Self-Employed Electrician Earnings vs Employed Earnings: What You Actually Take Home

- Technical review: Thomas Jevons (Head of Training, 20+ years)

- Employability review: Joshua Jarvis (Placement Manager)

- Editorial review: Jessica Gilbert (Marketing Editorial Team)

- Last reviewed:

- Changes: Initial publication comparing PAYE versus self-employed electrician net earnings using ONS ASHE 2025 data, JIB 2025 rates, and self-employment cost analysis

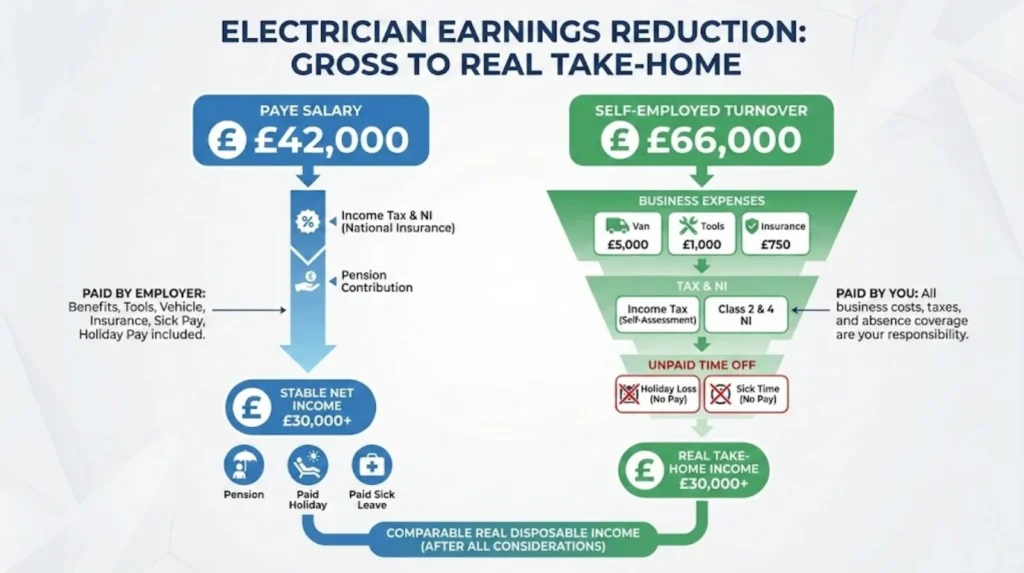

The conversation about electrician salary in the UK splits into two camps almost immediately. PAYE electricians quote annual salaries of £35,000-£45,000 and talk about stability, paid holidays, and employer pensions. Self-employed electricians mention day rates of £250-£350 and calculate annual earnings north of £60,000. On paper, self-employment appears to offer substantially higher income. In practice, once you account for the cost stack that employed electricians never see (van, fuel, tools, insurance, unpaid holidays, sick time, business admin, tax compliance), the gap between the two models narrows considerably, and in some scenarios disappears entirely.

This isn’t about which employment structure is “better.” It’s about understanding what you actually take home after all deductions, costs, and risks are accounted for. The headline gap between a £20 per hour PAYE rate and a £300 per day self-employed rate looks substantial until you realise the PAYE worker receives 5.6 weeks of paid holiday worth approximately £3,000 annually, employer pension contributions adding another £1,200-£2,000, and has zero business overhead costs. The self-employed electrician earning £66,000 gross (220 working days at £300) will spend £10,000-£20,000 on van, tools, insurance, training, accountancy, and unpaid leave provision before paying tax, reducing net income to a range that frequently overlaps with senior PAYE positions.

The trade-off is stability and benefits versus earning potential and autonomy. Neither model consistently delivers higher net income across all scenarios. Regional variations, sector specialisation, career stage, risk tolerance, and business management skills all determine whether PAYE or self-employment produces better financial outcomes in individual circumstances. Understanding the real numbers, not advertised rates or forum brag figures, helps electricians make informed decisions about employment structure rather than chasing headline figures that don’t reflect take-home reality.

What Employment Structure Actually Means

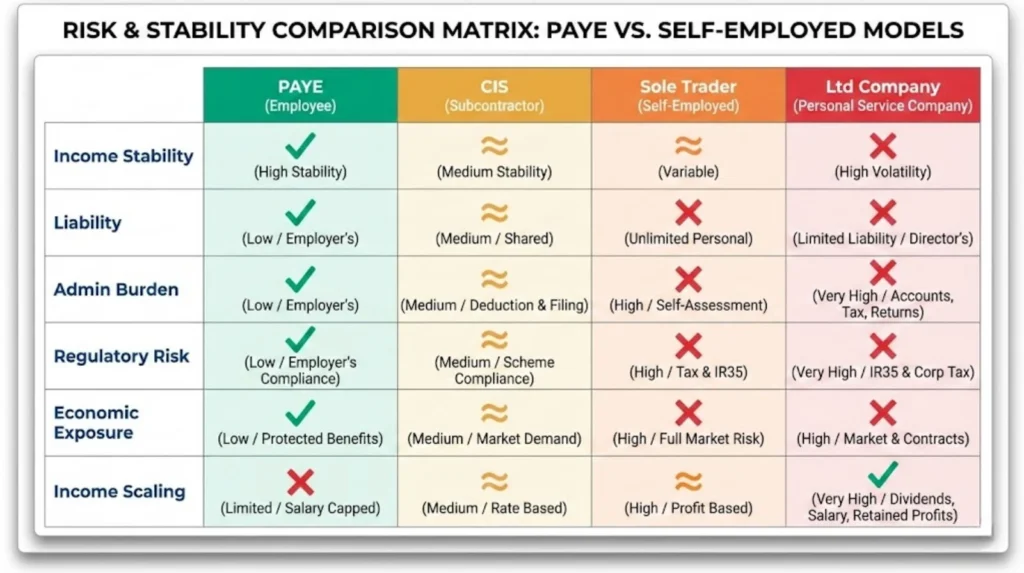

Before comparing earnings, you need to understand what fundamentally differs between PAYE employment and the various self-employment structures electricians use. These aren’t just different tax classifications. They represent different risk allocations, benefit structures, and financial responsibilities.

