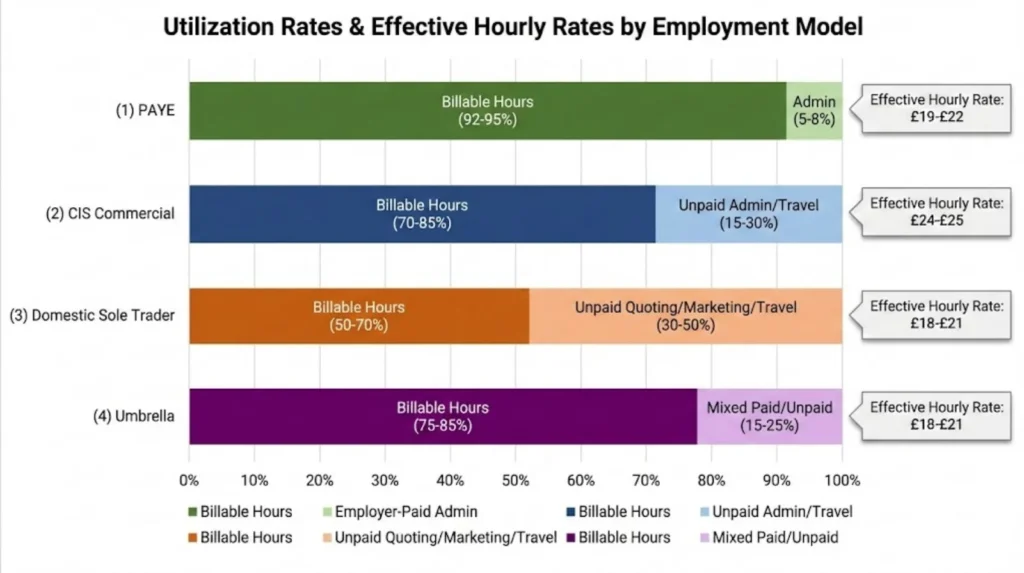

This gross-to-net transformation explains why electricians transitioning to self-employment often experience disappointment when elevated day rates (£300-£450) or hourly charges (£40-£60) don’t translate to proportional income increases. The transformation occurs through multiple erosion factors: overhead burden (£5,000-£15,000 annually depending on sector and business model), non-billable time consuming 20-40% of working hours (quoting, invoicing, admin, travel between jobs), downtime gaps (4-12 weeks annually between contracts or during seasonal slowdowns), utilization rates significantly below 100% (domestic electricians billing only 50-70% of available hours, commercial contractors 70-85%), CIS tax deductions (20% withheld at source for subcontractors), umbrella company fees (3-5% plus employer NI obligations reducing gross to net), and benefit value loss (self-funded holidays, sick pay gaps, pension underfunding).

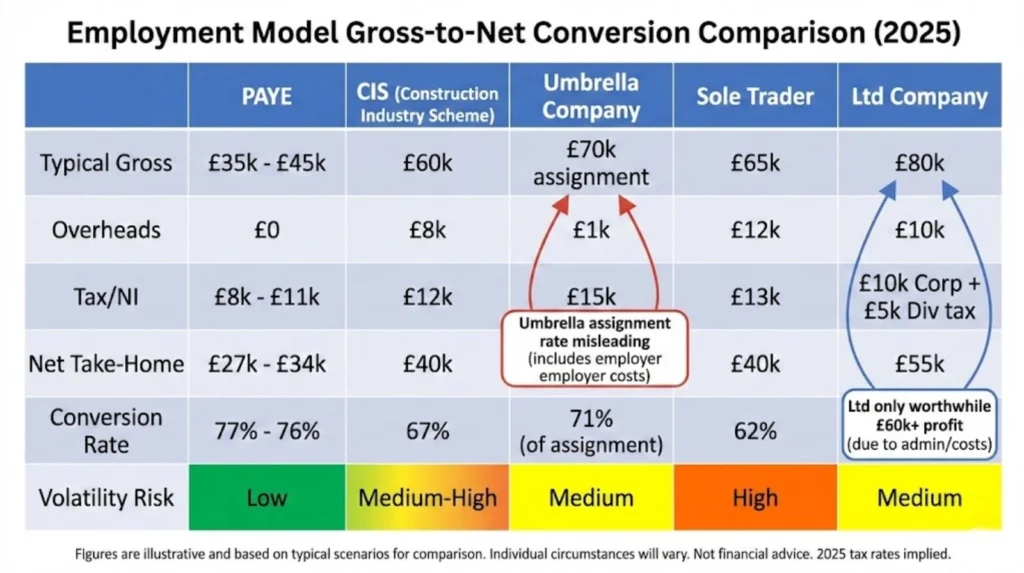

The employment model choice—PAYE employee, CIS subcontractor, umbrella contractor, domestic sole trader, limited company director—creates different gross-to-net conversion patterns. PAYE demonstrates highest conversion efficiency (approximately 75-78% gross to net after tax/NI) with zero overhead absorption but capped earning ceiling. CIS subcontracting offers flexibility with 70-75% conversion after 20% deduction and moderate overheads. Umbrella arrangements appear attractive with high “assignment rates” but suffer lowest conversion (60-70%) due to employer NI, fees, and deduction stacking. Domestic sole traders achieve highest nominal hourly rates (£40-£60) but lowest utilization (50-70%) creating moderate conversion (65-75%). Limited companies enable tax efficiency for high earners (£60,000+ profit) through salary/dividend optimization but carry compliance costs and administrative complexity.

Career stage critically determines whether self-employment boosts or suppresses income. Newly qualified electricians (0-3 years post-qualification) transitioning to self-employment almost universally earn less net income than PAYE equivalents after accounting for slow working speed (tasks taking 2-3x experienced electrician time), lack of professional network (resulting in 8-16 weeks annual downtime), high business learning curve overhead (admin consuming 15-20 hours weekly initially), and low initial client base (requiring expensive marketing £2,000-£4,000 annually). Mid-career electricians (5-10 years experience) with established networks and commercial working speed typically see 20-35% net income increases going self-employed. Experienced specialists (10+ years, HV/CompEx/niche competencies) command premium rates (£350-£450/day) with efficient operations achieving 35-50% net increases.

