Daily vs Hourly vs Price-Work Electrician Rates: What UK Electricians Actually Earn

- Technical review: Thomas Jevons (Head of Training, 20+ years)

- Employability review: Joshua Jarvis (Placement Manager)

- Editorial review: Jessica Gilbert (Marketing Editorial Team)

- Last reviewed:

- Changes: Initial publication analyzing JIB 2025 hourly rates, CIS day rate structures, and price-work models using ONS ASHE 2024/25 data

Ask an electrician how much do electricians make and you’ll get three completely different answers depending on whether they’re paid hourly under a JIB agreement, working CIS day rates through an agency, or doing price-work on new build housing. A £20.25 per hour JIB rate sounds modest compared to a £300 day rate, which in turn sounds pedestrian compared to a domestic installer claiming £55 per socket and completing ten points per day.

The problem is these figures aren’t comparable without significant adjustment. The hourly rate includes paid holidays, pension contributions, and sick pay. The day rate doesn’t. The price-work figure assumes consistent productivity with zero downtime, no snagging, and perfect planning. In reality, understanding what electricians actually earn requires unpicking what’s included in each model, what costs are hidden, where risk sits, and how effective hourly rates compare once you account for unpaid time, overheads, and employment benefits.

This isn’t about which model is “best.” It’s about understanding the trade-offs between stability and upside, guaranteed income versus performance-based earnings, and employer-carried risk versus personal financial exposure. The UK electrical labour market operates across three distinct payment structures, each common in different sectors, each with fundamentally different risk profiles.

How Each Payment Model Actually Works

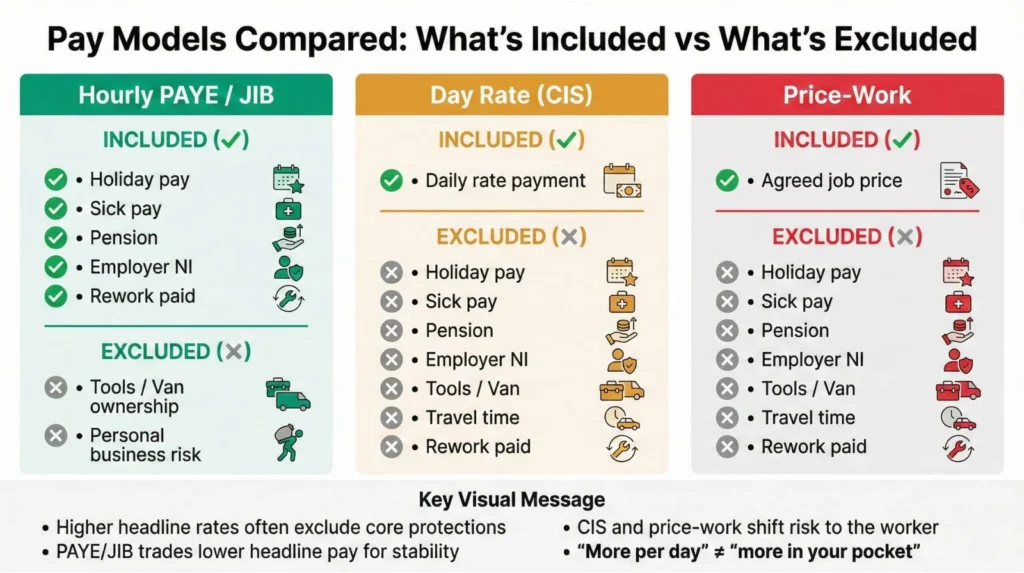

Before comparing rates, you need to understand what each model includes and excludes. The differences aren’t just mathematical. They represent fundamentally different employment relationships and risk allocations.

Hourly (PAYE/JIB) with overtime. This is employee-based payment, typically under JIB (Joint Industry Board) agreements for commercial and industrial work or direct PAYE employment for smaller firms. You’re paid per hour worked, usually based on a standard week of 37.5 to 39 hours, with overtime paid at multipliers like 1.5x for weekdays beyond standard hours and 2.0x for Sundays and bank holidays. JIB grades determine base rates: Electrician (£16.95-£18.59 per hour in 2026-2028 projections), Approved Electrician (£18.61-£20.41), and Technician (£21.24-£23.30). The 2025 Approved Electrician national rate sits at approximately £20.25 per hour.

What’s included: base pay, overtime multipliers, paid breaks, statutory holiday pay (5.6 weeks minimum), auto-enrolment pension (3% employer contribution minimum), employer National Insurance contributions (13.8% on top of your salary), and sick pay. JIB agreements include enhanced sick pay of £190-£210 per week after the second week. Employers typically provide tools, vehicles for site work, and cover public liability insurance.

What’s not included: travel time unless specified in site agreements, personal tools beyond what the employer provides, and downtime between scheduled work (though you’re paid if you’re scheduled and the work doesn’t materialise).

Day rate (CIS/umbrella/agency). This is contractor-based payment, common for site electricians working through agencies or directly with contractors under the Construction Industry Scheme (CIS). You’re paid a fixed amount for a working day, typically assumed to be 8-10 hours. Rates quoted in job adverts range from £125 to £600 depending on region, specialism, and whether it’s quoted gross or net of deductions, with an average around £335 per day. London and South East rates sit at the higher end (£300-£400), while other regions average £250-£300.

What’s included: the day’s work, sometimes travel if explicitly stated in the contract. Under CIS, 20% is deducted at source from gross pay for tax (assuming net CIS status), which you reclaim via self-assessment if you’ve overpaid. If working through an umbrella company, you’re treated as an employee for tax purposes, meaning both employee and employer National Insurance are deducted, plus umbrella company fees of £20-£30 per week.