PAYE employment means you’re an employee of a company, working under an employment contract with statutory protections. Tax and National Insurance are deducted at source through Pay As You Earn. You receive 5.6 weeks of paid annual leave (28 days including bank holidays), statutory sick pay after the first three days of illness, and auto-enrolment pension contributions (minimum 3% from employer, 5% from employee on qualifying earnings). Many JIB-aligned employers provide enhanced benefits including sick pay from week two at £190-£210 per week, death in service insurance, and structured pay progression through Electrician, Approved Electrician, and Technician grades. The employer provides or reimburses tools, vehicles, fuel, insurance, and training costs. Working hours are typically defined (37.5-39 hours standard, with overtime paid at 1.5x or 2.0x multipliers), and the employer assumes liability for defects in your work provided you followed specifications and worked competently.

CIS subcontractor means you’re self-employed but working within the Construction Industry Scheme, common for electricians on commercial and industrial sites subcontracting to main contractors. You register with HMRC for CIS status, and contractors deduct 20% tax at source from your payments (30% if you’re not registered). These deductions are credited against your final tax bill when you complete self-assessment, so you reclaim overpayments if your actual tax liability is lower. You provide your own hand tools, PPE, and often transport (though this varies by contract). Holiday pay, sick pay, and pension contributions don’t exist unless you self-fund them. You’re liable for your own public liability insurance (typically £1 million to £5 million cover costing £300-£1,500 annually). Payments are for labour only, with materials handled separately depending on contract terms.

Sole trader (domestic/service) means you’re self-employed operating directly with domestic or commercial clients without creating a separate legal entity. You register for self-assessment with HMRC, invoice clients directly, and handle all business administration personally. You’re personally liable for business debts and any claims against your work. Income is variable and depends entirely on your ability to generate leads, convert quotes to jobs, and maintain client relationships. All business costs (van, tools, insurance, training, accountancy, marketing) come from turnover before you calculate profit. There’s no distinction between you and the business for legal purposes, meaning personal assets are at risk if the business fails or faces legal action.

Limited company director means you’ve created a private limited company registered with Companies House, with you as director and typically sole shareholder. The company is a separate legal entity, providing limited liability (you’re only liable up to the value of your shares, protecting personal assets). This structure allows you to pay yourself a small salary (often £12,570 annually to use the personal tax allowance) and take the rest as dividends taxed at lower rates (8.75% for basic rate taxpayers in 2025/26). However, it adds complexity: you need to file annual accounts with Companies House, maintain proper records, potentially register for VAT if turnover exceeds £90,000, and navigate IR35 rules if working through agencies or for single clients long-term, which can deem you a “disguised employee” and remove tax advantages.

Umbrella worker means you work through an agency that places you with clients, but instead of being paid directly, you’re employed by an umbrella company that acts as your legal employer. You’re treated as a PAYE employee of the umbrella company for tax purposes, with tax and National Insurance deducted at source. However, umbrella companies charge fees (typically £15-£30 per week or 5-10% of gross), and crucially, you pay both employee and employer National Insurance contributions, which are deducted from your gross rate before you receive it. Holiday pay is often “accrued” from your rate rather than being additional. While advertised umbrella rates might be £280 per day, actual take-home after umbrella fees, both sets of NI, and tax can be £210-£230, making it comparable to or worse than direct PAYE employment despite higher headline figures.

The critical distinction across all models is what counts as “earnings.” For PAYE employees, earnings mean gross salary plus the value of benefits (pension contributions, paid holidays, employer NI, sick pay). For self-employed workers, you must distinguish between turnover (total money invoiced), gross profit (turnover minus materials if you supply them), net profit (gross profit minus all business expenses like van, tools, insurance), and actual earnings (net profit minus tax and National Insurance, and ideally minus provision for unpaid holidays and sick time). A self-employed electrician with £70,000 turnover doesn’t earn £70,000. They might net £40,000-£45,000 after costs and tax, which is the figure to compare against a £42,000 PAYE salary.

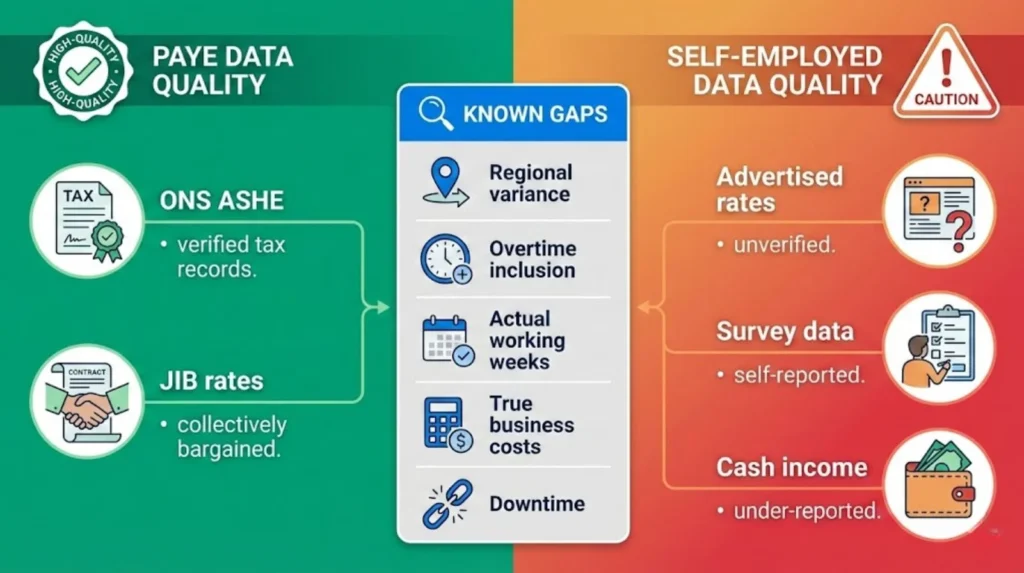

What the Actual Data Shows

Understanding baseline earnings requires separating verified official statistics from advertised rates and market signals, which often exaggerate or reflect best-case scenarios rather than typical outcomes.