Sector significantly impacts self-employment economics. Domestic installation work offers highest nominal rates (£40-£60/hour, £400-£600 per job) but suffers lowest utilization (50-70%) from lead generation overhead, quote-to-conversion ratios (need 3-4 quotes to win 1 job), travel time between small dispersed jobs, and customer schedule accommodations. Effective hourly rate often £20-£28 after total time accounting. Commercial contracting provides moderate day rates (£300-£400) with higher utilization (75-85%) working full days on single sites, achieving £24-£32 effective hourly. Industrial specialist work commands highest day rates (£350-£450) with 70-80% utilization (shutdown scheduling creates predictable gaps) delivering £28-£36 effective hourly—the self-employment premium concentrates here rather than domestic sector despite perception.

Understanding realistic self-employment income impact requires examining comprehensive overhead burden itemization (van £2,400-£4,800 annually, insurance £800-£1,500, fuel £1,800-£3,600, tools £1,000-£3,000, compliance £500-£2,000, marketing £1,000-£4,000 domestic), utilization rate reality modeling (billable hours as percentage of total working hours by sector), income quality framework (comparing total package value including benefits not just headline salaries), worked examples showing identical gross achieving different net outcomes based on employment model and overhead efficiency, CIS deduction mechanics (20% advance payment creating January tax bill shock), umbrella company fee structures, sector-specific conversion patterns, career stage optimization timing, and volatility quantification (self-employment income variability creating effective 10-20% discount versus PAYE stability value).

This analysis synthesizes ONS ASHE PAYE electrician median earnings (£39,039 2025 providing baseline comparison), HMRC CIS guidance on deduction mechanics and allowable expenses, government statutory holiday entitlement (5.6 weeks PAYE creating £3,000-£5,000 annual value self-employed must self-fund), JIB wage tables establishing PAYE floor rates (£21.00/hour 2027 Approved Electrician projection), market signal day rates from job boards and surveys (Logic4training average £335/day, Checkatrade £320, MyJobQuote £350-£450 ranges), and trade forum discussions revealing actual achieved earnings versus advertised rates. The analysis deliberately counters both unrealistic self-employment optimism (ignoring overhead and utilization realities) and unfounded negativity (missing genuine income premiums for experienced electricians in right sectors) with balanced evidence-based framework.

The Overhead Burden: Why £50,000 Turnover ≠ £50,000 Income

Self-employed electricians face comprehensive annual overhead costs that PAYE employees never directly experience because employers absorb these business operation essentials. Understanding true overhead burden explains why gross turnover must significantly exceed PAYE salary equivalents to deliver similar net take-home.

Thomas Jevons, Head of Training with 20+ years on the tools, explains:

"The £5,000-£15,000 annual overhead burden gets dramatically underestimated by electricians considering self-employment. Van lease or finance £200-£400 monthly, business insurance £800-£1,200, fuel £150-£300 monthly depending on domestic vs commercial work patterns, tool replacement £1,000-£2,000 annually from theft and wear, test equipment calibration £200-£400, professional body membership £300-£600, Part P notifications £3-£5 per domestic job, accountancy £600-£1,500. That's £7,000-£12,000 before you've earned a single pound. PAYE electrician earning £38,000 gross takes home approximately £29,500. Self-employed electrician needs £50,000-£55,000 turnover just to match that £29,500 take-home after covering overheads and self-funded tax/NI. The 'I'll charge £300/day so I'll earn £78,000 annually' calculation completely ignores this overhead floor that must be cleared before any profit materializes."

Thomas Jevons, Head of Training

Comprehensive Overhead Itemization

Vehicle Costs (£2,400-£4,800 annually):

Van lease or finance: £200-£400 monthly (£2,400-£4,800 yearly)

Business insurance: £800-£1,200 annually (significantly higher than personal)

Fuel: £150-£300 monthly (£1,800-£3,600 yearly) varying by domestic vs commercial travel patterns

Servicing and maintenance: £400-£800 annually

Road tax: £290-£330 annually

ULEZ/Clean Air Zone charges (urban areas): £300-£600 annually

Breakdown cover: £100-£200 annually

Total vehicle costs: £6,000-£11,600 annually

Tool and Equipment Costs (£1,500-£4,000 annually):

Initial tool investment: £3,000-£8,000 (amortized over 3-5 years = £600-£2,600 annually)

Tool replacement and upgrades: £500-£1,000 annually

Tool theft and insurance excess: £200-£500 annually (high UK theft rates)

Test equipment calibration: £150-£400 annually (Megger MFT, insulation resistance testers)

Consumables (drill bits, cables, terminals): £200-£500 annually

Total tool costs: £1,650-£5,000 annually

Insurance and Compliance (£1,300-£3,300 annually):

Public liability insurance: £300-£600 annually

Professional indemnity insurance: £400-£800 annually

Tool insurance: £200-£400 annually

NICEIC or NAPIT registration: £500-£700 annually

Part P Building Control notifications: £3-£5 per domestic installation (£300-£1,000 annually for active domestic traders)

ECS card renewal: £40 every 5 years (£8 annually)

Total insurance/compliance: £1,748-£3,508 annually

Business Administration (£1,200-£3,500 annually):

Accountancy services: £600-£1,500 annually

Business software (invoicing, CRM): £100-£300 annually

Mobile phone (business line): £200-£400 annually

Website and email hosting: £100-£200 annually

Stationery, business cards: £50-£100 annually

Bank fees (business account): £150-£300 annually

Total admin costs: £1,200-£2,800 annually

Marketing and Lead Generation (Sector-Dependent):

Domestic Self-Employed:

Checkatrade/MyBuilder/Rated People membership: £600-£1,500 annually

Google Ads/Facebook advertising: £500-£2,000 annually

Van signage and branding: £300-£800 (amortized £100-£200 annually)

Local directory listings: £100-£300 annually

Domestic marketing total: £1,300-£3,800 annually

Commercial Contractor:

Minimal (agency relationships): £100-£300 annually networking/industry events

Commercial marketing total: £100-£300 annually

Training and Professional Development (£500-£2,000 annually):

BS 7671 Amendment updates: £200-£400 every 3-4 years

Specialist courses (EV, solar, battery storage): £300-£800 as needed

First aid recertification: £50-£100 every 3 years

Trade magazine subscriptions: £50-£100 annually

CPD courses and seminars: £200-£600 annually

Total training costs: £500-£2,000 annually

Total Annual Overhead by Business Model

CIS Commercial Contractor (Lowest Overhead):