What’s not included: holiday pay (you must self-fund your unpaid weeks off), sick pay, pension contributions unless you arrange them personally, breaks (unpaid unless agreed), overtime as a separate concept (you might negotiate higher day rates for weekends but there’s no automatic multiplier), tools, van, fuel, insurance, and professional development costs. These are your responsibility.

Price-work (task-based/piecework). This is payment per completed task or unit, predominantly used in domestic electrical work, particularly new build housing (“house bashing”), rewires, and some solar or EV installation work. You’re paid per socket, per light point, per consumer unit, or per completed job rather than per hour. Rates commonly quoted on trade forums show £45-£50 per point for first and second fix in new builds, rising to £60-£65 per point for rewires due to increased complexity. A “point” typically means a socket, light, or switch.

What’s included: payment for the completed task, sometimes materials if you’re pricing labour only for a contractor who supplies them.

What’s not included: travel time (completely unpaid), breaks and downtime between tasks (unpaid), snagging and rework (you fix errors for free), variations from the original scope (often unpaid unless you negotiate a variation), holiday and sick pay (none), pension (none), tools, van, fuel, insurance (your cost), and critically, any time spent on jobs that overrun due to unforeseen issues or poor initial estimates.

The fundamental difference is where risk sits. In hourly PAYE, the employer carries the risk of defects, delays, and variations. In day rate, risk is partially shared depending on contract terms. In price-work, you carry all the risk. If a job takes twice as long as expected, you earn half the effective hourly rate.

Why Headline Figures Are Misleading

Comparing £20 per hour PAYE to £250 per day CIS to £55 per socket price-work is like comparing apples, oranges, and something that might be a fruit but could also be a vegetable depending on how the week goes. The headline figures ignore benefits, costs, time, and risk that fundamentally change the effective value.

Paid versus unpaid holidays. A PAYE electrician earning £20 per hour works approximately 232 days per year (52 weeks minus 28 days statutory holiday and bank holidays) but is paid for 260 days because holidays are paid. A CIS contractor earning £250 per day works the same 232 days but is only paid for those 232 days. To match the PAYE worker’s annual income, they need to earn an extra 10.7% to self-fund those 28 unpaid days. That £250 day rate needs to be £278 to provide equivalent annual income when holidays are factored in.

Travel time and costs. JIB agreements often include travel allowances for distances beyond a certain radius or paid travel time on specific sites. CIS day rates are frequently quoted as “all-in,” meaning your two-hour daily commute is unpaid. If you’re travelling two hours per day on a £250 day rate and working 8 hours on site, your 10-hour day yields an effective rate of £25 per hour, not the £31.25 you’d get if only the 8 working hours counted. Price-work doesn’t pay for travel at all. Driving 40 minutes to a job, working 6 hours, driving 40 minutes back means 7 hours and 20 minutes out of the house for 6 hours of paid work.

Rework and snagging liability. On PAYE hourly contracts, if a socket is installed at the wrong height, you’re paid for the time spent relocating it. The employer absorbs the cost of the mistake (whether it was your error or unclear specifications). On price-work, you fix it for free. If you’ve priced a first fix at £600 and it takes an extra day because of design changes or unforeseen obstacles, you’ve just halved your effective daily rate. This risk is transferred entirely to you.

Pension and National Insurance contributions. PAYE employers contribute 13.8% Employer’s National Insurance on top of your salary and pay at least 3% into your pension. These don’t appear on your payslip as “your” money, but they’re part of the total cost of employing you and represent real economic value. A £40,000 PAYE salary has an actual cost to the employer of approximately £45,500 once Employer’s NI and pension are included. CIS contractors and price-work electricians must fund their own pensions and receive no employer NI contribution. This 12-15% difference is invisible when comparing gross rates.

Downtime and productivity assumptions. Price-work earnings assume consistent workflow. If you can complete ten points per day at £55 each, you gross £550 daily. If you can only find work three days per week, or if jobs routinely take longer than estimated, that £550 becomes £330 (60% productivity) or £220 (40% productivity). PAYE hourly workers are paid for scheduled time regardless of productivity variations, and even during slower periods, they’re often kept on payroll for planned maintenance or other tasks.

Umbrella company mechanics. Many electricians assume umbrella companies are just payment processors. In reality, when you work through an umbrella company, you become an employee of that company for tax purposes. This means you pay both employee National Insurance (12% on earnings between £12,570 and £50,270) and the employer’s National Insurance contribution (13.8%), which is deducted from your gross pay before you receive it. On top of this, umbrella companies charge fees of £20-£30 per week. A £280 advertised day rate can shrink to £210-£220 after umbrella deductions, fees, and tax, bringing it much closer to PAYE take-home than the gross figure suggests.

The checklist for comparing pay models:

Adjust all figures to the same time period (annual or hourly after accounting for working days)

Add back the value of benefits for PAYE (holiday pay is roughly 10.7% uplift, pension 3-5%, sick pay harder to quantify)

Subtract fees and overheads for contractors (umbrella fees 5-10%, CIS admin, tools, van, insurance collectively 10-20% of gross)

Factor realistic downtime for price-work (10-30% reduction from theoretical maximum earnings)

Include risk premiums for rework and variations (5-15% additional cost in price-work if jobs frequently overrun)

Only after these adjustments do figures become comparable.