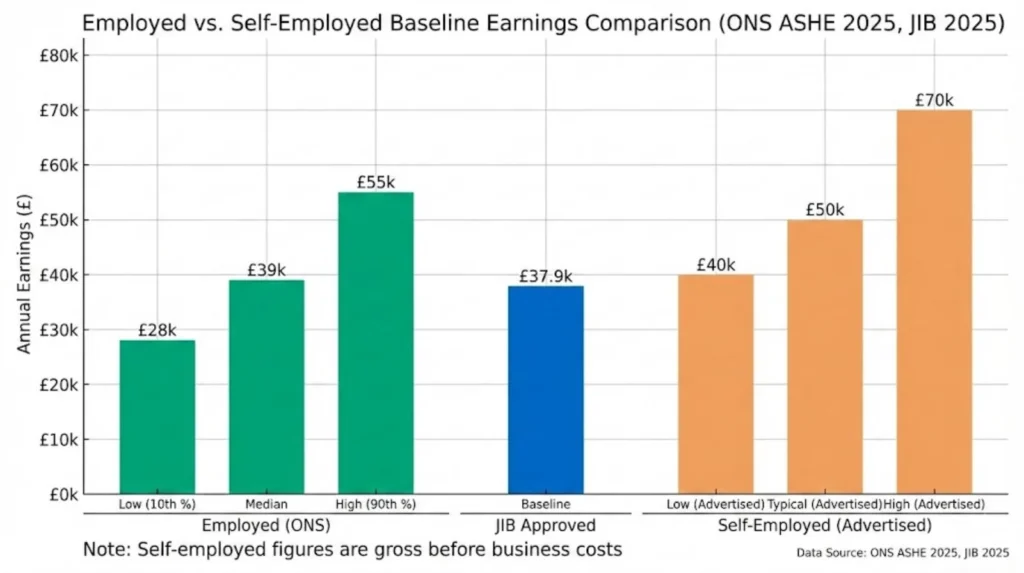

Employed electrician earnings (ONS ASHE 2025). The Office for National Statistics Annual Survey of Hours and Earnings provides the most reliable data on actual employee pay, derived from HMRC tax records. The 2025 ASHE data shows median gross annual earnings for full-time employed electricians at £39,039. The 10th percentile (lower earners) sits around £28,000 annually, while the 90th percentile (higher earners) reaches approximately £55,000. Hourly rates for employed electricians average £18-£25 nationally, rising to £22-£30 in London for JIB-aligned roles. The JIB 2025 national rate for Approved Electrician grade is £19.44 per hour, equivalent to approximately £37,918 for a 37.5-hour week before overtime. London JIB rates add a 10-20% premium depending on grade and zone.

These are actual paid rates, not advertised rates. They represent what electricians in employment genuinely earned in 2025 according to tax records, making them high-quality baseline figures. The range reflects experience, sector (industrial and commercial typically pay more than domestic service companies), region (London and South East highest, Wales and North East lowest), and whether overtime is regularly available.

Self-employed electrician earnings (survey and advertised data). Reliable data on self-employed electrician income is substantially weaker. ONS self-employment income statistics are known to under-report actual earnings due to cash payments not declared for tax purposes and the complexity of separating business turnover from personal income. Survey data and recruiter advertisements suggest self-employed electricians report average net profits of £40,000-£60,000 annually, but this is based on self-reported figures with no tax verification and likely skewed toward higher earners willing to discuss income publicly.

Advertised day rates for CIS subcontractors and agency workers range from £245 to £350 gross, with most commercial and industrial roles clustering around £280-£320. Domestic self-employed electricians quote hourly rates of £40-£60 for service work and first-hour call-outs of £80-£120, though actual billable hours per week are typically lower than employed electricians due to travel, quoting, and administrative time. These figures are market signals showing what work is advertised at, not verified incomes. Recruiter data from Reed, Indeed, and Hays consistently shows higher figures than ONS verified data, suggesting advertised rates exceed realised earnings in many cases.

The quality gap. ONS ASHE data represents verified employee earnings from tax records. Self-employed income data relies on surveys, self-reporting, and advertised rates, none of which are independently verified. The best available evidence suggests median employed earnings of £39,000 are reliable, while self-employed figures claiming £50,000-£60,000 net profit should be treated as indicative rather than definitive. Regional variations are substantial: London and South East self-employed day rates of £320-£400 contrast with Northern regions at £220-£280, creating 30-40% geographic variance that distorts national averages.

JIB rates provide regulatory minimums for unionised employers but don’t capture the full market. Many smaller electrical contractors pay above JIB rates to attract skilled workers, while others pay below. The gap between JIB minimums (£19.44/hour Approved) and ONS median (approximately £18.76/hour across all grades and employers) suggests JIB rates sit slightly above the true median, likely because JIB-aligned firms tend to be larger, more established contractors with better pay structures than smaller domestic companies.

The detailed comparison of PAYE versus self-employed electrician income requires adjusting for benefits in PAYE roles and costs in self-employed structures, neither of which are captured in headline rate comparisons.