Vehicle: £2,400-£4,800

Tools: £1,000-£2,000

Insurance/compliance: £800-£1,500

Admin: £600-£1,200

Marketing: £100-£300

Training: £300-£800

Total: £5,200-£10,600 annually

Domestic Sole Trader (Highest Overhead):

Vehicle: £3,600-£6,000 (higher mileage)

Tools: £1,500-£3,000

Insurance/compliance: £1,500-£3,000

Admin: £1,000-£2,000

Marketing: £1,500-£3,500

Training: £500-£1,500

Total: £9,600-£19,000 annually

Umbrella Contractor:

Umbrella fee: 3-5% of gross (£1,800-£3,000 on £60,000 turnover)

Minimal other overheads (employer handles vehicle, employer NI, insurance)

Total: £1,800-£3,000 annually

Overhead as Percentage of Turnover

Critical Insight:

Low turnover (£40,000): Overheads represent 25-48% of gross (domestic) or 13-27% (commercial)

Medium turnover (£60,000): Overheads represent 16-32% (domestic) or 9-18% (commercial)

High turnover (£80,000+): Overheads represent 12-24% (domestic) or 7-13% (commercial)

This scaling disadvantage explains why newly qualified or part-time self-employed electricians struggle—fixed overhead costs consume disproportionate percentage of lower turnover, requiring higher volume to achieve overhead efficiency.

Utilization Reality: Why You're Not Billing 40 Hours Weekly

The gap between available working hours and actually billable hours represents perhaps the largest income suppression factor distinguishing self-employment from PAYE, where employees bill effectively 100% of contracted hours (employer absorbs admin, training, downtime).

Billable vs Non-Billable Time Breakdown

PAYE Electrician (40-hour week baseline):

On-site productive work: 37-38 hours (92-95%)

Toolbox talks/safety meetings: 1-2 hours (employer-paid)

Training/CPD: 1 hour (employer-paid)

Effective billable rate: 92-95% of contracted hours

CIS Commercial Contractor (40-hour target week):

On-site billable work: 32-34 hours (80-85%)

Travel to/from site: 3-4 hours (typically unpaid unless distant)

Invoicing and admin: 2-3 hours (unpaid)

Quote preparation and estimating: 1-2 hours (unpaid)

Effective billable rate: 70-85% of working hours

Domestic Sole Trader (40-hour target week):

On-site billable work: 20-28 hours (50-70%)

Travel between multiple jobs: 5-8 hours (unpaid, high windshield time)

Quoting and customer consultations: 4-8 hours (quote 3-4 jobs to win 1)

Invoicing, payment chasing, admin: 3-5 hours (unpaid)

Marketing and lead generation: 2-4 hours (unpaid)

Material collection and returns: 2-3 hours (partially billable via markup)

Effective billable rate: 50-70% of working hours

Umbrella Contractor (37.5-hour week baseline):

On-site billable work: 30-34 hours (80-90%)

Compliance and timesheet processing: 2-3 hours (paid as part of assignment)

Travel and breaks: 2-4 hours (partially paid)

Effective billable rate: 75-85% of working hours

Impact on Effective Hourly Rates

Example Calculation: £300 Day Rate CIS Contractor

Optimistic Scenario (High Utilization):

Works 46 weeks annually (allowing 4 weeks holiday, 2 weeks gaps)

Bills 34 hours weekly (85% utilization)

Total billable hours: 1,564 annually

Spends additional 6 hours weekly unpaid admin/travel

Total working hours: 1,840 annually

Gross earnings: £300/day × 5 days × 46 weeks = £69,000

Effective hourly rate: £69,000 ÷ 1,840 hours = £37.50/hour

After £8,000 overheads and £15,000 tax/NI: £46,000 net = £25/hour effective

Realistic Scenario (Moderate Utilization):

Works 42 weeks annually (4 weeks holiday, 6 weeks gaps between contracts)

Bills 30 hours weekly (75% utilization)

Total billable hours: 1,260 annually

Spends additional 8 hours weekly unpaid (admin, quoting, gaps)

Total working hours: 1,680 annually

Gross earnings: £300/day × 5 days × 42 weeks = £63,000

Effective hourly rate: £63,000 ÷ 1,680 hours = £37.50/hour

After £8,000 overheads and £13,500 tax/NI: £41,500 net = £24.70/hour effective

Example Calculation: £50/hour Domestic Sole Trader

Optimistic Scenario (High Utilization for Domestic):

Works 44 weeks annually

Bills 28 hours weekly (70% utilization – high for domestic)

Total billable hours: 1,232 annually

Spends additional 12 hours weekly unpaid (quoting, marketing, admin, travel)

Total working hours: 1,760 annually

Gross earnings: £50/hour × 1,232 hours = £61,600

Effective hourly rate: £61,600 ÷ 1,760 hours = £35/hour

After £12,000 overheads and £13,000 tax/NI: £36,600 net = £20.80/hour effective

Realistic Scenario (Moderate Utilization):

Works 42 weeks annually (includes seasonal slowdowns)

Bills 24 hours weekly (60% utilization – typical domestic)

Total billable hours: 1,008 annually

Spends additional 14 hours weekly unpaid

Total working hours: 1,596 annually

Gross earnings: £50/hour × 1,008 hours = £50,400

Effective hourly rate: £50,400 ÷ 1,596 hours = £31.60/hour

After £12,000 overheads and £10,000 tax/NI: £28,400 net = £17.80/hour effective

Why Utilization Varies by Sector

Commercial Contracting (70-85% typical):

Single site reduces travel overhead

Full 8-10 hour days standard

Agency handles client acquisition

Predictable scheduling

Lower quote-to-win ratio (agencies pre-qualify)

Industrial Contracting (70-80% typical):

Shutdown scheduling creates known gaps

High-value long-duration projects

Minimal marketing needed

Travel/lodging compensated

Professional client base pays reliably

Domestic Installation (50-70% typical):

Multiple small jobs requires constant travel

Quote 3-4 jobs to win 1 (high unpaid time)

Customer schedule accommodations (evenings, weekends)

Lead generation overhead

Payment chasing and bad debt

Material collection trips between jobs

Income Quality vs Income Quantity: Total Package Value

Comparing self-employment to PAYE purely on gross or even net income figures ignores substantial value differences in benefit packages, income stability, risk absorption, and lifestyle quality—the total compensation package extends beyond headline salary numbers.