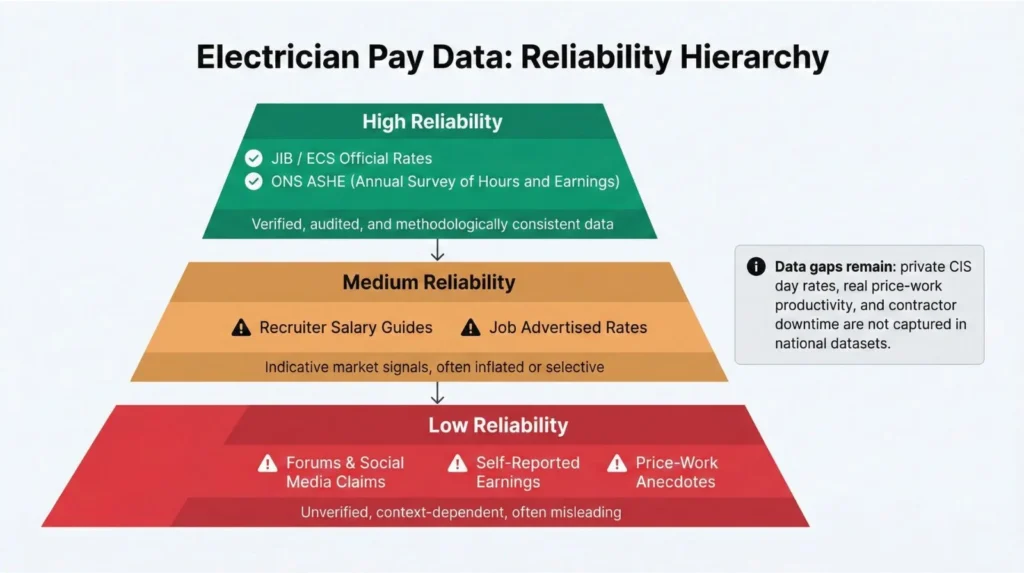

Where the Data Comes From (and What It Actually Measures)

Not all rate information is equally reliable. Understanding source quality helps you separate actual market rates from advertised wishful thinking.

JIB and ECS official documentation represents the highest quality data. These are collectively bargained minimum rates negotiated between unions (Unite, ETU) and employer bodies (ECA, SELECT). They set legal floors for JIB-aligned employers and are publicly available. The 2025 JIB rates show Approved Electrician at £20.25 per hour nationally, rising to approximately £22.75 in London. These represent actual contracted minimums, not aspirational figures. Reliability: high.

ONS Annual Survey of Hours and Earnings (ASHE) measures actual employee earnings through HMRC tax data. The 2024 ASHE data shows median full-time electrician earnings at £38,760 annually, equivalent to approximately £18.04 per hour across a standard working year. This represents what electricians actually earned, not what was advertised or promised. However, ASHE only captures employees (PAYE), not self-employed contractors or price-work earnings. It also uses sampling, so regional breakdowns can show inconsistencies. Reliability: high for employee earnings, not applicable to CIS or price-work.

Recruiter salary guides from Hays, Reed, and Indeed aggregate advertised salaries from job postings and self-reported data. Reed shows advertised electrician salaries ranging from £39,000 to £49,000 annually. Indeed reports an average of £22.40 per hour based on 15,100 salary submissions. These figures tend to run higher than ONS data because they reflect what employers need to advertise to attract applicants in a competitive market, not what they actually pay once negotiations conclude. London and South East roles are overrepresented, inflating national averages. Reliability: medium, useful for market trends but not precise earnings.

Trade forums and consumer quote sites like ElectriciansForums, MyBuilder, and Checkatrade provide anecdotal evidence and user-submitted pricing. These sources report price-work rates of £45-£65 per point and day rates of £200-£350 depending on region. However, these are self-reported and often conflate labour with materials, include one-off exceptional jobs, or represent aspirational pricing rather than consistent achieved rates. There’s no verification, no sampling methodology, and heavy selection bias toward electricians willing to discuss their earnings publicly. Reliability: low for precise figures, useful for directional understanding only.

HMRC and GOV.UK CIS guidance explains the tax framework for contractors (20% deduction at source for net CIS status, 30% for gross CIS until verified) but publishes no data on actual rates paid. It confirms compliance requirements but doesn’t measure market rates. Reliability: high for tax rules, not applicable to earnings.

The evidence hierarchy matters because advertised rates consistently exceed actual earnings. When you see £350 per day advertised, the ONS data showing median employee earnings equivalent to £180 per day suggests either the advertised figure is unrepresentative, or it’s gross before significant deductions, or it applies to a small subset of highly specialist roles.

UK Rate Ranges by Worker Type (2025 Evidence)

Rates vary significantly by employment model, region, and sector. These ranges reflect actual data from the sources outlined above, with clear notes on what drives the variance.

Domestic installer/service electrician (employed PAYE). Hourly rates: £16-£20 per hour. Annual: £30,000-£40,000 including overtime. This covers electricians working for small to medium firms on domestic maintenance, EICRs, consumer unit changes, and minor installations. ONS median data sits in this range. Regional variance: London adds approximately £2-£3 per hour, South East £1-£2. Reliability: high (ONS verified).

Domestic installer/service electrician (self-employed/CIS). Day rates: £200-£350. Price-work: £45-£65 per point depending on job type (£45-£50 new build first fix, £60-£65 rewire). This represents self-employed sparks working directly for customers or subcontracting to builders. Wide variance reflects experience, reputation, speed, and regional demand. Reliability: medium to low (recruiter advertised and forum anecdotal).

Site electrician (JIB-aligned employed PAYE). Hourly rates: £17-£23 per hour depending on grade (Electrician, Approved, Technician). Annual: £35,000-£45,000 base, rising to £45,000-£55,000 with regular overtime. This covers commercial construction sites, industrial facilities, and infrastructure projects under JIB agreements. London rates add £2-£5 per hour depending on grade. Reliability: high (JIB published minimums).

