Electrician Pay by Years of Experience: What 1, 5, and 10+ Years Actually Earns You

- Technical review: Thomas Jevons (Head of Training, 20+ years)

- Employability review: Joshua Jarvis (Placement Manager)

- Editorial review: Jessica Gilbert (Marketing Editorial Team)

- Last reviewed:

- Changes: Initial publication analyzing electrician pay progression by experience bands using ONS ASHE 2025 data, JIB grade structures, and market patterns showing non-linear progression and qualification-driven increases

When researching electrician salary uk data, you’ll find broad ranges that seem unhelpful: £26,000 to £60,000+ depending on “experience.” What these ranges don’t explain is how pay actually progresses from year one to year ten, why two electricians with identical years of experience can earn £10,000-£20,000 apart, or when experience stops driving pay increases without additional qualifications or sector changes.

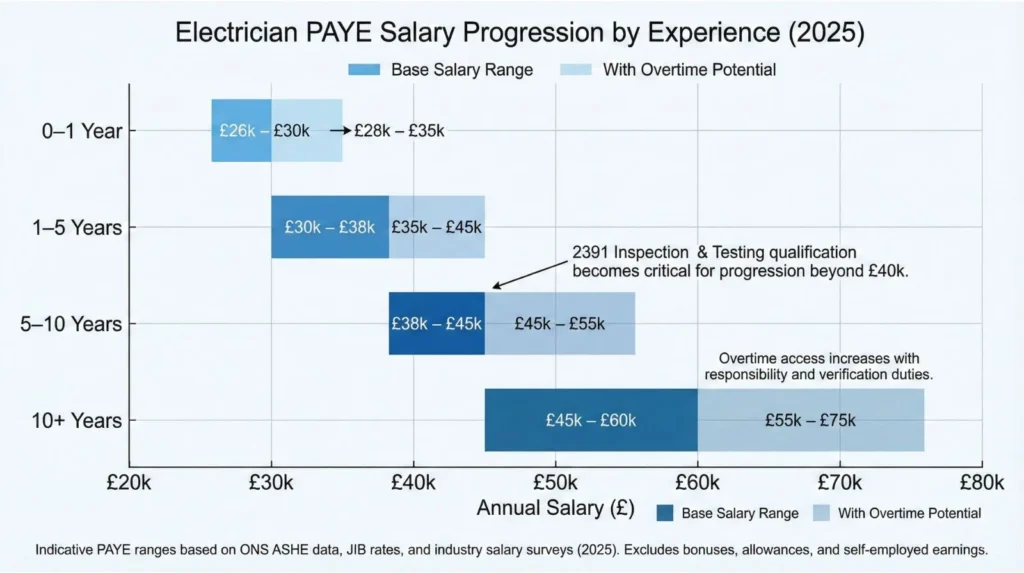

The assumption that each year automatically brings a pay rise is misleading. ONS data for 2025 shows median full-time electrician earnings of £39,039, but this aggregates everyone from newly qualified electricians earning £28,000 to senior technicians earning £55,000+. Pay progression isn’t linear. It accelerates rapidly in the first three years as you build competence and speed, slows significantly between years five and ten unless you gain Testing and Inspection qualifications or move sectors, and often plateaus entirely without deliberate career development decisions.

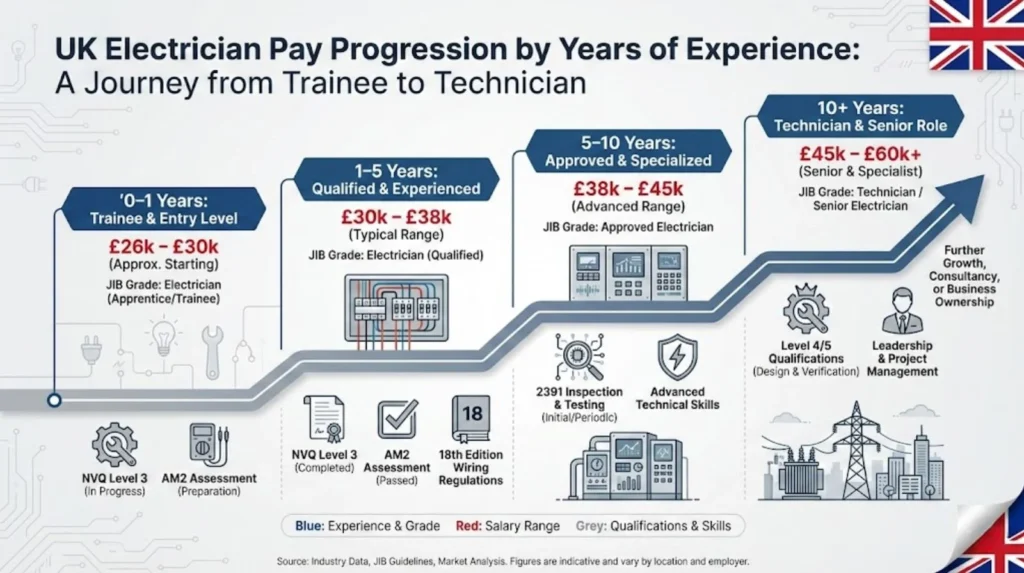

This article breaks down electrician pay by experience bands (0-1 year post-qualification, 1-5 years, 5-10 years, 10+ years) using ONS employee data, JIB grade structures, and current market signals from recruitment platforms. You’ll see what newly qualified electricians actually earn in PAYE roles versus CIS contracting, how pay progression maps to JIB grades (Electrician to Approved to Technician), why experience alone doesn’t guarantee higher earnings without qualifications like 2391, and what sector moves (domestic to commercial, commercial to industrial) do to annual salary more dramatically than adding another year of service.

Understanding pay by experience requires understanding that “experience” measures time served, while “competence” and “qualifications” determine what employers pay. Five years pulling cables in domestic installations develops different competencies and commands different rates than five years in commercial fit-out or industrial maintenance. JIB progression from Electrician grade to Approved grade requires specific Testing and Inspection qualifications plus minimum two years’ experience, not just accumulated years on the tools. The data shows experience matters most in the first three years when you’re building autonomy, matters less from years three to seven when pay progression depends more on qualification decisions, and often stops mattering entirely after year seven unless you move into supervisory, specialist, or contractor roles.

What "Years of Experience" Actually Means (and Why It's Measured Inconsistently)

The phrase “years of experience” appears in almost every electrician job advert, but employers, recruiters, and electricians themselves measure it differently, creating confusion when comparing pay data.

Time Served vs Post-Qualification Time

Some adverts count “years of experience” from when you started your apprenticeship (age 16-18 for many), while others count from when you completed NVQ Level 3 and AM2 assessment and became a qualified electrician. A 26-year-old who started an apprenticeship at 18 and qualified at 22 might claim “eight years’ experience” (total time in the trade) or “four years’ experience” (post-qualification time). Employers typically care about post-qualification time because that’s when you’re working autonomously rather than as a supervised apprentice.