The Cost Stack Most Employed Electricians Never See

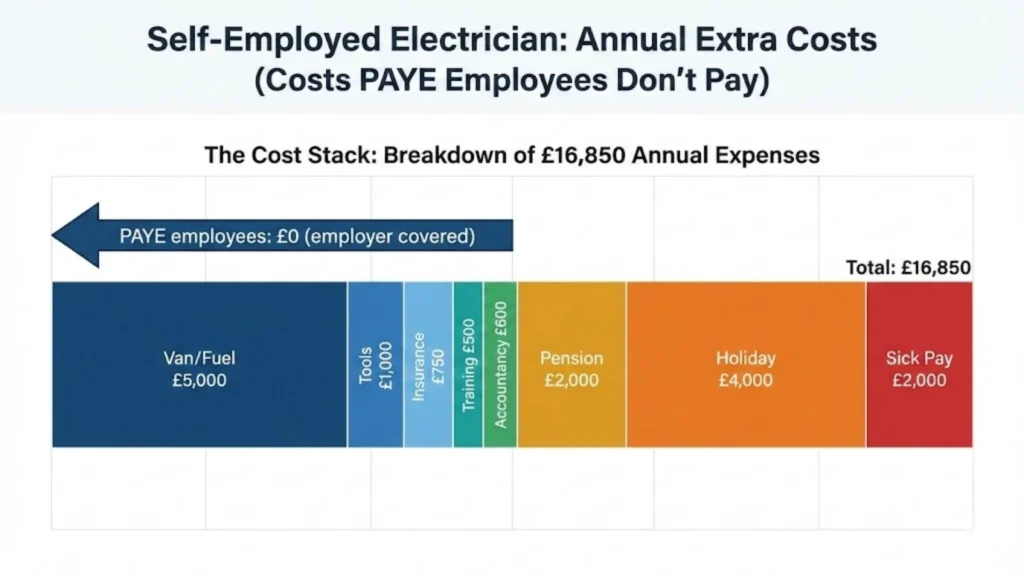

PAYE electricians have business costs covered by their employer. Self-employed electricians fund these personally from turnover before calculating profit. Understanding this cost stack explains why gross self-employed earnings of £60,000-£70,000 often net down to figures comparable with £40,000-£45,000 PAYE salaries.

Van, fuel, and vehicle costs. Employed electricians typically have a company van provided, with fuel either covered or reimbursed through mileage allowances. Self-employed electricians buy, lease, insure, maintain, tax, and fuel their own vehicles. A basic work van costs £12,000-£18,000 to purchase outright or £200-£350 per month on lease. Commercial van insurance runs £800-£1,500 annually depending on location and claims history. Road tax is £290-£355. Servicing, MOT, tyres, and repairs average £800-£1,200 annually. Fuel for 10,000-15,000 business miles costs £1,500-£2,500 annually at current diesel prices. Total annual van costs: £4,000-£6,000 at the mid-range, with £3,000 at the lower end for older vehicles and £8,500 at the high end for newer leased vans with comprehensive cover.

Tools, equipment, and calibration. Employed electricians use company-provided test equipment, power tools, and specialist kit. Self-employed electricians buy and maintain their own. A multifunction tester (essential for EICR and installation testing) costs £400-£800 for reliable models like Megger or Kewtech. Annual calibration to maintain accuracy and insurance validity costs £150-£200. Hand tools (screwdrivers, pliers, cutters, strippers, spanners) run £300-£500 for a decent starting set, with replacements and additions averaging £200-£400 annually. Power tools (drills, grinders, saws) cost £500-£1,000 initially, with replacements adding £200-£400 annually. PPE (hard hats, safety boots, hi-vis, gloves) costs £150-£300 annually. Consumables (cable strippers, drill bits, saw blades, fixings) add another £200-£400. Total annual tool and equipment costs: £1,000-£2,000 after initial setup year.

Public liability and professional indemnity insurance. Employers carry public liability and employer’s liability insurance covering their workforce. Self-employed electricians need personal public liability insurance (typically £1 million to £5 million cover) costing £300-£600 annually for domestic work, rising to £800-£1,500 for commercial and industrial contracts requiring higher cover limits. Professional indemnity insurance (covering errors and omissions in design or advice) adds £200-£400 annually. Some schemes combine both for £500-£1,200 depending on turnover and risk profile.

Training, certifications, and renewals. JIB employers typically fund continued professional development, sending electricians on specialist courses. Self-employed electricians pay for training personally while also losing income during course attendance. ECS card renewal costs £36-£108 every five years depending on card type. 18th Edition BS 7671 update courses cost £200-£400 every five years, though the cost is spread across years (approximately £40-£80 annually pro-rated). Specialist qualifications like COMPEX (explosive atmospheres), EV charging installation, or solar PV add-ons cost £800-£2,000 per course. Even assuming minimal specialist training, annual training and certification costs average £300-£600 for self-employed electricians, compared to zero for employed workers whose companies sponsor development.

Accountancy fees and business software. Self-employed electricians need accountancy support for self-assessment tax returns (sole traders) or company accounts (limited companies). Accountancy fees range from £300 for basic self-assessment to £1,200+ for limited company annual accounts, corporation tax, and payroll. Invoicing and bookkeeping software (QuickBooks, Xero, FreshBooks) costs £10-£30 per month (£120-£360 annually). Total admin and accountancy: £500-£1,500 annually.

Pension contributions. PAYE electricians receive automatic employer pension contributions (minimum 3% of qualifying earnings, typically £1,000-£2,000 annually). Self-employed electricians fund pensions entirely from their own net profit if they choose to save. To match the employer contribution an employed electrician receives automatically, a self-employed worker would need to set aside £1,500-£3,000 annually, though many don’t, leaving them without retirement provision.

Holiday and sick time provision. This is the largest hidden cost. PAYE electricians receive 5.6 weeks of paid annual leave plus bank holidays, worth approximately £3,000-£4,000 annually based on median earnings. Self-employed electricians taking 4-5 weeks off per year lose that income entirely unless they’ve built it into their rates. At £300 per day, five weeks unpaid leave (25 working days) represents £7,500 of lost gross income. Even after deducting business costs and tax from that figure, the net holiday provision is £3,500-£5,000. Sick time is similar: PAYE workers receive statutory sick pay (£116.75 per week in 2025/26 after the first three days, with JIB-enhanced schemes paying £190-£210 from week two). Self-employed electricians lose income entirely when sick, with 2-4 weeks of illness or injury costing £2,000-£4,000 in lost net earnings annually.

Bad debts and cancellations (domestic only). Domestic self-employed electricians face clients who don’t pay, cancel jobs after quotes are prepared, or dispute invoices. Industry estimates suggest 5-10% of turnover is uncollected or written off, costing £500-£2,000 annually depending on volume. PAYE electricians never face this risk; they’re paid regardless of whether clients pay the employer.