Agency site electrician (umbrella/PAYE). Hourly: £20-£30 per hour advertised, reducing to £16-£24 after umbrella fees and deductions. Day rates: £220-£280 per day gross. This represents temporary site workers placed by agencies, often paid through umbrella companies. The gap between advertised and net is significant due to fee structures. Reliability: medium (advertised figures high, actual take-home lower).

Subcontractor on CIS day rates. Day rates: £125-£600, average around £335. The wide range reflects region (London £300-£400, other areas £250-£300), sector (commercial fit-out higher than domestic maintenance), and individual negotiation. This is gross before 20% CIS deduction. Reliability: medium (advertised rates from recruiters, actual private agreements unreported).

Industrial/maintenance electrician with shift work (PAYE). Hourly: £19-£25 per hour base, rising to £38,000-£50,000 annually once shift allowances (typically 10-20% uplift for nights, weekends, rotating patterns) are included. This represents factory electricians, water treatment, power generation, and similar 24/7 operations. Reliability: high (ONS and Indeed verified).

Regional differences are substantial. A £250 day rate in the North West might be £320 in London for equivalent work, but London’s cost of living (particularly housing) often erodes the premium. The same applies to hourly rates: £18 per hour in Wales versus £22 in London sounds like a significant gap until rent and transport costs are factored in.

Data gaps: private CIS agreements between known contractors and electricians aren’t centrally tracked, so the true average day rate is unknown. Price-work rates are entirely informal and dependent on individual builder or developer agreements, with no official benchmarks beyond forum discussions.

Thomas Jevons, Head of Training with 20+ years on the tools, explains:

"The electricians commanding £300+ day rates aren't just NVQ Level 3 qualified. They've built reputations for speed and accuracy, they understand how to quote realistically, and they can manage their own tax, insurance, and business admin. The qualification gets you started. The business skills determine whether you survive as a contractor."

Thomas Jevons, Head of Training

Worked Examples: What Each Model Actually Delivers

Comparing models requires walking through realistic scenarios with transparent assumptions. These examples use 2025 rates and standard working patterns.

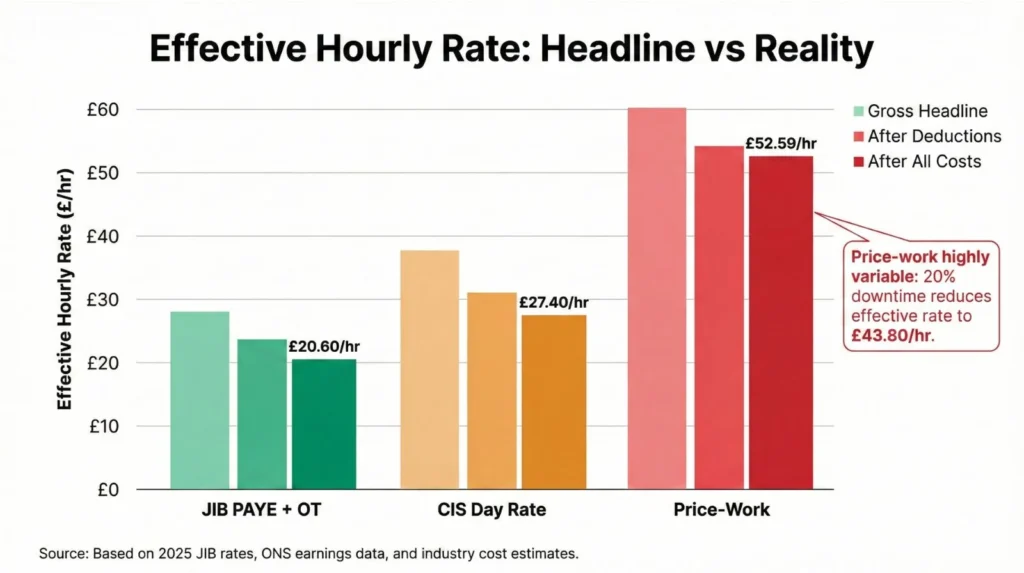

Assumptions for all scenarios: 48 working weeks per year (accounting for 4 weeks holiday/downtime), standard tax and National Insurance rates per HMRC 2025/26 (20% CIS deduction, 13.8% Employer NI for PAYE), umbrella company fees of £25 per week where applicable, 10% downtime factored into price-work, van and tool costs of £5,000 per year for self-employed workers. These are gross comparisons focused on understanding effective hourly rates before personal income tax.

Scenario 1: JIB/PAYE Approved Electrician with overtime. Base rate: £19 per hour (close to 2025 national rate). Standard week: 37.5 hours. Overtime: 7.5 hours per week at 1.5x (£28.50 per hour). Calculation: (37.5 hours x £19 x 48 weeks) + (7.5 hours x £28.50 x 48 weeks) = £34,200 base + £10,260 overtime = £44,460 gross annual. Benefits adjustment: employer pension contribution approximately £1,334 (3%), holiday pay already included in hourly rate structure, sick pay available. Effective hourly rate: £44,460 divided by (45 hours x 48 weeks) = £20.60 per hour equivalent including benefits and overtime.

Scenario 2: CIS contractor on day rates. Day rate: £300 per day (gross before deductions). Working pattern: 5 days per week, 48 weeks per year. Calculation: £300 x 5 days x 48 weeks = £72,000 gross annual. CIS deduction: 20% = £14,400 (reclaimable if overpaid via self-assessment). Overheads: van, fuel, insurance, tools, professional indemnity estimated at £5,000 annually. Adjusted gross: £72,000 – £14,400 – £5,000 = £52,600. Working hours: assuming 8-hour days, 40 hours per week, 1,920 hours annually. Effective hourly rate: £52,600 divided by 1,920 hours = £27.40 per hour. This is before personal income tax but after CIS deduction and business costs.