For pay comparison purposes, this article uses post-qualification time as the standard. “1-5 years” means one to five years after completing NVQ Level 3, passing AM2/AM2E, and receiving your ECS Gold Card. This aligns with JIB grade progression requirements, which measure experience from qualification completion rather than apprenticeship start.

JIB Grade Alignment by Experience

The Joint Industry Board structures electrician grades loosely around experience bands, though qualifications and demonstrated competence matter more than years alone:

Electrician grade (JIB). Typically covers newly qualified through to approximately five years post-qualification. Requires NVQ Level 3, AM2 pass, and ECS Gold Card at Electrician grade. Capable of independent installation work under BS 7671 standards but not authorised for final verification, periodic inspection, or supervisory responsibilities. National hourly rate (2025) is £17.54, rising to £18.38 in January 2026.

Approved Electrician grade. Requires minimum two years as a qualified Electrician plus completion of Level 3 Initial Verification and Periodic Inspection qualification (City & Guilds 2391-52 or equivalent). Typically covers electricians from approximately three years post-qualification onwards, though many don’t pursue 2391 and remain at Electrician grade indefinitely. Authorised for testing, inspection, EICR production, and supervisory duties. National hourly rate (2025) is £19.01, rising to £20.08 in January 2026. This is an 8-9% premium over Electrician grade at JIB minimums, though market rates often show 15-20% differentials.

Technician grade. Requires five years as an Electrician (with at least two years at Approved grade and three years in supervisory roles) plus Level 4 qualifications in electrical design, verification, or project management. Typically covers electricians from approximately eight years post-qualification onwards in senior, lead, or specialist roles. Handles complex fault diagnosis, team leadership, quality assurance, and client-facing project management. National hourly rate (2025) is £21.52, rising to £22.70 in January 2026.

The critical point: you don’t progress through these grades automatically by accumulating years. You progress by meeting qualification and competency requirements. An electrician with ten years’ experience but no 2391 qualification remains at Electrician grade and earns Electrician grade pay (£17.54-£18.38/hour JIB minimum). An electrician with four years’ experience who completed 2391 after two years and gained supervisory experience moves to Approved grade and earns £19.01-£20.08/hour minimum, with market rates often reaching £21-£23/hour.

Sector and Role Variations

Experience also means different things across sectors. Five years in domestic installation (new-build housing, rewires, consumer unit changes) develops competence in domestic wiring regulations, customer interaction, and working alone. Five years in commercial fit-out (office buildings, retail, hospitality) develops competence in three-phase systems, emergency lighting, fire alarm integration, and working within main contractor project structures. Five years in industrial maintenance (manufacturing, data centres, utilities) develops competence in motor controls, PLC systems, critical infrastructure, and planned preventative maintenance regimes.

These different competency sets command different pay even at identical experience levels. Industrial roles typically pay 15-25% more than domestic roles at equivalent experience because the complexity, risk profile, and scarcity of electricians familiar with industrial systems drives employer premiums. Commercial sits between domestic and industrial, typically 10-15% above domestic rates.

Job adverts asking for “five years’ experience” in industrial settings often really mean “five years in industrial or similarly complex environments,” not just any five years as a qualified electrician. An electrician with five years in domestic work applying for an industrial role might be offered entry-level industrial pay (similar to 1-2 years industrial experience) rather than mid-career industrial pay because their competency set doesn’t transfer directly.

Pay by Experience Bands: PAYE Employee Earnings

Using ONS Annual Survey of Hours and Earnings (ASHE) 2025 data combined with JIB published rates and market analysis from job board advertised salaries, here’s what electricians actually earn at different experience levels in PAYE employment (permanent or fixed-term staff with benefits including paid holiday, sick pay, and pension).

Thomas Jevons, Head of Training with 20+ years on the tools, explains:

0-1 Year Post-Qualification (Newly Qualified)

Typical gross annual salary: £26,000-£30,000 (lower quartile to median for entry-level roles)

Hourly equivalent: £13-£15 base (assuming 37.5-40 hour standard week)

With overtime/shift premiums: £28,000-£35,000 gross annually

JIB grade alignment: Electrician (entry level)

Typical responsibilities: Installation work under supervision or alongside more experienced electricians, basic fault-finding, testing circuits for continuity and insulation resistance (but not full verification), working from drawings and specifications with guidance, learning company procedures and site protocols.

Sector patterns: Most common in domestic installation (new builds, housing developers), commercial maintenance (facilities management contracts), or as “improvers” in commercial fit-out teams. Industrial roles rarely hire at this experience level unless through structured graduate schemes or apprenticeship-to-employment pathways.

What limits pay: Lack of speed (experienced electricians complete installations 2-3x faster, reducing labour costs), need for supervision (someone must check work quality), limited fault-finding capability (can identify obvious issues but struggles with complex diagnostics), and absence of Testing and Inspection qualifications meaning you cannot produce installation certificates or EICRs independently.

Newly qualified electricians often perceive their starting salary (£26,000-£28,000) as low compared to advertised “experienced electrician” salaries (£38,000-£45,000), creating frustration. However, your value to employers at this stage is genuinely lower because you require supervision, work slower than experienced electricians, and can’t perform verification duties that unlock higher billing rates. The rapid pay progression in years two and three (typically £4,000-£8,000 total increase) reflects your increasing speed and reducing supervision requirements as you build competence.

Overtime is critical at this experience level. Base salaries of £28,000 seem modest, but many newly qualified electricians in facilities management or commercial contracts access 5-10 hours weekly overtime at 1.5x rates (JIB standard), adding £6,000-£8,000 annually and bringing total gross to £34,000-£36,000. This overtime access varies by employer and sector-domestic installation roles rarely offer consistent overtime, while maintenance contracts often guarantee it.

1-5 Years Post-Qualification (Building Autonomy)

Typical gross annual salary: £30,000-£38,000 (varies significantly by sector and whether 2391 qualified)

Hourly equivalent: £15-£19 base

With overtime/shift premiums: £35,000-£45,000 gross annually (20-30% uplift in contracts with regular overtime)

JIB grade alignment: Electrician (years 1-3), progressing to Approved Electrician (years 3-5 if 2391 qualified)

Typical responsibilities: Independent installation work, fault-finding without constant supervision, mentoring apprentices, working from complex drawings, making minor design decisions (cable routing, accessory positioning) within specifications, beginning to interface with clients or site management.

Sector patterns: Broad spread across domestic (rewires, consumer units, solar installations), commercial fit-out (office buildings, retail, restaurants), and entry-level industrial maintenance. Electricians who enter industrial or commercial sectors early in this band typically earn towards the upper range (£36,000-£38,000) even without 2391, while those remaining in domestic installation cluster towards lower range (£30,000-£34,000).