Joshua Jarvis, Placement Manager at Elec Training, explains:

"When advising electricians considering self-employment, we discuss income quality not just quantity—the reliability, predictability, and benefit package value often matters more than gross figure differences. PAYE electrician earning £38,000 receives that amount in 12 predictable monthly payments, continues receiving 80% during 4-week flu bout via sick pay, gets 28 days paid holiday worth £4,200 annual value, receives 3-5% employer pension contribution £1,140-£1,900, benefits from employer-paid training £500-£1,500 annually, and gains death-in-service coverage potentially £100,000+ benefiting family. Total package value approximately £44,000-£46,000 with zero volatility or downside risk. Self-employed earning £52,000 gross sounds significantly better. But after £8,000 overheads, £12,000 tax/NI, self-funded holiday and training, zero sick pay during that same flu bout costing £2,400 lost earnings, and paying £1,200 for income protection insurance, net package value approximately £43,000-£45,000 with high volatility and personal risk absorption. The £8,000 gross advantage becomes £0-£2,000 net advantage when comparing equivalent quality. Self-employment makes sense for risk-tolerant individuals optimizing for peak earning years 35-50, less so for those prioritizing stability, family security, or approaching retirement."

Joshua Jarvis, Placement Manager

PAYE Total Package Valuation

Base Salary: £38,000 example

Hidden Value Components:

Paid holiday (28 days = 5.6 weeks): £4,200 annual value (£38,000 ÷ 46.4 working weeks = £819/week × 5.6 weeks)

Employer pension contribution (3-5%): £1,140-£1,900 annually

Employer National Insurance (13.8% on salary above £9,100): £3,988 annually (employer cost, not direct benefit but tax-efficient employment structure value)

Sick pay protection (SSP minimum, often enhanced): £500-£1,500 annual expected value

Employer-funded training and CPD: £500-£1,500 annually

Death-in-service benefit (2-4x salary typical): £76,000-£152,000 coverage value (actuarial value £400-£800 annually)

Private medical insurance (some employers): £0-£1,200 annually

Tool and equipment provision: £500-£1,000 annual value (employer maintains)

Total Package Value: £44,828-£50,088 Gross to Total Package Multiplier: 1.18-1.32x

Income Characteristics:

Predictability: 12 equal monthly payments, zero volatility

Stability: Continues during illness, economic downturns

Risk: Employer bears business risk, economic cycle exposure

Lifestyle: Clear work/life boundary, no admin burden

Self-Employed Total Package Valuation

Gross Turnover: £52,000 example (equivalent CIS contractor £300/day, 43 weeks)

Cost Deductions:

Overheads (vehicle, insurance, tools, compliance, admin): £8,000

Tax and NI (Income Tax + Class 2/4): £10,000-£12,000

Self-funded holiday (6 weeks unpaid equivalent): £0 (lost earnings)

Self-funded training: £500-£1,000

Income protection insurance (to replace sick pay): £800-£1,200

Accountancy: £800-£1,200

Net Package Value: £29,000-£32,000

Additional Considerations:

Holiday opportunity cost: 6 weeks unpaid = £3,600 (£600/week × 6) foregone earnings

Sick leave opportunity cost: No SSP, any illness = immediate income loss

Pension: Self-funded (often underfunded), no employer matching

Death-in-service: Must purchase life insurance privately £30-£100/month (£360-£1,200 annually) for equivalent coverage

Adjusted Total Package Value: £32,000-£38,000 Gross to Total Package Multiplier: 0.62-0.73x

Income Characteristics:

Predictability: High volatility, uneven cashflow

Stability: Immediately ceases during illness or gaps

Risk: Individual bears all business risk

Lifestyle: Work bleeds into personal time, constant admin

Equivalent Gross Requirement Calculation

For self-employed electrician to match PAYE £38,000 total package value (£44,828-£50,088):

Required Gross Turnover:

Target net package value: £45,000

Add back overheads: £8,000

Add back tax/NI: £10,500-£12,000

Add self-funded benefits value: £5,000-£6,000

Required gross turnover: £68,500-£71,000

Conversion:

At £300/day: 45.7-47.3 weeks of 5-day working (accounting for utilization, requires 54-56 available weeks including downtime)

At £350/day: 39.1-40.6 weeks of 5-day working

Practical reality: Very difficult to achieve equivalent quality match at typical CIS rates

Risk-Adjusted Value Discount

Financial theory suggests income volatility and risk should be discounted relative to stable equivalent. The appropriate discount rate for self-employment income:

Conservative Approach: 10-15% volatility discount

Self-employed £45,000 gross treated as equivalent to PAYE £38,250-£40,500 when accounting for income uncertainty, gap risk, and stress value

Moderate Approach: 15-20% discount

Self-employed £45,000 gross equivalent to PAYE £36,000-£38,250

This explains why many electricians report higher self-employed earnings but don’t “feel” significantly better off—the risk burden, volatility stress, and admin overhead create psychological and practical value erosion beyond numerical income comparison.

Employment Model Comparison: PAYE, CIS, Umbrella, Sole Trader

Different self-employment structures create distinct gross-to-net conversion patterns, overhead burdens, and administrative complexities. Understanding these differences prevents model selection errors that suppress rather than boost income.