Scenario 3: Price-work domestic installer. Rate: £55 per point. Productivity: 9 points per day average after factoring 10% downtime for job delays, material sourcing, snagging (theoretical 10 points reduced to 9). Working pattern: 5 days per week, 48 weeks per year. Calculation: £55 x 9 points x 5 days x 48 weeks = £118,800 gross annual. Overheads and risk: van, tools, insurance, plus additional 15% for unpaid rework and variations = £17,820. Adjusted gross: £118,800 – £17,820 = £100,980 before personal tax. Working hours: 40 hours per week, 1,920 hours annually. Effective hourly rate: £100,980 divided by 1,920 hours = £52.59 per hour.

Sensitivity analysis: if travel time adds 2 hours per day (10 hours total time for 8 hours paid work in scenarios 2 and 3), effective rates drop by 20%. If price-work downtime increases to 20%, the effective hourly rate in scenario 3 falls to £43.80. If price-work snagging and rework increase to 25-30% (common on poorly specified jobs), the rate drops to £36.70-£39.00, making it comparable to or worse than the JIB scenario despite much higher headline gross.

The key insight: JIB PAYE provides the most predictable effective hourly rate. CIS day rates offer moderate upside with moderate variability. Price-work offers the highest theoretical earnings but the widest range of actual outcomes depending on productivity, job quality, and unforeseen issues.

Risk, Stability, and Where the Burden Falls

Each payment model distributes risk differently. Understanding where financial exposure sits helps you evaluate whether higher headline earnings justify the trade-offs.

Hourly PAYE/JIB: high stability, low risk, capped upside. The employer carries risk of defects, project delays, and client non-payment. You’re paid for time worked regardless of productivity variations within reason. If a job overruns due to poor planning or unforeseen issues, you’re still paid hourly. Rework caused by design changes or errors (unless gross negligence) is paid time. Downside risk is minimal: as long as you show up and work competently, you receive your salary. Sick pay and holiday pay provide income protection during non-working periods. The trade-off is limited earnings upside. Your maximum income is determined by your hourly rate and available overtime, with no performance bonuses or efficiency gains captured personally.

Day rate CIS/agency: medium stability, medium risk, moderate upside. Risk is partially shared. You’re paid for days worked, so short-term project cancellations or weather delays result in no income for those days. However, you’re not personally liable for defects in most cases (though this depends on contract terms). Productivity pressure exists because agencies and contractors expect output, but rework is typically a shared responsibility rather than entirely yours. You absorb the cost of your own tools, van, and insurance, creating ongoing overhead regardless of work volume. Downtime between contracts is unpaid, and finding the next job is your responsibility. The upside is higher gross rates than PAYE, with flexibility to move between contractors for better pay. The risk is employment insecurity and lack of benefits requiring self-funding.

Price-work: low stability, high risk, high potential upside. You carry all the risk. If a job takes longer than estimated, you earn less per hour. If you quote £600 for a first fix that should take two days and it takes four due to poor access, unexpected complications, or specification changes, your £300 per day estimate becomes £150 per day actual. Rework and snagging are entirely unpaid. Variations from scope often go uncompensated unless you’re skilled at negotiating change orders. Downtime is unpaid, and income volatility can be extreme: a great month with perfect jobs might yield £8,000-£10,000, while a poor month with problem jobs, cancellations, or gaps between work might yield £2,000-£3,000. The upside is that efficiency and speed translate directly to higher earnings. An experienced price-work electrician who can accurately estimate jobs, work quickly without sacrificing quality, and manage client expectations can earn substantially more than PAYE or day rate equivalents. The question is whether you have the skill, risk tolerance, and financial reserves to weather the variability.

Quality and safety pressures also vary. Hourly PAYE workers face less pressure to rush because they’re paid for time. Day rate workers face moderate pressure to maintain productivity. Price-work creates strong incentives to complete tasks quickly, which can lead to quality shortcuts or safety violations if not carefully managed. BS 7671 compliance, testing procedures, and certification requirements don’t change based on payment model, but the financial incentive to skip steps or rush through testing is highest in price-work.

Where Each Model Dominates

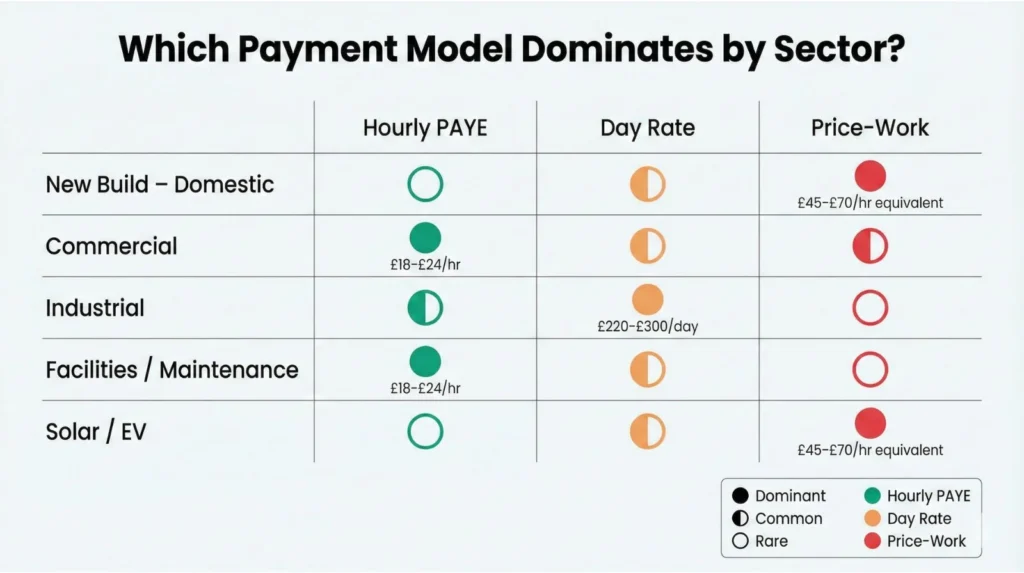

Different sectors of the electrical industry have settled on specific payment models based on the nature of the work, client expectations, and risk allocation preferences.