What drives pay within this band: Completion of 2391 Testing and Inspection qualification is the single largest driver, typically adding £3,000-£5,000 to annual salary because it enables progression to Approved Electrician grade and opens roles requiring EICR production. Sector moves from domestic to commercial or commercial to industrial create immediate £4,000-£8,000 increases even at identical experience levels because the complexity and client billing rates differ. Regional factors matter significantly-London and South East roles pay £4,000-£8,000 more than equivalent Midlands or Northern roles at this experience level.

The detailed breakdown of electrician pay progression by qualification and sector shows how 2391, 18th Edition updates, and specialist certifications combine to determine earning potential within each experience band.

This band sees the most variation in individual earnings. Two electricians both three years post-qualification can earn £32,000 and £44,000 respectively-the difference reflecting that one remained in domestic installations without additional qualifications while the other completed 2391, moved into commercial work, and accessed regular overtime in a facilities management contract. Experience alone doesn’t explain the gap; qualification decisions and sector positioning do.

Speed and productivity also increase significantly during this period. At year one, you might install three domestic consumer units per day. By year four, you’re installing five to six of equivalent complexity. This productivity increase doesn’t always translate directly to higher pay within the same employer (annual reviews might give 3-5% increases), but it makes you more attractive to employers offering higher-paying roles, enabling you to move for pay jumps rather than waiting for incremental raises.

5-10 Years Post-Qualification (Established Competence)

Typical gross annual salary: £38,000-£45,000 (PAYE employee without supervisory duties), £42,000-£52,000 (Approved Electrician with 2391 or supervisory roles)

Hourly equivalent: £19-£23 base (£21-£27 for Approved grades in commercial/industrial sectors)

With overtime/shift premiums: £45,000-£55,000 gross annually (30-40% uplift common in industrial shift work)

JIB grade alignment: Approved Electrician (if 2391 qualified), Electrician (if not qualified beyond NVQ Level 3)

Typical responsibilities: Lead small teams or sections of larger projects, fault diagnosis in complex systems, client liaison, producing EICRs and installation certificates (if 2391 qualified), mentoring multiple apprentices, making design decisions and material procurement choices, managing job schedules and coordination with other trades.

Sector patterns: Strong bias towards commercial fit-out, industrial maintenance, critical infrastructure (data centres, hospitals, transport), and specialist areas (solar/EV installation, building management systems). Domestic roles at this experience level are predominantly self-employed or small business owners rather than PAYE employees (covered separately in contractor section). PAYE domestic roles exist in social housing maintenance or local authority property services but cluster at the lower end of the salary range (£38,000-£42,000).

What determines position within range: 2391 qualification is no longer optional for career progression at this stage-it’s the minimum requirement to access the upper half of this salary band (£42,000-£52,000). Without it, you plateau around £38,000-£42,000 even with ten years’ experience because you cannot perform verification duties, produce EICRs, or take final responsibility for installation compliance. Sector matters enormously: industrial electricians at this experience level earn £45,000-£52,000 base in manufacturing, utilities, or data centres, while commercial electricians in fit-out or maintenance earn £40,000-£46,000, and the few remaining PAYE domestic electricians earn £38,000-£42,000.

Supervisory responsibility adds £3,000-£5,000 beyond technical competence alone. An Approved Electrician at a large contractor managing a team of three electricians and two apprentices on a commercial project typically earns £46,000-£50,000, while an Approved Electrician performing equivalent technical work without team responsibility earns £42,000-£45,000. Employers pay for the management overhead reduction when electricians can run sections of work independently.

Regional variance remains significant but proportionally smaller than at junior levels. A £45,000 role in Manchester becomes £50,000-£52,000 in London (approximately 15% uplift), compared to 20-25% uplifts at 1-3 years’ experience. This suggests regional differences reflect cost of living and market tightness more at junior levels, while at 5-10 years the competency premium (what you can actually do) matters more than location.

This is the band where many electricians plateau without further development. You’ve built speed, autonomy, and solid technical competence. You can handle most installations and basic fault-finding. Without 2391, you’re at the top of Electrician grade (approximately £38,000-£42,000 PAYE). With 2391 but no supervisory experience or specialist sector exposure, you’re at mid-Approved grade (£42,000-£46,000). Moving beyond £50,000 in PAYE employment typically requires either progression towards Technician grade (supervisory, quality assurance, or specialist roles) or transition to contracting.

10+ Years Post-Qualification (Senior/Lead Roles)

Typical gross annual salary: £45,000-£60,000+ (varies enormously by role type and sector)

Hourly equivalent: £23-£31+ base

With overtime/shift premiums: £55,000-£75,000+ gross annually (40%+ uplifts common in critical infrastructure and specialist sectors)

JIB grade alignment: Approved Electrician (senior), Technician Electrician (supervisory/specialist)

Typical responsibilities: Project leadership, quality assurance across multiple sites, compliance auditing, advanced fault diagnosis in critical systems, client account management, tender pricing and technical specifications, training and assessment of junior electricians, design review and approval.

Sector patterns: Predominantly industrial (manufacturing, utilities, transport, data centres), critical infrastructure (hospitals, emergency services, defence), specialist contractors (renewables, building management systems, industrial automation), or senior positions in large commercial contractors. Very few PAYE domestic roles exist at this salary level-domestic electricians with this experience are almost always self-employed business owners (covered in contractor section).

What determines position within range: The spread in this band (£45,000 to £75,000+) is the widest of any experience category, reflecting genuine diversity in role types rather than simple pay variation. At the lower end (£45,000-£52,000) are Approved Electricians in commercial maintenance or facilities management doing technically competent work without supervisory or specialist responsibilities. At the upper end (£60,000-£75,000) are Technician-grade electricians in site management roles, quality assurance positions, or highly specialist technical roles (industrial controls, critical power systems, complex fault diagnosis).

Sector specialisation becomes critical. An electrician with fifteen years in general commercial work might earn £48,000-£52,000, while an electrician with fifteen years in data centre critical power systems earns £62,000-£70,000 because the specialist knowledge commands scarcity premiums. Similarly, electricians with deep expertise in particular systems (Siemens building management, industrial PLC programming, high-voltage switching) earn 20-30% above generalist electricians at equivalent experience levels.

Supervisory and project management capability often matters more than hands-on technical work at this stage. Electricians managing teams of ten electricians across multiple concurrent projects, handling contractor coordination and client liaison, might spend only 20% of their time with tools and 80% managing, but command £60,000-£70,000 salaries because they’re reducing senior management workload. This transition from “doing” to “managing” is often the progression path beyond £55,000 in PAYE employment.

Overtime and shift premiums make substantial differences at senior levels. A £52,000 base salary in industrial maintenance with regular callouts, shift allowances, and weekend shutdown work can reach £68,000-£72,000 total gross. Some critical infrastructure contracts (utilities, hospitals, transport) offer guaranteed overtime in exchange for on-call availability, making effective earnings much higher than base pay suggests.