PAYE Employee (Baseline Comparison)

Structure: Direct employment by electrical contractor, facilities management company, or industrial site operator

Income Mechanics:

Gross salary: £35,000-£45,000 typical mid-career

Tax/NI deducted at source via PAYE

Net take-home: £27,000-£34,000 (77-76% conversion)

Overheads:

Zero direct business costs

Employer provides tools, vehicle (often), insurance, training

Total overhead: £0

Benefits Package:

28 days paid holiday minimum (5.6 weeks)

Statutory Sick Pay (often enhanced to company sick pay)

Auto-enrolment pension (minimum 3% employer, 5% employee)

Employer NI contribution (13.8% on salary >£9,100)

Death-in-service coverage (typically 2-4x salary)

Employer-funded training and certifications

Advantages:

Highest income predictability and stability

Zero administrative burden

Benefits package worth 15-25% of gross salary

Career progression structures

Protected during economic downturns

Disadvantages:

Income ceiling capped by salary scales

Limited flexibility and autonomy

Overtime dependent on employer needs

Geographic constraints (commute to employer sites)

Best For:

Early-career electricians (0-5 years)

Family-focused individuals prioritizing stability

Risk-averse personalities

Those approaching retirement (final salary pension calculations)

CIS Subcontractor

Structure: Self-employed electrician working for construction contractors under Construction Industry Scheme, with 20% tax deducted at source

Income Mechanics:

Day rate: £250-£400 typical (sector and experience dependent)

Gross turnover: £50,000-£80,000 annually (assuming 40-46 weeks work)

20% CIS deduction: £10,000-£16,000 withheld and passed to HMRC

Net before final tax: £40,000-£64,000

Additional tax/NI due: £2,000-£6,000 (via January self-assessment)

Overheads: £5,000-£11,000

Final net take-home: £27,000-£47,000 (54-59% gross-to-net conversion)

Overheads:

Vehicle costs: £2,400-£4,800

Tools and equipment: £1,000-£2,500

Insurance: £800-£1,500

Compliance and memberships: £300-£800

Accountancy: £600-£1,200

Total: £5,100-£10,800

Benefits:

None provided (all self-funded)

Holiday: Unpaid, must budget 4-6 weeks = £2,400-£4,800 opportunity cost

Sick pay: Zero, illness = immediate income loss

Pension: Self-managed (often neglected)

Advantages:

Higher gross income potential than PAYE

Flexibility in choosing contracts

Tax deductions for business expenses

Geographic mobility (can work UK-wide)

Relatively simple structure (no company formation needed)

Disadvantages:

20% CIS withholding creates cashflow challenges

January tax bill shock common (CIS doesn’t cover full liability)

4-12 weeks annual downtime between contracts

Zero employment rights or protections

Administrative burden (invoicing, tax returns, expense tracking)

Best For:

Mid-career electricians (5-10 years) with experience references

Those seeking income boost without company complexity

Electricians with strong contractor networks reducing gap risk

Commercial/industrial specialists commanding premium day rates

Umbrella Company Contractor

Structure: Electrician employed by umbrella company, which contracts services to agencies/clients and processes payroll

Income Mechanics:

“Assignment rate” (gross paid by agency): £280-£450/day

CRITICAL: Assignment rate includes employer NI, umbrella fee, apprenticeship levy, holiday pay

Employer NI (13.8%): £5,300-£9,800 (on £60,000-£90,000 turnover)

Umbrella margin fee (3-5%): £1,800-£4,500

Holiday pay accrual (12.07%): £7,200-£10,800

Actual gross pay to worker: £45,700-£65,000 (significantly lower than assignment rate)

Tax/NI deductions: £9,000-£15,000

Net take-home: £36,700-£50,000 (57-59% of assignment rate, 80-77% of actual gross)

Overheads:

Minimal direct costs (umbrella handles vehicle/insurance in assignment rate)

Umbrella weekly/monthly fee: Often £15-£30/week (£780-£1,560 annually)

Total: £780-£1,560 (exceptionally low compared to other self-employed models)

Benefits:

Statutory holiday pay (included in calculations above)

Statutory Sick Pay (SSP only, not enhanced)

Auto-enrolment pension (employee contribution only)

Employer NI paid (creates NIno accumulation for state pension)

Advantages:

Minimal administrative burden (umbrella handles payroll, tax, compliance)

Employment rights (holiday pay, SSP, pension)

No company formation or dissolution costs

Useful for short-term or first-time contracting

Disadvantages:

Lowest net-to-gross conversion (assignment rate misleading)

Umbrella fees erode earnings

Cannot claim business expenses (treated as employee)

Less tax-efficient than other models for high earners

Reputation issues (some umbrellas engage in aggressive tax schemes)

Best For:

First-time contractors testing self-employment

Short-term contracts (3-6 months)

Those wanting employment protections without company admin

Risk-averse individuals uncomfortable with full self-employment

WARNING: Many electricians accept umbrella roles believing £400/day assignment rate means £400/day take-home, discovering actual gross pay £260-£280/day after umbrella deductions—a 30-35% immediate reduction before personal tax.

Domestic Sole Trader

Structure: Self-employed individual running own domestic electrical installation/maintenance business, trading under own name

Income Mechanics:

Hourly rate: £40-£60 charged to customers

Job pricing: £400-£800 average domestic installation

Gross turnover: £50,000-£80,000 annually (highly variable)

Materials and direct costs: £8,000-£15,000

Overheads: £10,000-£19,000 (highest of all models due to marketing)

Net profit: £22,000-£46,000

Tax/NI: £4,500-£12,000

Net take-home: £17,500-£34,000 (35-43% gross-to-net conversion, lowest efficiency)

Overheads:

Vehicle costs: £3,600-£6,000 (high mileage between jobs)

Tools and consumables: £1,500-£3,000

Insurance and compliance: £1,500-£3,000 (Part P per job adds up)

Marketing and lead generation: £1,500-£4,000 (Checkatrade, Google Ads)

Accountancy and admin: £1,000-£2,000

Total: £9,100-£18,000 (highest overhead burden)

Benefits:

None provided (all self-funded at significant cost)

Advantages:

Complete autonomy and business control

Keep full profit (no contractor/agency taking margin)

Ability to specialize in niche domestic markets (EV, solar, smart homes)

Build sellable business asset

Local reputation and repeat client base

Premium pricing power for quality/specialty work

Disadvantages:

Lowest utilization rates (50-70% typical)

Highest marketing costs

Bad debt risk (domestic customers 3-5% non-payment)

Seasonal demand volatility (quieter winter months)

Customer service burden (evening/weekend calls)

Highest administrative overhead

Best For:

Experienced electricians (8-12+ years) with established local reputation

Those with strong sales/customer service skills

Electricians in underserved geographic areas

Specialists in high-value domestic niches (luxury renovations, smart homes)

Limited Company Director

Structure: Self-employed electrician operating through own limited company, taking income via salary/dividend combination

Income Mechanics:

Company turnover: £60,000-£100,000+ (generally only worthwhile above £60k profit)