New build domestic housing (“house bashing”) uses price-work almost exclusively. Developers and volume house builders contract electricians at per-point rates for first fix (cables, back boxes) and second fix (faceplates, testing, commissioning). The work is highly repetitive, specifications are standardised, and speed is prioritised. Electricians on new builds might complete multiple properties simultaneously, working across several plots in a week. The model works because the tasks are predictable, volumes are high, and experienced electricians can accurately estimate completion times. Typical rates: £45-£50 per point first fix, £50-£60 second fix.

Commercial fit-outs and construction sites predominantly use day rates or hourly JIB agreements. Office refurbishments, retail developments, schools, and hospitals contract electricians through agencies at £250-£350 day rates (CIS) or directly employ under JIB frameworks at £20-£23 per hour plus overtime. The work is more varied than new builds, often involves coordination with other trades, and specifications can change during the project. Day rates provide flexibility for short-term projects, while JIB contracts suit longer-term site work. The model works because projects have defined timelines, budgets allow for labour costs, and the complexity of work makes per-task pricing impractical.

Industrial maintenance and infrastructure operates almost entirely on hourly PAYE under JIB or NAECI (National Agreement for the Engineering Construction Industry) frameworks. Factories, water treatment plants, power stations, and data centres employ electricians at £19-£25 per hour base rates with shift allowances adding 10-20%. The work requires high levels of technical competence, fault-finding skills, and often safety certifications beyond standard NVQ Level 3. The complexity, safety criticality, and need for 24/7 coverage make hourly employment with benefits the only practical model. Employers need reliable staffing and can’t risk contractors deciding not to show up.

Facilities management and in-house maintenance teams use hourly PAYE exclusively. Hospitals, universities, local authorities, large commercial buildings, and retail chains employ electricians directly on salaries of £30,000-£42,000 annually. The work is reactive maintenance, planned preventive work, and compliance testing (EICRs, emergency lighting, fire alarm testing). Consistency, reliability, and institutional knowledge are valued over speed. The stability and benefits package (pension, sick pay, often better work-life balance) suit electricians prioritising job security.

Solar, EV charging, and heat pump installation shows mixed models. Some installers work on day rates (£220-£280) contracted to renewable energy companies. Others work price-work per installation (quoted per system rather than per point). Emerging sectors haven’t settled on dominant models yet, and rates vary widely based on whether you’re installing as part of new builds, retrofitting existing properties, or working on commercial-scale systems.

The full electrician pay structure breakdown examines how these sector differences combine with regional variations and qualification levels to determine overall earning potential across different career pathways.

Who Should Use Which Model (and What the Traps Are)

Suitability depends on experience, risk tolerance, business skills, and personal priorities. There’s no universally “best” choice, but there are clear mismatches to avoid.

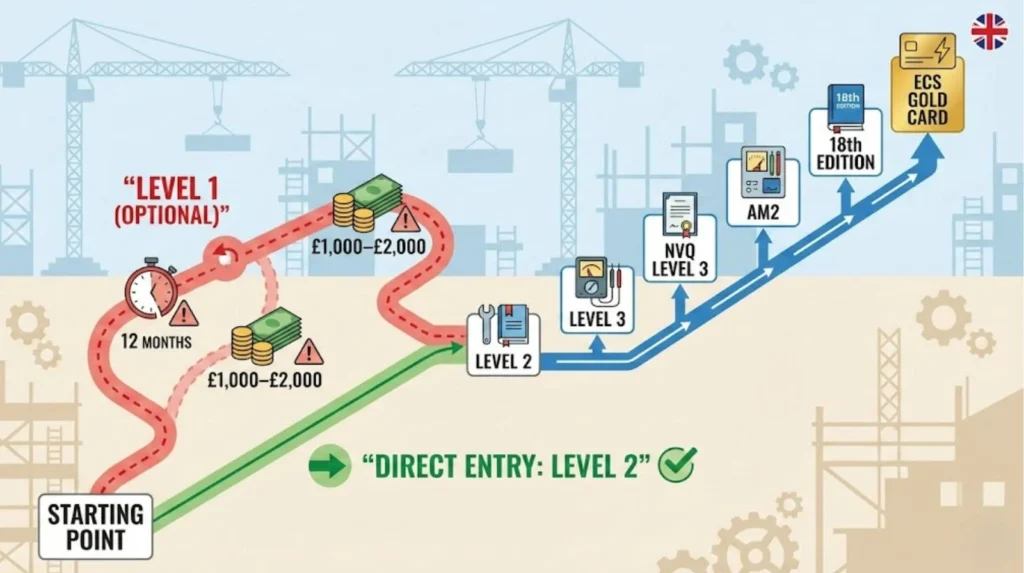

Newly qualified electricians and improvers suit hourly PAYE roles. The stability allows you to build competence without financial pressure. Making mistakes is part of learning, and in PAYE employment, the employer absorbs the cost of errors and rework. You’re paid while developing speed and accuracy. Jumping straight into CIS day rates or price-work risks financial hardship during the learning curve when productivity is low and errors are frequent. The trap: accepting low hourly rates (under £16-£17) at small firms that undervalue newly qualified workers. Look for JIB-aligned employers or those paying close to ONS median rates.