This band also includes quasi-management roles with “electrician” job titles but predominantly administrative duties: electrical estimators, contract managers, compliance officers, technical trainers. These roles pay towards the upper range (£55,000-£65,000) but require competencies beyond installation and testing-commercial awareness, bid writing, regulatory knowledge, training delivery skills.

Thomas Jevons, Head of Training with 20+ years on the tools, explains:

"The progression plateau between five and ten years is real. Without Testing and Inspection qualifications or specialist training, you'll reach the top of the Electrician grade pay scale and stay there. BS 7671 knowledge from NVQ Level 3 is foundational, but it doesn't cover periodic inspection, fault diagnosis methodology, or the verification responsibilities that unlock Approved rates."

Thomas Jevons, Head of Training

Contractor and Self-Employed Earnings by Experience

CIS contractors, umbrella workers, and sole traders often earn higher gross income than PAYE employees at equivalent experience levels, but effective hourly rates and take-home pay are closer than headline day rates suggest once downtime, overheads, and self-funded benefits are factored in.

0-1 Year Post-Qualification (Rare at Contractor Level)

Typical CIS day rate: £200-£250 (rare for newly qualified to secure contractor work)

Effective hourly rate: £25-£31 (assuming 8-hour day, deducting 10% for downtime/overheads)

Typical umbrella day rate: £220-£270 (umbrella margins reduce net by 10-15%)

Annual gross (if consistent work): £47,000-£60,000 (assuming 47 weeks worked, 5 weeks downtime/holiday)

Annual net after overheads: £40,000-£50,000 (deducting £5,000-£7,000 typical costs: van, tools, insurance, training, holiday provision, 20% CIS tax deduction)

Newly qualified electricians rarely work as contractors successfully. Contractor rates assume speed, autonomy, and minimal supervision-competencies that take 2-3 years to develop. Agencies and main contractors hiring CIS electricians typically require minimum two years post-qualification experience plus references from previous employers. Those who do attempt contracting at year one often experience extended downtime between contracts (8-12 weeks annually rather than 4-6 weeks for experienced contractors) because they lack the networks and reputation to secure continuous work.

The gross figures (£47,000-£60,000) look attractive compared to PAYE (£26,000-£30,000), but the net reality is less dramatic. After 20% CIS tax deduction (£9,400-£12,000), overheads (£5,000-£7,000), and factoring realistic downtime (contractors at this experience level often work only 42-45 weeks rather than 47), effective take-home is approximately £32,000-£40,000-better than PAYE but not transformationally so, and without the security of paid holiday, sick pay, or pension contributions.

Umbrella arrangements are marginally more common for newly qualified contractors because they handle tax administration and provide some employee rights (statutory holiday pay), but umbrella margins (10-15% of assignment rate) plus employer NI pass-through reduce net pay by 15-20% compared to direct CIS arrangements, often making umbrella day rates of £220-£270 net similar to PAYE employment of £28,000-£32,000 after all deductions.

1-5 Years Post-Qualification

Typical CIS day rate: £250-£350

Effective hourly rate: £28-£39 (8-hour day, 15% overhead allowance including downtime)

Typical umbrella day rate: £270-£370 (before 12% margin deduction)

Annual gross (if consistent work): £60,000-£84,000 (assuming 48 weeks worked, 4 weeks downtime)

Annual net after overheads: £48,000-£67,000 (deducting £8,000-£12,000 overheads: van lease/depreciation, fuel, tools, calibration, insurance, training, accountancy if sole trader, holiday provision, downtime between contracts)

This experience band sees the most contractor activity because electricians have built sufficient speed and competence to work without supervision while day rates significantly exceed PAYE equivalents. An electrician earning £34,000 PAYE at three years’ experience can potentially net £50,000-£55,000 as a CIS contractor working 48 weeks at £280-£300 day rates, creating genuine financial incentive to transition.

However, contractor income is volatile. The “48 weeks worked” assumption is optimistic-many contractors at this experience level face 6-8 weeks annual downtime (gap between contracts ending and new ones starting, seasonal slowdowns in December/January, economic uncertainties). This reduces annual gross from £72,000 (£300/day × 240 days) to £63,000-£66,000 (£300/day × 210-220 days), narrowing the gap with senior PAYE roles.

Sector matters as much for contractors as PAYE employees. Domestic contractors at this experience level might charge £40-£50/hour to end clients but spend substantial non-billable time on quotes, material procurement, and client liaison, reducing effective hourly earn to £28-£35. Commercial and industrial CIS contractors billing £280-£320 day rates work steadier schedules with less admin overhead, making effective hourly rates of £32-£38 more achievable.

The 2391 qualification premium exists in contracting but manifests differently. Rather than increasing base day rate dramatically (£280 without 2391 versus £310 with it), 2391 qualification opens access to higher-paying contract types (industrial shutdowns, commercial final fix and testing, periodic inspection contracts) that wouldn’t be available without verification capability. This increases average day rate over a year even if individual contracts don’t pay more per se.

5-10 Years Post-Qualification

Typical CIS day rate: £350-£450

Effective hourly rate: £39-£50 (8-hour day, 20% overhead allowance for comprehensive business costs)

Typical umbrella day rate: £370-£470 (before margin deduction)

Annual gross (if consistent work): £84,000-£108,000 (assuming 48 weeks worked)

Annual net after overheads: £65,000-£83,000 (deducting £10,000-£15,000 overheads: vehicle, tools/equipment upgrades, calibration, insurance, professional indemnity, training/CPD, accountancy/bookkeeping, holiday/sick provision, downtime between contracts)

At this experience level, contractors command significant premiums over PAYE equivalents (£38,000-£45,000 PAYE versus £65,000-£83,000 contractor net) because they’re often specialists in high-demand sectors (industrial shutdowns, data centres, critical infrastructure maintenance) where contractors are preferred for flexibility. Main contractors use CIS electricians for surge capacity during busy periods without long-term employment commitments.

Day rate variation within this band reflects specialisation more than raw experience. A generalist commercial electrician with eight years’ experience might secure £350-£380 day rates, while an industrial electrician specialising in motor controls or critical power systems commands £420-£450 because the competency is scarcer. Renewable energy specialists (solar, EV charging infrastructure, battery storage) increasingly command similar premiums as the sector grows.

Downtime reduces at this experience level for successful contractors (typically 4-6 weeks annually rather than 6-8 weeks) because they’ve built networks, reputations, and often return to the same clients or main contractors repeatedly. However, downtime risk never disappears entirely-economic downturns, project cancellations, or client payment issues can create sudden 8-12 week gaps that dramatically impact annual earnings.

Umbrella arrangements at this level often reduce net more significantly than at junior levels because the day rates are higher so the fixed percentage margins represent larger absolute amounts. A 12% umbrella margin on a £400 day rate costs £48 daily (£11,520 annually), versus £30 daily on £250 rate (£7,200 annually). Many contractors at this experience level prefer direct CIS or forming limited companies to retain more control over tax efficiency, though limited company IR35 regulations since 2021 complicate this for contractors working via agencies.