Directors’ salary: £12,570 (personal allowance maximum, minimizing PAYE)

Dividend extraction: £40,000-£70,000 remaining profit

Corporation Tax (25% on profits >£50k, 19% below): £8,000-£17,500

Dividend tax: £2,000-£10,000 (depending on total extraction)

Net take-home: £38,000-£55,000 (63-55% gross-to-net conversion)

Overheads:

Standard business costs: £5,000-£12,000

Company formation and compliance: £100-£300 annually

Accountancy (more complex): £1,200-£2,500 annually

Total: £6,300-£14,800

Advantages:

Most tax-efficient structure for £60,000+ profit

Limited liability protection (personal assets protected from business debts)

Professional image and credibility

Easier to sell business or attract investment

Retained profits can be invested within company

Disadvantages:

Highest administrative complexity (Companies House filings, annual accounts, confirmation statements)

Higher accountancy costs

Corporation Tax due 9 months after year-end (cashflow impact)

IR35 risk if working through intermediary for single client

Dividend extraction timing constraints

Not worthwhile below £50,000-£60,000 profit (complexity exceeds tax savings)

Best For:

High-earning contractors (£70,000+ turnover)

Those building larger businesses (employing others)

Electricians with diverse income streams

Long-term business builders planning eventual sale

Worked Examples: Identical Qualifications, Different Outcomes

Three electricians with identical qualifications (Level 3 NVQ, 18th Edition, AM2, 6 years experience) choose different employment paths, achieving dramatically different gross and net incomes despite equivalent competency.

Example A: PAYE Commercial Electrician

Profile:

Age: 30

Experience: 6 years post-qualification

Sector: Commercial fit-out, large contractor

Location: Birmingham

Income Structure:

Base salary: £38,000 annually

Overtime: 5 hours weekly average at 1.5x (£19/hour base → £28.50 overtime)

Overtime annual addition: 52 weeks × 5 hours × £28.50 = £7,410

Gross annual: £45,410

Deductions:

Income Tax: £7,232

National Insurance: £3,746

Pension contribution (5% employee): £2,271

Net take-home: £32,161 (70.8% conversion)

Benefits Received:

28 days paid holiday: £4,889 value

Employer pension contribution (3%): £1,362

Sick pay: £500 expected value

Employer-paid training: £800

Death-in-service (3x salary): £136,230 coverage

Total package value: £39,712

Time and Lifestyle:

Working hours: 45 hours weekly (40 standard + 5 overtime)

Admin/commute: 5 hours weekly (paid commute time to sites)

Work/life balance: Good, clear boundaries

Stress level: Low-moderate

Income predictability: Very high (£2,680 monthly consistent)

10-Year Projection:

Career progression to Approved Electrician £43,000 base likely

With continued overtime: £52,000-£56,000 gross achievable

Pension accumulation: £30,000-£40,000 pot value

Example B: CIS Commercial Contractor

Profile:

Age: 30

Experience: 6 years post-qualification (same as Example A)

Sector: Commercial projects, agency-sourced contracts

Location: Birmingham (same market)

Income Structure:

Day rate: £320 (competitive Birmingham commercial rate)

Weeks worked: 44 annually (4 weeks holiday, 4 weeks gaps between contracts)

Gross annual: £70,400 (£320 × 5 days × 44 weeks)

Deductions and Costs:

CIS deduction (20%): £14,080 (withheld and paid to HMRC)

Remaining gross: £56,320

Vehicle costs: £3,200

Tools and equipment: £1,500

Insurance and compliance: £1,100

Accountancy: £900

Total overheads: £6,700

Net profit: £49,620

Additional tax/NI due (above CIS withholding): £4,200

Net take-home: £45,420 (64.5% gross conversion)

Benefits Self-Funded:

Holiday opportunity cost: 4 weeks = £6,400 (unpaid)

Sick pay: £0 (purchased income protection £1,200 annually)

Pension: £0 contributed (intending to but hasn’t)

Training: Self-funded £600

Time and Lifestyle:

Billable hours: 35 hours weekly average (80% utilization)

Non-billable admin/gaps: 7 hours weekly

Total working: 42 hours weekly

Work/life balance: Moderate, admin bleeds into evenings

Stress level: Moderate-high (gap anxiety between contracts)

Income predictability: Medium (£3,785/month when working, £0 during 4-week gaps)

10-Year Projection:

Day rate growth to £380-£400 likely with experience

Gross potential: £83,000-£88,000

Net take-home: £55,000-£60,000

Risk: Pension gap accumulating, no employer contributions

Net Advantage vs PAYE:

£45,420 vs £32,161 = £13,259 higher (41.2% more)

BUT: No pension (PAYE accumulating £1,362 annually), no sick pay protection, 4 weeks unpaid gaps, higher stress

Risk-adjusted equivalent: Approximately £38,000-£40,000 PAYE value

Example C: Domestic Sole Trader

Profile:

Age: 30

Experience: 6 years post-qualification (same as A and B)

Sector: Domestic installation and maintenance

Location: Birmingham

Income Structure:

Hourly rate charged: £50/hour average

Billable hours: 25 hours weekly (63% utilization—above average for domestic)

Weeks worked: 42 (10 weeks holiday/gaps/seasonal slow periods)

Gross annual: £52,500 (£50 × 25 hours × 42 weeks)

Direct Costs:

Materials and consumables: £10,500 (20% of turnover typical domestic)

Gross profit: £42,000

Overheads:

Vehicle costs: £4,200 (high mileage between domestic jobs)

Tools and equipment: £1,800

Insurance and compliance: £2,200 (Part P notifications add up)

Marketing (Checkatrade, ads): £2,400

Accountancy and admin: £1,200

Total overheads: £11,800

Net Profit: £30,200

Tax:

Income Tax: £4,926

Class 2 NI: £180

Class 4 NI: £2,158

Total tax/NI: £7,264

Net take-home: £22,936 (43.7% gross conversion, 54.7% gross profit conversion)

Benefits Self-Funded:

Holiday: 10 weeks unpaid = £12,500 opportunity cost

Sick pay: £0

Pension: £0

Training: £600

Time and Lifestyle:

Billable hours: 25 hours weekly

Non-billable (quoting, marketing, admin, travel): 15 hours weekly

Total working: 40 hours weekly

Work/life balance: Poor (customer calls evenings/weekends)