Total annual cost stack. Adding mid-range estimates: van £5,000, tools £1,000, insurance £750, training £500, accountancy £600, pension £2,000, holiday provision £4,000, sick provision £2,000, bad debts £1,000. Total: £16,850 per year. Low-end scenarios (older van, minimal training, no pension saving) might reduce this to £10,000. High-end scenarios (new leased van, specialist training, full pension matching) can exceed £25,000. None of these costs apply to PAYE employed electricians, whose employers absorb them.

What Self-Employment Actually Nets After Costs

Understanding net take-home requires working through realistic scenarios that account for costs, tax, and unpaid time. These examples use 2025 tax rules and mid-range cost assumptions, avoiding heavy mathematical detail while showing how gross figures translate to net reality.

Scenario A: JIB PAYE Approved Electrician with modest overtime. Base hourly rate of £20 per hour (slightly above 2025 JIB minimum to reflect market reality). Standard 37.5-hour week equals £39,000 gross annually. Add 10% overtime at 1.5x multiplier (approximately £3,900 additional gross). Total gross salary: £42,900. Employer pension contribution (3% of qualifying earnings): approximately £1,170. Effective value including pension: £44,070. After income tax and employee National Insurance (approximately £7,500), net take-home is around £35,400. However, this doesn’t account for the value of 5.6 weeks paid holiday (worth £3,000-£3,500 in gross terms), sick pay provision, employer NI contributions (13.8% on top of salary, worth approximately £5,900 to the employer but not directly received by the employee), or the £1,170 pension already noted. The total package value to the employee is approximately £44,000-£45,000 when benefits are included, with £35,400 cash take-home.

Scenario B: CIS subcontractor at £300 per day. Gross day rate £300, working 220 days per year (accounting for 4-5 weeks unpaid holiday, 2 weeks downtime/gaps between contracts, bank holidays). Gross turnover: £66,000. CIS deduction at 20%: £13,200 (deducted at source but reclaimable if tax liability is lower). Business costs (van, tools, insurance, training, accountancy): £8,500. Adjusted gross after costs: £44,300. Income tax and National Insurance on £44,300 profit after allowances: approximately £8,200. Net profit after tax: £36,100. However, this hasn’t accounted for holiday or sick provision. Setting aside £3,500 for unpaid holiday weeks and £2,000 for potential sick time: £30,600 actual spendable income. The CIS deduction of £13,200 will be partially refunded via self-assessment (likely £4,000-£5,000 refund depending on allowable expenses), bringing actual net to approximately £34,600-£35,600 after accounting for all costs and tax.

Scenario C: Domestic sole trader at higher rates. Working 35 billable hours per week at £50 per hour for domestic service and installation work. Theoretical turnover: £91,000 annually (35 hours x 52 weeks x £50). However, 10-15 hours per week are spent on quoting, invoicing, chasing payments, materials sourcing, and travel, leaving approximately 25-30 actual billable hours. Adjust turnover down 20% for non-billable time and no-shows: £72,800 effective turnover. Business costs (including marketing, higher insurance for public-facing work, consumables): £12,000. Net profit: £60,800. Income tax and Class 2/4 National Insurance: approximately £13,500. Net after tax: £47,300. Deduct £4,000 holiday provision and £2,000 sick provision: £41,300 actual spendable income. This scenario requires consistent client flow, strong reputation, and effective marketing, which isn’t guaranteed in early self-employment years.

Scenario D: Limited company director. Company turnover £70,000. Director draws salary of £12,570 (personal tax allowance, no income tax or NI). Remaining profit after business costs (£15,000) and salary: £42,430. Corporation tax at 25% (2025/26 rate for profits over £50,000): approximately £6,200. Distributable profit: £36,230. Director takes this as dividends taxed at 8.75% (basic rate): approximately £3,170 dividend tax. Net income: £12,570 (salary) + £33,060 (post-dividend-tax) = £45,630. However, this structure requires accountancy fees of £1,000-£1,500, Companies House filings, and potential IR35 risk if working through agencies. It offers the highest net income when successful but adds significant administrative complexity and compliance risk.

The scenarios show employed net around £35,400 cash (£44,000 total package value), CIS net around £34,600-£35,600, sole trader net around £41,300 if client flow is consistent, and limited company director net around £45,600 if structured efficiently and compliant. The gap between PAYE and self-employment is far smaller than gross figures suggest, and PAYE provides stability and benefits that self-employment doesn’t.

Joshua Jarvis, Placement Manager at Elec Training, notes

"From our network feedback, newly self-employed electricians often experience 4-8 weeks of low or zero income in their first year while building client bases and reputations. Even established self-employed sparks report 2-4 weeks annually between contracts or during seasonal slowdowns. That's income volatility PAYE workers never face, and it needs to be factored into annual earnings comparisons."

Joshua Jarvis, Placement Manager

Risk, Volatility, and What Stability Actually Costs

Financial comparisons focus on annual totals, but day-to-day reality for self-employed electricians involves cashflow volatility, unpaid administrative burden, and risk exposure that PAYE workers never face.

Income stability and monthly predictability. PAYE electricians receive fixed monthly salaries on predictable dates. A £42,000 annual salary means £3,500 gross deposited monthly, with tax and NI deducted automatically. Budgeting, mortgage applications, and financial planning are straightforward because income is guaranteed regardless of market conditions, seasonal slowdowns, or client payment behaviour. Self-employed income fluctuates substantially. A CIS subcontractor might earn £6,000 in February when a large commercial project is running, then £1,500 in March when that contract ends and the next one doesn’t start for three weeks. Domestic sole traders report earning £8,000-£10,000 in busy summer months, then £2,000-£4,000 in January and February when homeowners defer spending after Christmas. Averaging to £50,000 annually doesn’t change the fact that some months require drawing on savings to cover fixed costs like van payments, insurance, and household bills.