10+ Years Post-Qualification

Typical CIS day rate: £450-£600 (specialist sectors and critical infrastructure)

Effective hourly rate: £50-£67 (8-hour day, 25% overhead allowance including admin time for business management)

Typical umbrella day rate: £470-£620 (before margin)

Annual gross (if consistent work): £108,000-£144,000 (assuming 48 weeks worked)

Annual net after overheads: £80,000-£105,000 (deducting £15,000-£25,000 comprehensive overheads: professional vehicle, comprehensive tool inventory, specialist equipment, multiple insurance policies, CPD/advanced training, accountancy/legal, holiday/sick provision, business development time, potential limited company costs)

Senior contractors at this level are often quasi-consultants, combining hands-on technical work with specialist knowledge that justifies premium rates. They’re solving complex problems (persistent faults in critical systems, design failures requiring remedial work, compliance issues in existing installations) that generalist contractors can’t address. Day rates of £500-£600 reflect not just competence but scarcity of people who can diagnose and resolve these specific issues quickly.

Sector specialisation is almost universal at this level. Contractors commanding £550+ day rates typically work in niche areas: industrial automation and controls, critical power systems in data centres, renewable energy integration, high-voltage installations, or specialist testing and inspection in complex commercial environments. Generalist contractors with ten years’ experience but no specialisation plateau around £400-£450 day rates, similar to less experienced specialists.

The gross-to-net gap widens at senior contractor levels because business overheads increase (more sophisticated tools, multiple vehicles for different job types, professional indemnity insurance reflecting higher contract values, advanced training courses costing £2,000-£5,000 annually) and non-billable time increases (estimating, client liaison, contract negotiation, managing subcontractors if you’ve grown into a small business). A £600 day rate might net £450 after all business costs and non-billable time are accounted for, still excellent but not the simple day-rate-times-days calculation that headline figures suggest.

Many contractors at this level transition into small business ownership, hiring employed or subcontracted electricians to increase revenue without proportionally increasing their own hours worked. This shifts the business model from “selling your own time” to “managing projects and people,” fundamentally changing the income drivers but also the work-life balance and risk profile.

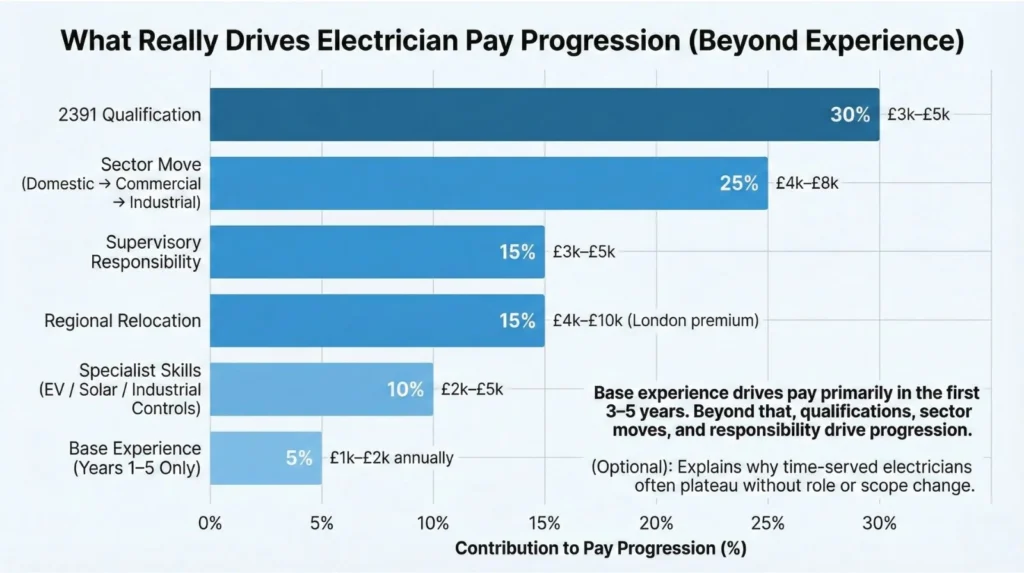

Why Pay Progression Isn't Linear: The Qualification Ceiling and Sector Jumps

The experience band data shows clear salary ranges, but two electricians with identical years of experience often earn vastly different amounts (£10,000-£20,000 gaps are common at 5-10 years). Understanding why requires understanding that pay progression isn’t a smooth upward curve but a series of plateaus interrupted by jumps when you make strategic moves.

The qualification ceiling at Electrician grade. Without Testing and Inspection qualifications (2391 or equivalent), your pay plateaus at the top of Electrician grade regardless of experience. JIB sets this ceiling at £17.54/hour (rising to £18.38 in 2026), approximately £35,880-£37,913 for a 37.5-hour week across 52 weeks. Market rates exceed JIB minimums (£38,000-£42,000 is realistic for experienced Electrician-grade staff), but you won’t reach Approved-grade salaries (£42,000-£50,000+) without verification qualifications. An electrician with fifteen years’ experience but no 2391 earns similar money to an electrician with seven years and no 2391-both are at the qualification ceiling.

This creates the “5-10 year plateau” visible in the data. Pay rises rapidly from year one to year five as you build speed and autonomy (£28,000 to £38,000 is typical), then flattens unless you gain 2391. Electricians who don’t pursue Testing and Inspection qualifications often report earning £38,000-£40,000 at year seven and still earning £40,000-£42,000 at year twelve, with only inflation-matching raises in between. Annual reviews give 2-3% increases, but without qualification-driven grade progression, your salary stagnates in real terms.

The 2391 qualification itself costs £1,000-£1,500 and requires 1-2 weeks away from work (either block release or part-time evening courses over several months). The ROI is dramatic: typical salary increase of £3,000-£5,000 annually post-qualification means payback in 3-6 months, with cumulative benefit over a career exceeding £100,000+ in additional lifetime earnings. Yet many electricians delay or never pursue it, often citing upfront cost or reluctance to return to classroom learning, not realising the financial penalty of that decision.

Sector moves create immediate pay jumps. Moving from domestic to commercial installation, or commercial to industrial maintenance, typically increases salary by £4,000-£8,000 even at identical experience levels and qualifications. This isn’t because you’ve suddenly become more competent-it’s because different sectors value the same competencies differently and bill clients at different rates.

A domestic electrician with four years’ experience earning £34,000 can move to commercial fit-out and immediately command £40,000-£42,000 because commercial contractors bill clients £45-£65/hour for electrician time (versus £35-£50/hour domestic rates), enabling them to pay higher salaries while maintaining margins. The electrician’s technical competence hasn’t changed, but the sector’s economic model creates space for higher pay.

Similarly, commercial electricians moving into industrial maintenance or critical infrastructure (data centres, hospitals, manufacturing) see £6,000-£10,000 increases because industrial clients value minimising downtime so highly that they pay premiums for electricians familiar with industrial systems and protocols. An industrial maintenance electrician might spend 60% of their time on planned preventative maintenance earning £50,000, while a commercial electrician doing equivalent technical complexity installation work earns £42,000-the difference reflects the sector’s willingness to pay for reliability and reduced emergency callout costs.