Approved Electricians and Technicians with 5+ years’ experience can consider day rate contracting. You have the technical competence to work independently, the speed to meet productivity expectations, and the judgment to avoid common errors. CIS day rates of £250-£300 offer higher gross than PAYE equivalents, and the flexibility to move between contracts can accelerate earnings. The trap: underestimating the administrative burden of self-employment (tax returns, CIS compliance, chasing payments) and the cost of unpaid downtime between contracts. Many electricians report taking 6-12 months to adjust to irregular income after leaving PAYE.

Domestic-focused electricians with strong customer service skills can transition to price-work if they have accurate quoting ability and speed developed through repetition. New build price-work suits those who can maintain quality under time pressure and accurately estimate job duration. The trap: taking on price-work before developing reliable speed, leading to jobs that take twice as long as estimated and effective hourly rates below PAYE equivalents. Poor quoting skills result in either underpricing (losing money) or overpricing (losing work to competitors).

Commercial and industrial site electricians often move between day rate and PAYE depending on project availability. Agency day rates provide income during gaps between permanent positions. JIB contracts offer stability for long-term projects. The trap: umbrella company fee structures reducing day rate take-home to levels comparable with or below PAYE, while sacrificing employment benefits. Always calculate net after fees before accepting umbrella work.

Stability-focused electricians (families, mortgages, risk-averse) benefit most from PAYE employment despite capped upside. Guaranteed income, paid holidays, sick pay, and pension contributions provide financial security and make mortgage applications straightforward. The trap: staying in low-paying PAYE roles out of fear of contracting when moving to JIB-aligned employers or negotiating better hourly rates could substantially increase earnings without the risks of self-employment.

Upside-focused electricians (high risk tolerance, strong business skills, single/mobile) can maximise earnings through price-work if they develop speed, accuracy, and client management skills. The highest earners in domestic electrical work are price-work electricians with efficient workflows and strong reputations. The trap: sacrificing quality for speed, leading to callbacks, rework, and reputational damage that undermine long-term earnings. Another trap: working unsustainable hours (60-70 hours per week) to maximise income, leading to burnout.

Speed and organisation-focused electricians excel at price-work if they can maintain quality. Efficiency tools (pre-made schedules, organised van stock, efficient cable routing, minimal return trips for materials) translate directly to higher effective hourly rates. The trap: cutting corners on testing, inspection, or certification to save time, creating liability and potential prosecution under BS 7671 and Building Regulations.

Complex fault-finding and maintenance specialists suit hourly PAYE in industrial or facilities management roles. Diagnostic work is unpredictable, and hourly payment ensures you’re compensated for the time required to solve difficult problems rather than being penalised for jobs that take longer than expected. The trap: undervaluing diagnostic skills and accepting standard electrician hourly rates when your expertise should command £22-£25+ per hour or specialist shift allowances.

Joshua Jarvis, Placement Manager at Elec Training, notes:

"Confidence in business management matters as much as technical skill when moving to day rates or price-work. Employers offering PAYE positions want reliable electricians who show up consistently. Contractors offering CIS day work want productivity and minimal supervision. Price-work clients expect speed. Understanding which environment suits your strengths is critical."

Joshua Jarvis, Placement Manager

Common Myths and What the Evidence Actually Shows

Several widely believed claims about electrician pay models don’t hold up under scrutiny.

Myth: Day rates always pay more than hourly PAYE. Reality: Gross day rates look higher (£250-£335 average versus £20 per hour), but after 20% CIS deduction, self-funded holidays, pension, tools, van, and insurance, net annual income is often only £5,000-£8,000 higher than PAYE equivalents earning £44,000 gross with benefits. The evidence: scenario calculations show £300 day rate netting approximately £52,600 annually after costs, compared to JIB PAYE with overtime at £44,460 plus employer pension and benefits valued at £3,000-£4,000. The gap narrows to £5,000-£6,000 difference for substantially more financial risk and administrative burden.

Myth: Price-work is easy money if you’re fast. Reality: Effective hourly rates in price-work vary dramatically with downtime, snagging, and job accuracy. The evidence: at 10% downtime and 15% snagging costs, the theoretical £52.59 per hour calculated earlier can drop to £36-£44 per hour in difficult months. Forum evidence shows electricians reporting price-work months where effective rates fell to £20-£25 per hour due to problem jobs, scope creep, and unpaid variations. It’s high-reward when conditions are perfect and high-risk when they’re not.

Myth: Hourly PAYE caps your earnings. Reality: Overtime and shift allowances add 20-30% to base salaries in many roles. The evidence: JIB scenario shows £34,200 base rising to £44,460 with just 7.5 hours weekly overtime. Industrial maintenance electricians on shifts report base salaries of £38,000-£42,000 rising to £50,000-£55,000 with shift premiums, weekend work, and call-out allowances. While the ceiling is lower than successful price-work, it’s not as restrictive as the myth suggests.

Myth: Umbrella companies and CIS are the same thing. Reality: CIS is a tax scheme where 20% is deducted at source from self-employed contractors. Umbrella companies employ you, meaning you pay both employee and employer National Insurance plus umbrella fees. The evidence: HMRC guidance and contractor forums consistently report umbrella workers losing 30-35% of gross pay to tax, NI (both portions), and fees, while CIS contractors lose 20% upfront but reclaim overpayments via self-assessment. A £280 day rate through umbrella nets approximately £210-£220. The same rate via CIS nets £224 before personal tax, allowing you to reclaim the difference if your actual tax liability is lower.

Where the Data Fails Us

Several aspects of electrician pay remain poorly documented, creating gaps in understanding true market rates.