Liability and professional risk. PAYE employed electricians work under their employer’s insurance and liability coverage. If work is found to be defective or non-compliant with BS 7671, the employer faces the legal and financial consequences provided the electrician followed company procedures and worked competently. Self-employed electricians carry personal liability (sole traders) or company liability (limited companies). A serious electrical fault causing fire or injury can result in prosecution under the Electricity at Work Regulations 1989 or Building Regulations, with fines, legal costs, and insurance claims running to tens of thousands of pounds. Public liability insurance covers claims, but premiums increase after claims, and gross negligence can void cover. This risk is real and ongoing.

Administrative burden and unpaid time. PAYE electricians arrive at work, complete assigned tasks, and leave. Quoting, invoicing, client communication, scheduling, materials procurement, and tax compliance are handled by office staff or management. Self-employed electricians spend 8-12 hours per week on business administration that generates zero revenue: preparing quotes (which convert to jobs only 30-50% of the time), invoicing completed work, chasing late payments, managing supplier accounts, ordering materials, updating insurance and certifications, maintaining vehicle and equipment, filing tax returns, and communicating with accountants. A 50-hour working week might include only 35-40 billable hours, with 10-15 hours unpaid admin. This invisible time erodes the effective hourly rate substantially.

IR35 and compliance exposure. Self-employed electricians working through agencies, umbrella companies, or long-term for single clients face IR35 scrutiny. HMRC’s off-payroll working rules (IR35) determine whether you’re genuinely self-employed or a “disguised employee” who should be paying employee tax and NI. If caught inside IR35, you lose self-employment tax advantages retroactively, facing large back-tax bills plus penalties. CIS workers face regular HMRC verification checks, with incorrect status declarations resulting in fines. Limited company directors face Companies House filing deadlines, late filing penalties (£150+ for missed deadlines), and corporation tax compliance. PAYE workers face none of these regulatory risks; their employer handles all compliance.

Exposure to economic downturns and sector slowdowns. PAYE electricians have redundancy protections (statutory redundancy pay, notice periods, potential tribunal claims for unfair dismissal). Self-employed electricians have zero safety net. When construction slows during recessions, CIS contracts dry up first. When consumer spending drops, domestic service work declines. During the 2008-2009 recession, self-employed construction workers saw income drops of 30-50%, while employed workers faced redundancy but with notice periods, redundancy payments, and unemployment benefits providing some buffer. Self-employment offers no such cushion.

Ability to scale income versus hours. The counter-argument for self-employment risk is upside potential. PAYE electricians are capped by hourly rates and available overtime. Self-employed electricians can theoretically scale income by raising rates, taking more work, or (for limited company directors) hiring employees to multiply capacity. In practice, scaling requires strong business skills, established reputation, and financial reserves to hire and manage staff. Most self-employed electricians remain sole operators, meaning income scales linearly with hours worked. The ceiling is higher than PAYE, but reaching it requires skills beyond electrical competence.

Career Stage Reality: When Each Model Makes Sense

No employment structure is universally superior. Suitability depends heavily on career stage, skills beyond technical competence, and personal circumstances.

Newly qualified electricians (NVQ Level 3, recently completed AM2). PAYE employment strongly favours early career electricians. Reasons: you’re building speed and competence, making mistakes that would cost money if you were funding rework personally. Employers provide exposure to varied work types (commercial, industrial, domestic), mentorship from experienced electricians, and structured training that develops skills faster than working alone. Starting salaries of £26,000-£32,000 might seem low compared to advertised self-employed day rates of £250-£300, but newly qualified electricians rarely secure consistent contracts at those rates. Lacking reputation, portfolio, and speed developed through repetition, early self-employment often results in lower actual income due to gaps between jobs, slower work pace, and errors requiring unpaid correction time. The financial stability of PAYE allows learning without income volatility.

Approved Electricians and Technicians (5+ years experience, strong technical competence). This stage offers genuine choice. PAYE roles at JIB Approved or Technician grades earn £37,000-£48,000 including overtime and benefits, with stability and predictable progression. Self-employment (CIS or sole trader) becomes viable because you have reputation, speed, and judgment to work independently. Day rates of £280-£350 on commercial contracts or domestic rates of £45-£60 per hour can net £40,000-£50,000 after costs if you manage business aspects competently. The decision depends on risk tolerance: PAYE offers security and capped upside, self-employment offers variability and higher potential. Many electricians at this stage move between models, doing CIS contract work during boom periods and returning to PAYE during slowdowns.

Domestic-focused electricians with established client bases. Self-employment (sole trader or limited company) can substantially outperform PAYE for electricians who’ve built strong reputations in local areas, generate consistent leads through word-of-mouth and online reviews, and have developed quoting accuracy to avoid underpricing jobs. Domestic self-employed electricians working 35-40 billable hours weekly at £50-£60 per hour can net £40,000-£55,000 annually. However, this requires 2-3 years building the client base, tolerating income volatility while establishing reputation, and developing customer service and sales skills that technical training doesn’t teach. Jumping into domestic self-employment immediately after qualification frequently fails due to lack of leads and business skills.

Commercial and industrial site electricians. CIS subcontracting suits experienced electricians working large commercial or industrial projects where day rates of £300-£400 are genuine and contracts run for months providing income stability. The gross income advantage over PAYE (£66,000-£88,000 gross on day rates versus £42,000-£50,000 PAYE) narrows after costs to approximately £45,000-£60,000 net for CIS versus £35,000-£42,000 net for PAYE, but the gap is still significant. The trade-off is employment security: when projects complete, there’s no guarantee the next contract starts immediately. PAYE site electricians working for main contractors have more stable income, especially during economic uncertainty.

Specialists in high-demand niches (EV charging, solar PV, controls, COMPEX). Limited company structures can maximise earnings for electricians with specialist qualifications commanding premium rates. EV installation specialists charging £800-£1,200 per domestic charger installation, solar PV electricians earning £150-£200 per day on commercial arrays, or COMPEX-certified electricians working hazardous areas at £350-£450 day rates can net £50,000-£70,000+ through limited companies with efficient tax structuring. However, these specialisms require upfront training investment (£1,000-£3,000 per qualification), ongoing CPD to maintain certifications, and often higher insurance premiums. They’re viable only after establishing core electrical competence and financial reserves to fund training while income pauses.