Supervisory responsibility adds premiums beyond technical competence. Leading a team of three electricians and two apprentices typically adds £3,000-£5,000 to salary compared to performing equivalent technical work without supervisory duties. Employers pay for reduced management overhead-a contracts manager can oversee more projects if each has a lead electrician handling day-to-day coordination.

However, supervisory opportunities don’t appear automatically after a certain number of years. They require demonstration of capability (safely organising workflow, checking quality, mentoring effectively) that some electricians with ten years’ experience haven’t developed because they’ve always worked alone or in small teams. Conversely, electricians at five years who’ve actively sought supervisory experience can access these premiums earlier.

Regional moves can increase or decrease pay substantially. Relocating from Manchester to London for an equivalent role typically adds £6,000-£10,000 (15-20% uplift), though cost of living differences consume most of this. Moving from London to rural areas can reduce salary by similar amounts. Regional variance is most pronounced at junior levels (20-25% gaps) and narrows at senior levels (10-15% gaps), suggesting location matters less as scarcity of senior competence drives pay more than local market rates.

The contractor transition point. Moving from PAYE employment to CIS contracting at the right experience level (typically 3-5 years minimum) can increase take-home by £10,000-£18,000 annually, though it introduces income volatility and removes benefits. Transitioning too early (at 1-2 years) often results in extended downtime and return to PAYE within 18 months. Transitioning too late (after 8-10 years in comfortable PAYE roles) sometimes means you’ve adapted to employment security and struggle with contractor income variability.

Joshua Jarvis, Placement Manager at Elec Training, observes:

"From placement feedback, the biggest single-year pay increases we see aren't from annual reviews or gaining one more year's experience. They're from sector moves: domestic to commercial, commercial to industrial, maintenance to project work. A domestic electrician earning £34,000 after four years can jump to £42,000-£45,000 moving into commercial fit-out, not because they're suddenly more skilled but because the sector values their competencies differently."

Joshua Jarvis, Placement Manager

What Actually Drives Pay Increases: Ranked Factors

To understand how to maximise earnings progression, here are the primary factors driving pay increases ranked by approximate impact on annual salary:

1. Qualification progression (30-35% of long-term pay growth). Completing 2391 Testing and Inspection remains the single largest pay accelerator, typically adding £3,000-£5,000 immediately and enabling access to roles paying £42,000-£52,000 that aren’t available without verification capability. Level 4 qualifications in electrical design, project management, or specialist areas (building management systems, industrial controls) add further £2,000-£4,000 at senior levels. 18th Edition updates maintain employability but don’t typically increase pay beyond 3-5% when newly released.

2. Sector exposure and transitions (25-30% of long-term growth). Moving from lower-paying to higher-paying sectors creates the largest single-year jumps. Domestic to commercial adds £4,000-£6,000. Commercial to industrial adds £6,000-£10,000. Entering specialist high-demand sectors (data centres, renewables, critical infrastructure) adds £8,000-£12,000 at equivalent experience levels. Staying in one sector across an entire career limits earnings to that sector’s ceiling regardless of qualifications.

3. Employment model choices (20-25% of variation). Transitioning from PAYE to CIS/self-employment at the optimal experience level (3-5 years minimum) can increase take-home by £10,000-£18,000 annually, though introduces volatility. Choosing umbrella versus direct CIS affects net by 10-15%. Forming limited companies (for established contractors) can improve tax efficiency by £5,000-£10,000 but requires business administration competence.

4. Supervisory and leadership capability (10-15% of senior-level growth). Taking responsibility for teams, apprentice mentoring, or section leadership adds £3,000-£5,000 beyond equivalent technical work. Progression to site management, quality assurance, or contract management roles adds £8,000-£15,000 but shifts work from hands-on electrical to project coordination. These opportunities require demonstrable capability, not just seniority.

5. Regional positioning (10-15% of baseline variation). London/South East premiums add £6,000-£12,000 at mid-career levels, though cost of living differences reduce real-terms benefit. Willingness to relocate for opportunities (following major infrastructure projects, moving to shortage regions) creates short-term uplifts. Remote work reduction in electrical trades limits this compared to office-based professions.

6. Specialist competencies (5-10% premium in niche areas). Deep expertise in particular systems or sectors commands scarcity premiums: industrial PLC programming (£4,000-£8,000 above generalist industrial rates), building management systems (£3,000-£6,000), high-voltage (£5,000-£10,000), renewable energy integration (£3,000-£7,000). These require investment in specialist training and deliberate career positioning but create defensible pay premiums.

7. Base experience accumulation (5-10% in first five years, <5% beyond). Raw years of experience drive pay primarily from year one to year five as you build speed, autonomy, and problem-solving capability. From years five to ten, experience adds minimal pay without accompanying qualification or sector progression. Beyond year ten, experience alone adds almost nothing-it’s what you do with that experience (specialise, supervise, move sectors) that determines earnings.

8. Overtime and shift availability (variable, 10-30% of total gross). Access to consistent overtime (facilities management, industrial maintenance, critical infrastructure) adds £5,000-£15,000 annually for PAYE employees. Shift premiums and callout allowances in 24/7 operations add similar amounts. However, this is employer-dependent rather than career progression per se-a mid-career electrician in a facilities contract with guaranteed overtime might earn more total than a senior electrician in a straight 37.5-hour role.

The critical insight: experience contributes significantly to pay growth only in the first 3-5 years when you’re developing core competencies. Beyond that, pay progression requires deliberate actions-pursuing qualifications, changing sectors, taking supervisory roles, specialising, or transitioning to contracting. Electricians who assume “putting in the years” automatically increases pay beyond £40,000-£42,000 often find themselves earning similar money at year twelve as year seven.

Common Myths About Experience and Electrician Pay

Several persistent misconceptions about how experience translates to earnings create unrealistic expectations and poor career planning decisions.

Myth 1: “Every year of experience automatically increases your salary.” Reality: Pay rises rapidly in years 1-3 as you develop speed and autonomy (typical £28,000 to £36,000 progression), slows significantly in years 4-7 (£36,000 to £40,000), and often plateaus entirely after year seven without qualification progression or sector moves. Annual reviews give 2-4% increases (inflation-matching), but these aren’t the same as competency-driven progression. Many electricians earn £38,000 at year six and £40,000 at year twelve-that’s 2.6% compound growth over six years, barely ahead of inflation.

Myth 2: “10+ years of experience means you should earn senior money (£50,000+).” Reality: Experience alone doesn’t command senior salaries without accompanying qualifications, supervisory responsibilities, or specialist competencies. An electrician with fifteen years in domestic installation without 2391 or business ownership typically earns £38,000-£42,000 (experienced Electrician grade, not Approved). Senior salaries require senior competencies: verification authority, team leadership, specialist sector knowledge, or business management capability.