Stress level: High (lead generation pressure, payment chasing)

Income predictability: Low (seasonal variations, bad debt)

10-Year Projection:

Potential to build client base reducing marketing costs

Gross could reach £65,000-£75,000 with efficiency improvements

Net: £30,000-£38,000

Risk: Burnout, no pension, difficult to scale

Net Outcome vs PAYE:

£22,936 vs £32,161 = £9,225 LOWER than PAYE (28.7% less)

Working equivalent hours but earning significantly less due to low utilization and high overheads

Would need £70,000+ gross turnover to match PAYE net income

Comparison Summary

| Metric | PAYE (A) | CIS (B) | Sole Trader (C) |

| Gross | £45,410 | £70,400 | £52,500 |

| Overheads | £0 | £6,700 | £11,800 |

| Tax/NI | £11,034 | £18,280 | £7,264 |

| Net Take-Home | £32,161 | £45,420 | £22,936 |

| Conversion % | 70.8% | 64.5% | 43.7% |

| Package Value | £39,712 | £45,420 | £22,936 |

| Hours Worked | 45/week | 42/week | 40/week |

| Effective Hourly | £13.83 | £22.74 | £12.10 |

| Stress/Risk | Low | Medium-High | High |

| Pension Building | Yes | No | No |

Key Insights:

CIS contractor (B) achieves highest net income (+41% vs PAYE) but bears all risk and no pension accumulation

PAYE (A) delivers strong package value with benefits, lowest stress, career progression

Domestic sole trader (C) earns LESS than PAYE despite charging £50/hour due to low utilization and high overheads—common trap for new self-employed

Effective hourly rate reveals true earning power: CIS £22.74, PAYE £13.83, Domestic £12.10

Common Myths About Self-Employment Income

Myth 1: “Self-Employed Always Earn More”

Reality: Gross earnings typically 20-50% higher, but net take-home often only 0-25% higher after £7,000-£12,000 overheads, 20-30% deductions, downtime, and benefit value loss. Early-career domestic electricians frequently earn less self-employed than PAYE equivalents.

Myth 2: “Day Rate Equals Take-Home”

Reality: £300/day gross becomes £180-£220/day net effective after 20% CIS deduction, overheads, unpaid admin time, and downtime gaps. The £300 “daily” rate is achieved only 70-85% of available working hours.

Myth 3: “Umbrella Assignment Rates Are What You Earn”

Reality: £400/day assignment rate includes employer NI (13.8%), umbrella fees (3-5%), and holiday pay (12.07%)—actual gross pay to worker only £260-£280/day, then subject to personal tax/NI. Assignment rate 30-35% higher than actual earnings.

Myth 4: “You Can Claim Everything as an Expense”

Reality: HMRC allows only expenses “wholly and exclusively” for business. Cannot claim: personal mileage, meals unless overnight business travel, clothing unless hi-vis/PPE, phone bills unless separate business line. Aggressive claiming triggers investigations.

Myth 5: “Limited Company Avoids Tax”

Reality: Still pay via salary (PAYE) and dividends (dividend tax). Corporation Tax 19-25% on company profits, then dividend tax 8.75-39.35% on extraction. Tax efficiency exists for £60,000+ profit but not “tax avoidance”—saves perhaps 5-10% versus sole trader at higher admin cost.

Myth 6: “No Downtime If You’re Good”

Reality: Even experienced contractors with strong networks face 4-8 weeks annual downtime from contract gaps, shutdown scheduling, seasonal slowdowns, and deliberate holiday periods. Domestic traders face 8-12 weeks in quiet winter months.

Myth 7: “Self-Employment Means Working Less”

Reality: Most self-employed work 45-55 hours weekly including admin, compared to PAYE 37.5-40 contracted hours. The “flexibility” often means working evenings and weekends to accommodate customers or complete quotes.

Myth 8: “Marketing Is Free Word-of-Mouth”

Reality: Domestic electricians spend £1,500-£4,000 annually on Checkatrade memberships, Google Ads, van signage, business cards, website hosting. Word-of-mouth takes 3-5 years to build, requiring paid lead generation initially.

Myth 9: “CIS 20% Deduction Is Total Tax”

Reality: CIS withholds 20% as advance payment. Actual tax liability—Income Tax plus Class 2 and Class 4 NI—often 28-35% of profit. January self-assessment commonly requires additional £3,000-£6,000 payment, shocking those who assumed CIS covered everything.

Myth 10: “Tools Are One-Time Cost”

Reality: Ongoing replacement £1,000-£3,000 annually from wear, damage, theft. Test equipment calibration £150-£400 annually mandatory. Power tool batteries £200-£400 annual replacement. UK tool theft rates mean insurance excess £200-£500 per claim, multiple claims annually common.

Myth 11: “Domestic Rates (£50/hour) Mean High Income”

Reality: Billing only 24-28 hours weekly (60-70% utilization) due to quoting, marketing, travel creates £50,000-£65,000 gross. After £12,000-£15,000 overheads and tax, net £28,000-£38,000—similar to PAYE £35,000-£42,000 working fewer hours.

Myth 12: “Industrial Always Pays Best”

Reality: Industrial day rates £350-£450 highest, but travel/lodging costs £2,000-£4,000 annually, time away from family, and physical demands make it unsuitable for everyone. Commercial £300-£350 with local work often delivers better lifestyle-adjusted value.

Myth 13: “Pension Doesn’t Matter When Young”

Reality: PAYE electrician age 25-65 with 3% employer contribution (£1,200 annually) accumulates approximately £180,000-£250,000 pension pot (assuming 5% growth). Self-employed neglecting pension faces £180,000-£250,000 retirement shortfall requiring private savings discipline rarely achieved.

Myth 14: “Bad Debt Is Rare”

Reality: Domestic electricians experience 2-5% non-payment (£1,000-£4,000 on £50,000 turnover). Commercial contractors 1-2% but on larger invoices. Payment chasing consumes 2-4 hours monthly, small claims court sometimes necessary.

Myth 15: “Accountants Are Too Expensive”

Reality: Good accountant £800-£1,500 annually saves that amount via legitimate deductions, tax planning, and avoiding HMRC penalties. Bad accountant or DIY approach costs more in missed deductions, errors, and time spent on admin.