Pre-retirement electricians (55+). PAYE employment offers substantial advantages approaching retirement. Employer pension contributions continue building retirement funds, death-in-service insurance provides family protection, and reduced physical demands (delegating heavy lifting to younger colleagues, moving into supervisory or inspection roles) extend working life. Self-employment requires full physical capability, offers no death-in-service cover, and provides no automatic pension accumulation unless self-funded. Many electricians move from self-employment back to PAYE in their 50s specifically for pension and insurance benefits in final working years.

Thomas Jevons, Head of Training with 20+ years on the tools, explains:

"The financial pressure to maximise billable days in self-employment can create incentives to rush testing procedures or skip proper documentation. Regulation 610.1 requires verification regardless of your employment status. The difference is that PAYE electricians are paid for the time proper testing takes, while self-employed workers might be tempted to cut corners to move to the next job faster. That's a compliance risk."

Thomas Jevons, Head of Training

Myths About Self-Employment Versus Employment

Several widely repeated claims about electrician earnings don’t survive scrutiny when costs, risks, and benefits are properly accounted for.

Myth: “Self-employed electricians always earn more than PAYE.” This assumes gross equals net and ignores costs. Supporting evidence: advertised day rates of £250-£350 suggest gross incomes of £55,000-£77,000, substantially higher than ONS median PAYE of £39,000. Contradicting evidence: after deducting business costs of £10,000-£20,000 annually and accounting for unpaid holidays and downtime, net self-employed income in the worked scenarios ranges from £34,600 (CIS) to £45,600 (limited company), overlapping substantially with PAYE ranges of £35,400-£42,000 when benefits are included. Verdict: false. Self-employment can net more, but it depends entirely on consistent workload, low costs, and effective business management. Many self-employed electricians earn comparable or lower net incomes than senior PAYE roles.

Myth: “PAYE electricians are badly paid.” This conflates base hourly rates with total package value. Supporting evidence: JIB base rate of £19.44/hour and headline day rates of £300+ make PAYE appear inferior. Contradicting evidence: PAYE salaries include employer pension contributions worth £1,000-£2,000, paid holidays worth £3,000-£4,000, sick pay, and employer National Insurance contributions of 13.8% (approximately £5,000-£6,000 on a £40,000 salary, though not received directly by the employee). When these benefits are valued, a £42,000 PAYE salary has a total package worth approximately £47,000-£50,000. Overtime at 1.5x or 2.0x multipliers adds £5,000-£10,000+ annually for electricians on busy commercial or industrial sites. Senior PAYE roles regularly exceed £50,000 total value. Verdict: partially false. Base PAYE rates appear low, but benefits and overtime substantially increase total compensation.

Myth: “Higher day rates equal higher take-home pay.” This ignores the 20-30% cost burden and unpaid time. Supporting evidence: £300 day rate across 220 working days equals £66,000 gross. Contradicting evidence: deduct 20% CIS (£13,200), business costs (£8,500), tax/NI (£8,200), holiday provision (£3,500), sick provision (£2,000), and the net is approximately £30,600 before reclaiming CIS overpayment. Even after reclaiming £4,000-£5,000, net is £34,600-£35,600. Meanwhile, a £42,000 PAYE salary nets £35,400 cash with additional benefits worth £8,000+. Verdict: false. Gross day rates substantially overstate take-home when costs and unpaid time are properly accounted for.

Myth: “Being your own boss means flexibility and freedom.” This assumes self-employment reduces work hours or stress. Supporting evidence: you set your own schedule, choose clients, and aren’t answerable to managers. Contradicting evidence: 8-12 hours weekly on unpaid admin (quoting, invoicing, compliance) extends working weeks beyond PAYE equivalents. Financial volatility creates stress that fixed salaries don’t. Regulatory exposure (IR35, CIS audits, self-assessment) adds complexity PAYE workers never face. Client disputes, late payments, and gaps between contracts create uncertainty. Many self-employed electricians report working 50-60 hour weeks (including admin) to match PAYE earnings achieved in 40 hours. Verdict: partially true. Flexibility exists (choosing when to take holidays, which clients to work with), but it’s offset by unstructured business demands, financial stress, and regulatory burden that reduce perceived freedom.

Data Limitations and What We Don't Know

Self-employed income data has significant gaps and weaknesses that make precise comparisons difficult.

Self-employed income under-reporting. ONS and HMRC data on self-employed electrician earnings is known to be incomplete. Cash payments (still common in domestic work despite digital payment growth) aren’t always declared for tax purposes. The Institute for Fiscal Studies found that official statistics overcounted self-employment by 10-20% in some periods, and income reporting by the genuinely self-employed showed substantial gaps between reported and actual earnings. This means advertised rates and survey figures may overstate typical self-employed income, while tax data understates it. The true median is unclear.

Regional distortion in averages. London and South East day rates of £320-£400 substantially exceed Northern, Welsh, and Scottish rates of £220-£280. Averaging these creates a misleading national figure. A self-employed electrician in Newcastle earning £48,000 gross (£220 day rate) after costs might net £32,000-£35,000, comparable to local PAYE roles at £35,000-£38,000. The same electrician in London earning £70,000 gross (£320 day rate) might net £45,000-£48,000 but faces housing costs and living expenses that erode the premium. Regional breakdowns in ONS data exist but aren’t granular enough for localised comparisons.

The role of overtime in PAYE earnings. ONS median figures include electricians working minimal overtime and those regularly working 10-15 hours weekly at premium rates. An electrician on £20/hour base working 10 hours overtime weekly at 1.5x adds £15,600 annually, lifting earnings from £39,000 to £54,600. This variability isn’t separated in aggregate data, making it difficult to compare “typical” PAYE earnings to self-employed figures. Overtime availability depends on sector (industrial and commercial offer more than domestic service companies) and employer practices.