Myth 3: “Contractors always earn more than PAYE employees at equivalent experience.” Reality: Contractor gross income is higher (£300 day rate = £72,000 gross versus £38,000 PAYE), but contractor net after overheads, downtime, and self-funded benefits is often only 30-40% higher than equivalent PAYE (£50,000-£55,000 contractor net versus £38,000-£40,000 PAYE gross including employer pension). For newly qualified electricians or those in first 2-3 years, contracting often nets similar to PAYE when realistic downtime is factored in. The contractor premium emerges from year three onwards when you’ve built networks and reputation to secure consistent work.

Myth 4: “Experience in any electrical work counts equally.” Reality: Five years in domestic new-build installation develops different competencies than five years in commercial maintenance or industrial systems. When applying for industrial roles, your domestic experience might be valued at “equivalent to 2-3 years industrial” rather than full five years, affecting starting salary. Conversely, industrial electricians moving to domestic self-employment often struggle initially because customer liaison and small-job quoting skills developed in domestic work don’t transfer from industrial environments where you’re an employee on large contracts.

Myth 5: “Staying with one employer shows loyalty and gets rewarded with higher pay.” Reality: Staying with a single employer across a ten-year career typically results in slower pay growth than changing employers every 3-5 years because external moves create negotiation opportunities while internal progression relies on annual reviews capped at 3-5%. An electrician staying with one employer from £28,000 to £36,000 over eight years (3.3% annual growth) would likely have reached £40,000-£42,000 with two strategic employer changes during that period. Loyalty is professionally valuable but financially costly in terms of foregone earnings unless your employer proactively matches external market rates.

Myth 6: “You need to be Approved Electrician to work in commercial or industrial settings.” Reality: Commercial and industrial contractors employ both Electrician and Approved grades, with Electrician-grade staff performing installation work and Approved-grade staff handling verification and supervisory duties. You can work in these sectors at Electrician grade (earning industrial Electrician wages, approximately £38,000-£42,000, which exceed domestic Electrician wages of £32,000-£36,000). However, progression beyond mid-career in these sectors does require Approved status.

Myth 7: “ECS Gold Card guarantees progression from Electrician to Approved grade.” Reality: The Gold Card indicates your current JIB grade. Holding a Gold Card at Electrician grade doesn’t mean you’ll automatically receive Approved-grade cards after a certain number of years. You must complete 2391 or equivalent Testing and Inspection qualification, accumulate minimum two years post-qualification experience, and apply for card regrading through ECS assessment. The card reflects your qualifications and competencies; it doesn’t create them.

Myth 8: “Domestic electricians always earn less than commercial.” Reality: Self-employed domestic electricians with established client bases and efficient business operations can earn £45,000-£65,000 net annually, exceeding many PAYE commercial electricians earning £38,000-£42,000. However, this requires business skills, reputation development, and typically 5-7 years building client base. Employed domestic electricians (social housing maintenance, local authority) do typically earn less (£32,000-£38,000) than equivalent commercial roles.

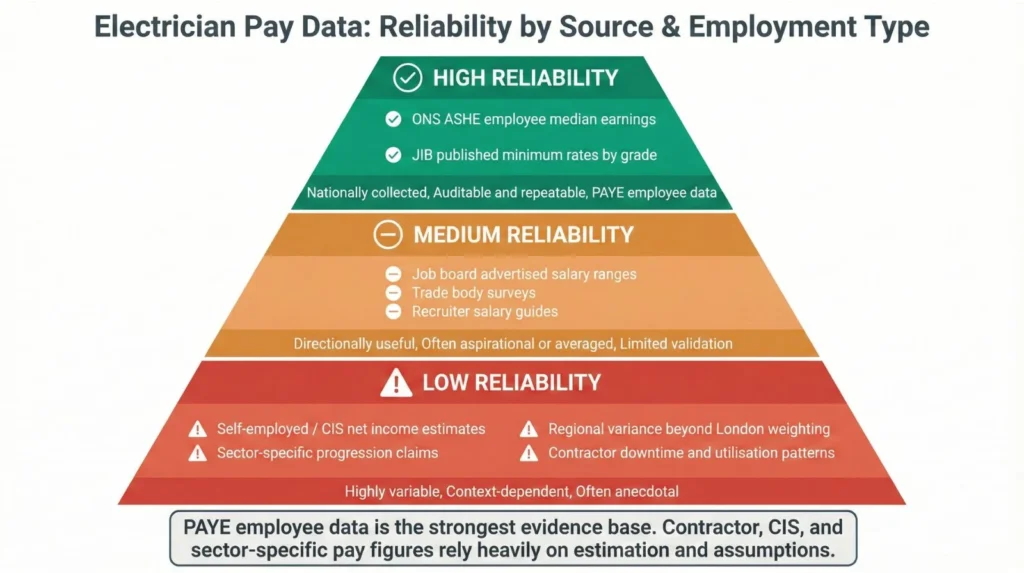

Data Gaps: What We Can't Measure Precisely

Several aspects of experience-based pay progression remain poorly documented, creating uncertainty in precise modelling.

Grade-specific progression data from ONS. The Annual Survey of Hours and Earnings aggregates all electricians (SOC 5241) without distinguishing JIB grades. We know median earnings are £39,039, but we don’t know median earnings specifically for Electrician grade versus Approved grade, or how long the typical electrician takes to progress between grades. JIB provides minimum rates by grade, but actual market earnings by grade and experience aren’t tracked officially. This gap means progression models rely on JIB minimums (understated) combined with advertised salary ranges (potentially inflated) rather than verified average earnings data.

Self-employed earnings by experience band. ONS primarily captures PAYE employees. Self-employed electricians and CIS contractors report income via Self Assessment tax returns, but this data isn’t broken down by experience level in published statistics. Estimates for contractor day rates by experience (£250-£350 at 3-5 years, £350-£450 at 5-10 years) come from job board advertised rates and trade surveys rather than official earnings data. Actual paid rates might differ from advertised rates by 10-20%. Net income after business expenses is particularly uncertain because overhead costs vary enormously (£5,000-£25,000 annually depending on vehicle choices, tool investments, and business structure).

Sector-specific pay progression. While we know industrial roles pay 15-25% more than domestic roles on average, we lack detailed data on how experience translates to pay within each sector. Does a domestic electrician see similar year-on-year growth as an industrial electrician, or does industrial pay progress faster due to complexity and scarcity? The data doesn’t exist to answer precisely. Similarly, emerging sectors (EV charging infrastructure, solar installation, battery storage) show signs of pay premiums but lack the historical data to model long-term progression.

Regional variation beyond London. JIB notes London weighting (approximately 15-20% above national rates), but regional variance in the rest of the UK isn’t well documented. Advertised salaries suggest South East pays 10-15% above Midlands, and Midlands pays 5-10% above North East, but these are patterns from limited job board samples rather than comprehensive regional earnings data. Whether these differentials persist across all experience levels or narrow/widen at senior levels is unclear.