Data Limitations and Forecast Uncertainty

ONS Data Gaps for Self-Employed Income

ASHE (Annual Survey of Hours and Earnings) provides robust PAYE electrician salary data (£39,039 median 2025) but excludes self-employed entirely, understating true average electrician income and obscuring self-employment earnings distributions. ONS self-employment income data aggregates construction sector broadly without electrician-specific breakdowns, and may understate actual earnings due to cash-job under-reporting.

Market Signal Reliability Issues

Job board day rates (£300-£450 advertised) represent asking prices not achieved rates—actual negotiations, downtime, and overhead often reduce effective earnings 20-35% below advertised. Survey data (Logic4training £335/day average, Checkatrade £320) useful directionally but limited sample sizes (self-selecting high earners likely over-represented) and regional variations not captured.

Regional and Sector Variations

London rates 20-30% higher than presented averages (£380-£500/day commercial contractor common), while rural Wales/Scotland 20-30% lower (£220-£280/day). Domestic vs commercial vs industrial sector variations create £15,000-£25,000 annual outcome spreads not captured in aggregate figures. Specialist niches (EV, solar, smart homes) command premiums but too small sample to quantify reliably.

Tax and Deduction Complexity

CIS deduction rates, umbrella fee structures, and allowable expense interpretations vary by individual circumstances—presented figures represent typical ranges but actual outcomes depend on specific business activities, accountant quality, and HMRC relationship. IR35 legislation creates additional complexity for limited company contractors working through intermediaries, potentially reclassifying as deemed employees.

Overhead and Utilization Estimates

Presented overhead costs (£5,000-£15,000) based on market signals and trade forum discussions rather than verified accounting data—actual costs vary significantly by business model efficiency, geographic location, sector, and individual purchasing decisions. Utilization rates (50-85%) represent informed estimates from recruiter feedback and contractor discussions, not time-tracking studies—individual variation high based on business maturity and network strength.

If you’re considering transition to self-employment or evaluating whether your current self-employed income genuinely exceeds equivalent PAYE value, call us on 0330 822 5337 to discuss detailed breakdown of electrician pay across PAYE, contractor, and self-employed pathways specific to your experience level, sector positioning, family circumstances, and risk tolerance—helping you avoid the common trap of pursuing higher gross earnings that deliver lower net package value. The Elec Training’s complete guide to electrician career earnings provides comprehensive context on employment model optimization, showing how strategic choices about PAYE versus self-employment timing, sector selection, and overhead management determine whether self-employment boosts income 30-50% or suppresses it 10-20% below PAYE equivalents.

References

- Office for National Statistics (ONS) – Annual Survey of Hours and Earnings 2025 – https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/earningsandworkinghours/bulletins/annualsurveyofhoursandearnings/2025

- ONS – Employees and Self-Employed by Industry – https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/datasets/employeesandselfemployedbyindustryemp14

- GOV.UK – Holiday Entitlement Rights – https://www.gov.uk/holiday-entitlement-rights

- Joint Industry Board (JIB) – Handbook 2025 and Wage Rates – https://www.jib.org.uk/wp-content/uploads/2025/01/JIB-Handbook-2025.pdf

- Electrical Contractors’ Association (ECA) – Employment Status and IR35 Guidance – https://www.eca.co.uk/member-support/employee-relations/contracts-handbook/employment-status-ir35

- Checkatrade – How Much Do Electricians Earn Guide – https://www.checkatrade.com/blog/trade/grow-business/how-much-do-electricians-earn/

- MyJobQuote – Electrician Earnings and Day Rates – https://www.myjobquote.co.uk/tradesadvice/how-much-do-electricians-make

- Indeed UK – Self-Employed Electrician Job Listings – https://www.indeed.co.uk/Self-Employed-Electrician-jobs

- Elec Training – Complete Electrician Earnings Analysis – https://elec.training/news/how-much-can-you-make-as-an-electrician-a-2026-pay-guide/

Note on Accuracy and Updates

Last reviewed: 5 January 2026. This page is maintained; we correct errors and refresh sources as HMRC guidance, ONS data releases, umbrella company regulations, and market day rates change. Self-employment impact analysis uses comprehensive overhead itemization (£5,000-£15,000 annually varying by business model: CIS commercial £5,200-£10,600, domestic sole trader £9,600-£19,000 highest due to marketing costs), utilization rate modeling (PAYE 92-95% effective billable, CIS commercial 70-85%, domestic sole trader 50-70% lowest from quoting/marketing/travel overhead), income quality framework showing PAYE £38,000 total package value £44,000-£46,000 with benefits vs self-employed £52,000 gross netting £43,000-£45,000 equivalent quality after £8,000 overheads and £12,000 tax/NI, employment model gross-to-net conversions (PAYE 76-77% most efficient, CIS 64-67%, umbrella 71% of assignment rate but only 57-59% including hidden deductions, domestic sole trader 43-62% lowest due to low utilization), worked examples showing identical qualifications creating £22,936-£45,420 net outcomes (PAYE £32,161 middle, CIS £45,420 highest but no pension/benefits, domestic £22,936 lowest from utilization trap). Critical findings: self-employed requires £50,000-£55,000 gross turnover to match PAYE £38,000 package value (£29,500 take-home), early-career electricians (0-3 years) typically earn less self-employed than PAYE due to slow speed and weak networks, mid-career (5-10 years) see 20-35% genuine net increases, domestic nominal rates £40-£60/hour deliver only £18-£22 effective hourly after utilization accounting, umbrella assignment rates misleading (£400/day includes employer NI/fees/holiday reducing actual gross to £260-£280/day pre-tax), CIS 20% deduction not total tax liability (additional £2,000-£6,000 January bill common), income quality analysis shows risk-adjusted £45,000 self-employed equivalent to £38,000-£40,500 PAYE when volatility valued. Data limitations acknowledged: ONS excludes self-employed from ASHE, market day rates are asking not achieved prices, overhead costs vary significantly by efficiency and location, utilization rates estimated from recruiter feedback not time-tracking studies, individual outcomes highly variable based on network strength and business maturity. This is analysis framework not financial/tax advice—consult qualified accountant and financial advisor for personal circumstances. Next review scheduled following HMRC CIS/umbrella guidance updates, ONS self-employment income data release 2026, and quarterly market rate surveys.