Unknown: actual self-employed working weeks per year. Scenarios assume 220 working days (44 weeks) accounting for holidays and downtime. In reality, downtime varies enormously: established CIS contractors with strong relationships might work 46-48 weeks annually, while newly self-employed sparks might work only 35-40 weeks due to gaps between jobs. Domestic sole traders report seasonal variation, working 48-50 weeks in spring/summer and 30-35 weeks in winter. There’s no systematic data on average working weeks for self-employed electricians.

Unknown: typical business cost ranges. The £10,000-£25,000 annual cost estimates are based on surveys, forum discussions, and anecdotal evidence. Actual costs vary with vehicle choice (old van £3,000/year versus new lease £8,000/year), insurance claims history, tool preferences, and accountancy arrangements. No comprehensive dataset tracks actual self-employed electrician business expenses, making cost stack estimates indicative rather than definitive.

These gaps mean comparisons require assumptions. The scenarios presented use mid-range figures and conservative estimates, but individual outcomes will vary substantially based on location, sector, business efficiency, and personal circumstances.

There’s no universally “better” employment structure for electricians. PAYE and self-employment represent different risk-reward profiles, and the optimal choice depends on individual circumstances, career stage, risk tolerance, business skills, and personal priorities.

The fundamental trade-off is stability versus potential. PAYE employment offers predictable monthly income, comprehensive benefits (paid holidays, sick pay, pension, insurance), zero business overhead costs, minimal administrative burden, and limited personal liability. The cost is capped earning potential: your maximum income is determined by your hourly rate, available overtime, and promotion opportunities within the employer’s structure. Self-employment offers higher gross earning potential, control over work schedule and client selection, and the ability to scale income through efficiency or business growth. The cost is financial volatility, business overhead of £10,000-£20,000+ annually, unpaid administrative time, personal liability risk, and regulatory compliance burden.

When gross figures are adjusted for costs, benefits, and unpaid time, the income gap narrows substantially. A £42,000 PAYE salary with benefits valued at £8,000+ delivers total compensation around £50,000. A £300 day rate self-employed position grossing £66,000 nets £34,600-£35,600 after all costs and provisions, rising to £39,600-£40,600 if CIS overpayment is reclaimed. The gap is £9,000-£10,000 in favour of PAYE when benefits are included, not the £24,000 the gross figures suggest. Higher self-employed rates (£350-£400/day) or more efficient cost management can flip this, but it’s not automatic.

Career stage matters enormously. Newly qualified electricians almost always benefit from PAYE employment’s training, mentorship, and stability while building competence. Experienced electricians with strong business skills, established reputations, and financial reserves can leverage self-employment for higher net earnings. Specialists in high-demand niches can maximise income through limited companies, but only after developing both technical expertise and business acumen. Pre-retirement electricians often prioritise PAYE for pension accumulation and reduced physical demands.

Personal circumstances drive decisions as much as finances. Electricians with families, mortgages, or low risk tolerance value PAYE’s guaranteed income and benefits. Single electricians, those with working partners providing household income stability, or high-risk-tolerance individuals may prefer self-employment’s upside potential despite volatility. Geographic location matters: self-employment premiums are largest in London and South East where day rates exceed PAYE equivalents substantially, while in Northern regions the gap is smaller and sometimes reversed.

The complete electrician salary and employment guide examines how qualification levels, sectors, and regional variations combine with employment structure to determine overall earning potential and career trajectory. If you’re weighing PAYE against self-employment and want to discuss which training pathway, qualification route, and employment structure align with your circumstances and goals, call us on 0330 822 5337. The conversation should focus on your risk tolerance, business skills, career stage, and personal priorities, not just headline rates that don’t reflect take-home reality.

References

- Office for National Statistics (ONS) – Annual Survey of Hours and Earnings (ASHE) 2025 – https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/earningsandworkinghours/bulletins/annualsurveyofhoursandearnings/2025

- JIB (Joint Industry Board) – National Working Rules and Pay Determination 2025 – https://www.jib.org.uk/wp-content/uploads/2025/06/JIB-Industrial-Determination-062025.pdf

- JIB – Apprentice Rates and Grading Structure 2025 – https://www.jib.org.uk/news/jib-apprentice-rates-2025/

- JIB Handbook 2025 – https://www.jib.org.uk/wp-content/uploads/2025/01/JIB-Handbook-2025.pdf

- HMRC – Construction Industry Scheme (CIS) Guidance – https://www.gov.uk/what-is-the-construction-industry-scheme

- HMRC – Expenses if You’re Self-Employed – https://www.gov.uk/expenses-if-youre-self-employed

- HMRC – Set Up as Self-Employed (Sole Trader) – https://www.gov.uk/set-up-self-employed

- National Careers Service – Electrician Job Profile – https://nationalcareers.service.gov.uk/job-profiles/electrician

- Institute for Fiscal Studies – Review of Self-Employment Statistics – https://ifs.org.uk/news/new-data-show-official-statistics-overcounted-self-employed-decades

- Trade Mastermind – Electrical Business Startup Costs – https://trademastermind.co.uk/electrical-business-startup-costs/

- Elec Training – JIB vs NICEIC vs NAPIT Pay Comparison – https://elec.training/news/jib-vs-niceic-vs-napit-pay-what-electricians-really-earn-and-why-the-comparison-is-wrong/

Note on Accuracy and Updates

Last reviewed: 31 December 2025. This page is maintained; we correct errors and refresh sources as JIB pay determinations, ONS ASHE releases, HMRC tax rules, and self-employment cost data are updated. PAYE figures reflect 2025 JIB published rates and ONS 2025 ASHE median data. Self-employed cost estimates are based on industry surveys, forum discussions, and recruiter advertised rates with data quality limitations noted in text. Tax calculations use 2025/26 rates (personal allowance £12,570, basic rate 20%, NI Class 1/2/4 as applicable, corporation tax 25% over £50,000). Next review scheduled following JIB 2026 wage determination (expected January 2026), ONS ASHE 2026 release (November 2026), and any significant changes to CIS, IR35, or self-employment tax rules.