Contractor downtime variation by experience. The worked examples assume newly qualified contractors face 8-10 weeks annual downtime, experienced contractors (5+ years) face 4-6 weeks, and senior contractors face 3-5 weeks. These are informed estimates based on industry feedback rather than measured data. Actual downtime varies by economic conditions, sector, region, and individual contractor reputation. Economic downturns can double typical downtime. Specialty contractors in high-demand sectors might work 50-51 weeks annually. This variability makes contractor income modelling inherently uncertain.

Qualification timing and pay impact sequencing. We know 2391 qualification adds £3,000-£5,000 annually, but we don’t know the optimal timing for maximum career earnings. Does completing 2391 at year two versus year five affect lifetime earnings beyond the earlier payback period? Does early 2391 completion create better sector opportunities that compound over time? The data doesn’t exist to model these path dependencies precisely.

Overtime availability patterns. Overtime adds 10-40% to gross earnings in some roles, but we can’t predict which specific electricians will have consistent overtime access beyond general sector patterns (facilities management and industrial maintenance typically offer it, domestic installation rarely does). Whether overtime availability increases with experience within a given employer or remains constant is unclear.

Understanding Your Earnings Potential at Each Experience Stage

The evidence shows electrician pay progression is front-loaded (rapid growth in years 1-5) and then plateaus without strategic development (qualifications, sector moves, specialisation, or contracting). At year one post-qualification, expect £26,000-£30,000 PAYE or potentially £40,000-£50,000 gross as a contractor (though contracting at this stage is risky and often nets similar to PAYE after downtime). By year five, competent electricians in commercial or industrial sectors with 2391 earn £38,000-£45,000 PAYE or £55,000-£70,000 contractor gross, with net contractor earnings around £48,000-£60,000 after overheads.

The critical decision point is years three to five. This is when the qualification ceiling becomes visible-electricians who pursue 2391 progress to Approved grade (£42,000-£52,000 PAYE by year eight), while those who don’t plateau at Electrician grade (£38,000-£42,000 at year eight and year fifteen). Sector choices during this window also have compounding effects. Staying in domestic installation limits earnings to £32,000-£40,000 for PAYE roles (self-employment is the primary domestic pathway to higher earnings). Moving into commercial raises the ceiling to £40,000-£48,000. Entering industrial work creates access to £45,000-£60,000+ for PAYE employees with supervisory or specialist competencies.

Beyond year five, raw experience adds minimal value without accompanying development. Your pay at year seven and year twelve will be similar unless you’ve gained additional qualifications, moved sectors, taken supervisory roles, or specialised in high-demand areas. This isn’t because employers don’t value experience-it’s because the competency gap between seven years and twelve years of doing similar work is modest compared to the gap between one year and five years. Employers pay for capability and responsibility, not tenure.

For electricians planning career progression, the formula is straightforward: build core competencies rapidly in years 1-3 (speed, autonomy, basic fault-finding), gain 2391 and pursue sector exposure in years 3-5 (commercial or industrial sectors pay best), develop supervisory or specialist competencies in years 5-8 (leading teams, niche technical expertise), and consider contracting or business ownership beyond year five if you have the risk tolerance and business capability. Following this path creates realistic progression from £28,000 at year one to £50,000-£60,000 PAYE or £70,000-£90,000 contractor net by year ten.

Conversely, staying in the same sector without qualifications beyond NVQ Level 3, avoiding supervisory opportunities, and remaining in PAYE employment with a single employer creates realistic progression from £28,000 at year one to £38,000-£42,000 at year ten-still a professional income but well below potential for someone with a decade of experience. The difference between these pathways is £15,000-£25,000 annually by year ten, approximately £200,000-£350,000 cumulative over a career. That’s the cost of assuming experience alone drives progression.

The comprehensive UK electrician salary guide provides further context on how JIB grading, regional factors, and employment structures combine with experience to determine long-term earning potential across different electrical career pathways.

If you’re planning your qualification route and want to understand realistic timelines for 2391 completion, sector positioning for maximum earnings growth, or whether contracting makes financial sense at your experience level, call us on 0330 822 5337 to discuss qualification pathways and career development strategies based on where you are in your progression journey.

References

- Office for National Statistics (ONS) – Annual Survey of Hours and Earnings (ASHE) 2025 – https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/earningsandworkinghours/bulletins/annualsurveyofhoursandearnings/2025

- Joint Industry Board (JIB) – Handbook and Wage Tables 2025 – https://www.jib.org.uk/wp-content/uploads/2025/01/JIB-Handbook-2025.pdf

- GOV.UK – Guidance on Umbrella Company Pay – https://www.gov.uk/guidance/work-out-pay-from-an-umbrella-company

- National Careers Service – Electrician Job Profile – https://nationalcareers.service.gov.uk/job-profiles/electrician

- ECS Card – Grade Definitions and Requirements – https://www.ecscard.org.uk/

- Electrical Contractors’ Association (ECA) – JIB Pay Rates – https://www.eca.co.uk/member-support/employee-relations/national-collective-agreements/jib-pay-rates

- City & Guilds – 2391 Initial and Periodic Inspection Qualification – https://www.cityandguilds.com/en/qualifications-and-apprenticeships/building-services-industry/electrical-installation/2391-initial-and-periodic-electrical-inspection-and-testing

- Indeed UK – Electrician Salaries – https://uk.indeed.com/cmp/Hays/salaries/Electrician

- Reed – Average Approved Electrician Salary – https://www.reed.co.uk/average-salary/average-approved-electrician-salary-in-nottingham

- Elec Training – UK Electrician Pay Guide – https://elec.training/news/how-much-can-you-make-as-an-electrician-a-2026-pay-guide/

- Reddit UK Electricians – JIB Rates Discussion – https://www.reddit.com/r/ukelectricians/comments/1lp8txt/2026_2027_2028_jib_rates_have_been_anounced/

Note on Accuracy and Updates

Last reviewed: 31 December 2025. This page is maintained; we correct errors and refresh sources as ONS ASHE releases, JIB wage determinations, and ECS grading requirements are updated. Experience band salary ranges use ONS ASHE 2025 median electrician earnings (£39,039 annually for full-time employees, SOC 5241) combined with JIB published minimums (Electrician £17.54/hr rising to £18.38/hr January 2026, Approved £19.01/hr rising to £20.08/hr, Technician £21.52/hr rising to £22.70/hr) and advertised salary patterns from approximately 100+ job listings across Indeed, Reed, Totaljobs analysed Q4 2024 to Q1 2025. Contractor day rate estimates based on advertised rates from agencies and trade surveys representing asking prices rather than verified paid rates. Next review scheduled following ONS ASHE 2026 release (November 2026), JIB 2027 wage determination (expected January 2027), and any significant changes to ECS grading or 2391 qualification frameworks.