True average day rates under private CIS agreements. Most CIS contracts are negotiated privately between electricians and contractors or agencies, with no central reporting. Advertised rates on job boards may not reflect actual agreed rates. Regional variation of ±20% is reported anecdotally but not systematically tracked. We don’t know if the commonly cited £335 average is accurate or skewed by high London rates dominating advertised data.

Actual price-work rates and productivity. Per-point pricing is informal, varying by builder, developer, region, and individual negotiation. There’s no official benchmark beyond electrician forum discussions. We don’t know what percentage of price-work electricians achieve theoretical maximum productivity (10 points per day) versus realistic averages accounting for delays, access issues, and specification problems. Anecdotal reports suggest 10-30% downtime, but no surveys exist.

Real-world downtime and gaps between contracts. How many weeks per year does the average CIS contractor spend between jobs? How does this vary by region, sector, and experience level? This data doesn’t exist in any systematic form. Forum evidence suggests 2-6 weeks annually is common, but this varies enormously and isn’t tracked.

Umbrella company net take-home variance. Different umbrella companies charge different fees (£15-£30 per week) and structure deductions differently. Some include benefits like insurance or pension contributions. Others don’t. The net effect on take-home pay varies by provider, but there’s no standardised comparison available.

Sector-specific emerging roles (solar, EV, heat pumps). These fields are growing rapidly, but earnings data is sparse and inconsistent. Are solar installation electricians typically paid hourly, day rate, or per-system price-work? What are typical rates? The evidence is fragmentary, mostly from job adverts rather than actual earnings.

These gaps mean some comparisons remain uncertain. When evidence is weak or unavailable, we’ve flagged it explicitly rather than speculating.

Understanding What You're Actually Comparing

The choice between hourly PAYE, CIS day rates, and price-work isn’t a question of which pays “best.” It’s a risk decision. Do you value stability and predictable income with capped upside, or are you willing to accept financial variability and administrative complexity for higher earning potential?

Gross figures are meaningless without adjustment for benefits, costs, time, and risk. A £20.25 per hour JIB rate with holiday pay, pension, sick pay, and employer NI contributions has a total economic value substantially higher than the headline figure suggests. A £300 per day CIS rate looks impressive until 20% CIS deduction, holiday self-funding, tool and van costs, and unpaid downtime reduce it to effective parity with high-end PAYE roles. A £55 per point price-work rate sounds exceptional until job delays, snagging, and scope creep push actual productivity well below theoretical maximums.

The payment model you choose should align with your experience level, risk tolerance, business management skills, and personal priorities. Newly qualified electricians generally benefit from PAYE stability while building competence. Experienced electricians with strong business skills can leverage day rates or price-work for higher earnings if they’re comfortable with financial volatility and administrative burden. Those prioritising work-life balance, family stability, or mortgage accessibility often find PAYE offers better long-term outcomes despite lower headline earnings.

The sectors where you want to work also constrain your options. New build domestic work operates on price-work. Industrial facilities use hourly PAYE. Commercial sites offer both JIB contracts and agency day rates. Choosing a sector effectively chooses your payment model.

What remains consistent across all models is that qualifications, competence, and reputation determine your earning potential within each structure. An NVQ Level 3 qualification and AM2 assessment are prerequisites for accessing better-paid roles regardless of model. Speed and accuracy improve earnings in all three structures. Business management skills (quoting, tax compliance, customer service) become critical as you move from PAYE employment toward self-employment.

If you’re considering electrician training or evaluating which career pathway suits your circumstances, understanding these payment structures helps you make informed decisions about qualification routes, sector preferences, and employment models. The Elec Training’s UK electrician earnings guide provides additional context on how regional variations, qualification levels, and sector choices combine to shape long-term earning potential across different electrician career paths. Call us on 0330 822 5337 if you have questions about which training route aligns with the payment models and sectors that match your goals and risk tolerance.

References

- JIB National Working Rules and Pay Determination 2025-2026 – https://www.jib.org.uk/

- Office for National Statistics (ONS) – Annual Survey of Hours and Earnings (ASHE) 2024/2025 – https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/earningsandworkinghours/bulletins/annualsurveyofhoursandearnings/2025

- HMRC – Construction Industry Scheme (CIS) Guidance for Contractors and Subcontractors – https://www.gov.uk/government/publications/construction-industry-scheme-cis-340

- Indeed UK – Electrician Salary Data and Job Listings – https://uk.indeed.com/career/electrician/salaries

- Reed – Average Electrician Salary Listings UK – https://www.reed.co.uk/average-salary/average-electrician-salary

- Elec Training – JIB vs Non-JIB Electrician Pay Comparison – https://elec.training/news/jib-vs-non-jib-electrician-pay-whats-the-real-difference/

- ContractorUK – Umbrella Company Costs and Fees Breakdown – https://www.contractoruk.com/umbrella_company/what_are_costs_and_fees_umbrella_company.html

- ElectriciansForums – Price Per Point Discussions (Domestic Work) – https://www.electriciansforums.net/

- Glassdoor UK – Solar and Battery Electrician Salary Data – https://www.glassdoor.co.uk/

- IET Wiring Regulations BS 7671:2018+A2:2022 – https://www.theiet.org/

- City & Guilds 2357 NVQ Level 3 Electrical Installation – https://www.cityandguilds.com/

Note on Accuracy and Updates

Last reviewed: 25 December 2025. This page is maintained; we correct errors and refresh sources as JIB pay determinations, ONS ASHE releases, and HMRC CIS guidance are updated. Rate ranges reflect 2025 JIB published minimums, ONS 2024 ASHE employee data, and recruiter advertised rates from Q4 2025. Price-work rates are based on forum discussions and anecdotal evidence with reliability limitations noted in text. Next review scheduled following JIB 2026 wage determination (expected January 2026) and ONS ASHE 2026 release (November 2026).